- China

- /

- Oil and Gas

- /

- SZSE:300483

Investors in Sino Prima Gas Technology (SZSE:300483) from five years ago are still down 48%, even after 14% gain this past week

It's nice to see the Sino Prima Gas Technology Co., Ltd. (SZSE:300483) share price up 14% in a week. But over the last half decade, the stock has not performed well. In fact, the share price is down 48%, which falls well short of the return you could get by buying an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Sino Prima Gas Technology

Because Sino Prima Gas Technology made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Sino Prima Gas Technology saw its revenue increase by 0.2% per year. That's not a very high growth rate considering it doesn't make profits. Given the weak growth, the share price fall of 8% isn't particularly surprising. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

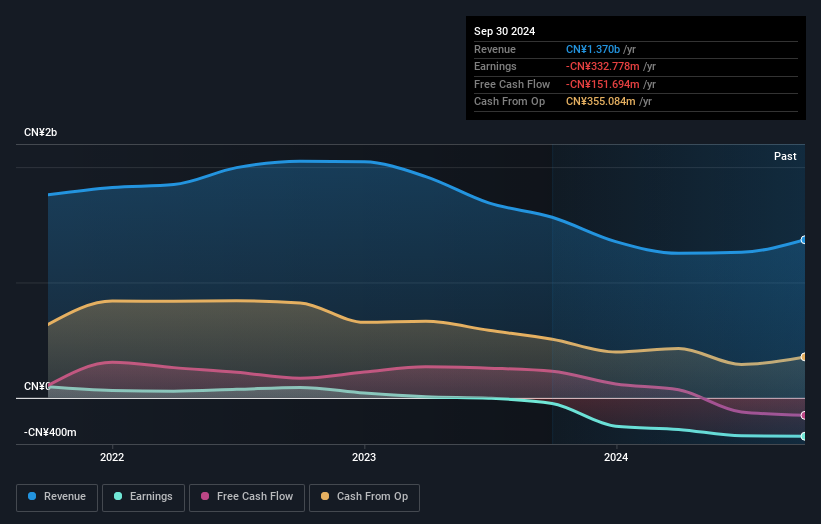

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Sino Prima Gas Technology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Sino Prima Gas Technology shareholders gained a total return of 5.0% during the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 8% per year, over five years. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Sino Prima Gas Technology that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300483

Sino Prima Gas Technology

Engages in the exploration, development, production, and sale of natural gas in the People’s Republic of China.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives