- China

- /

- Food and Staples Retail

- /

- SHSE:603883

3 Solid Dividend Stocks Offering Yields Up To 5.5%

Reviewed by Simply Wall St

As global markets continue to experience record highs, driven by domestic policy shifts and geopolitical developments, investors are increasingly seeking stability amid the volatility. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for those looking to balance growth with income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.70% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.34% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.91% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

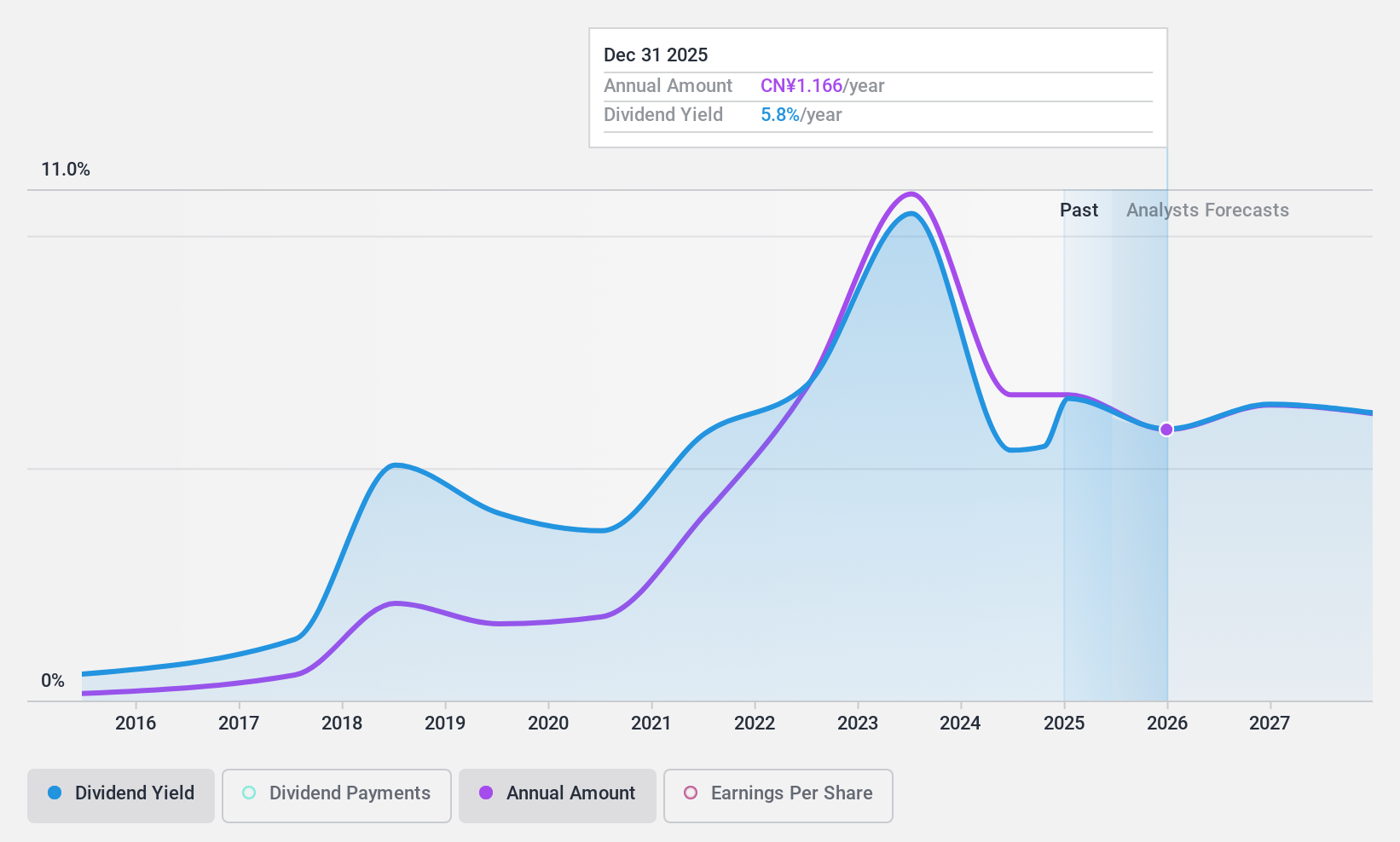

Shaanxi Coal Industry (SHSE:601225)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shaanxi Coal Industry Company Limited, along with its subsidiaries, is involved in the mining, production, washing, processing, and sale of coal both in China and internationally, with a market cap of CN¥228.03 billion.

Operations: Shaanxi Coal Industry Company Limited generates revenue through its activities in coal mining, production, washing, processing, and sales on both domestic and international fronts.

Dividend Yield: 5.6%

Shaanxi Coal Industry's dividend yield is among the top 25% in the Chinese market, supported by a reasonable payout ratio of 65.9% and a cash payout ratio of 41.3%, indicating good coverage by earnings and cash flows. However, its dividend history has been volatile over the past decade, raising concerns about reliability despite recent increases. The company trades at a significant discount to estimated fair value, but recent earnings show slight declines in sales and net income compared to last year.

- Get an in-depth perspective on Shaanxi Coal Industry's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Shaanxi Coal Industry's current price could be quite moderate.

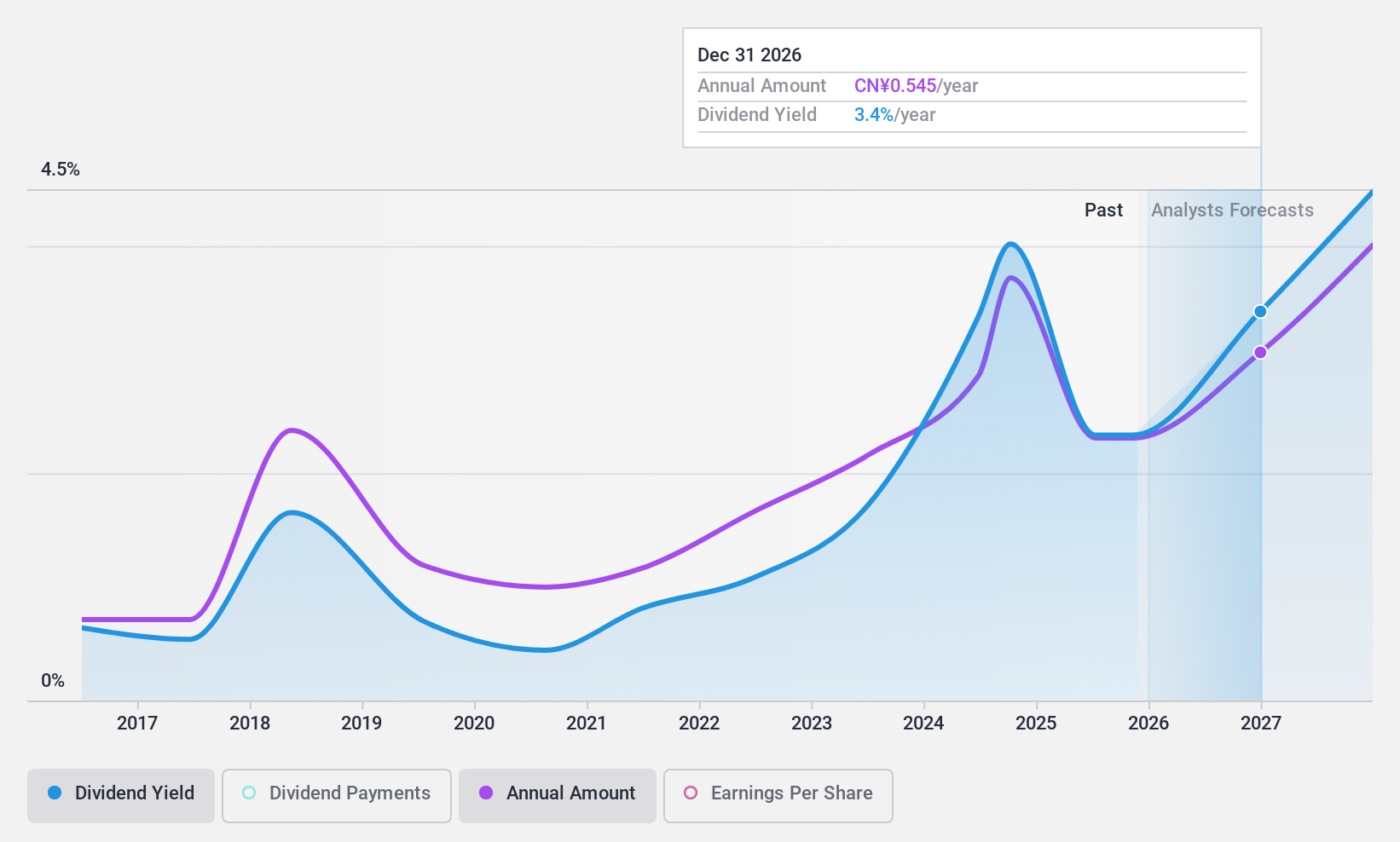

LBX Pharmacy Chain (SHSE:603883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LBX Pharmacy Chain Joint Stock Company operates a pharmacy store chain in China with a market cap of CN¥14.60 billion.

Operations: LBX Pharmacy Chain Joint Stock Company generates revenue primarily through its pharmacy store chain operations in China.

Dividend Yield: 3.4%

LBX Pharmacy Chain's dividend yield ranks in the top 25% of the Chinese market, with a cash payout ratio of 27.1% and an earnings payout ratio of 75.3%, suggesting solid coverage by both cash flows and earnings. Despite this, its dividend history over nine years has been unreliable due to volatility. The company reported slight revenue growth but a decline in net income for the first nine months of 2024, impacting overall financial stability.

- Click to explore a detailed breakdown of our findings in LBX Pharmacy Chain's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of LBX Pharmacy Chain shares in the market.

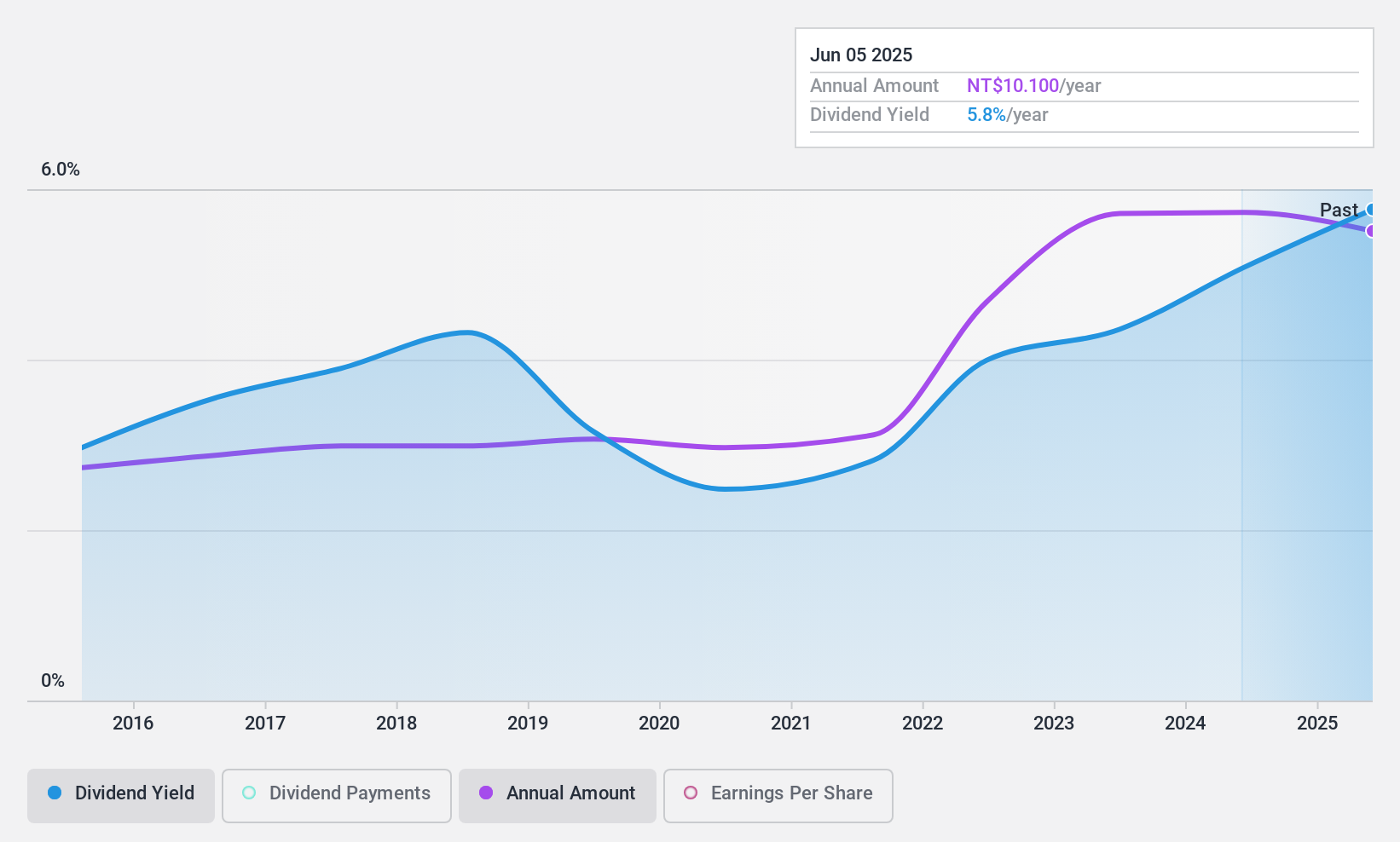

Sporton International (TPEX:6146)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sporton International Inc. offers product testing and certification services both in Taiwan and internationally, with a market cap of NT$20.88 billion.

Operations: Sporton International Inc. generates revenue primarily from its testing certification and verification services, which account for NT$4.15 billion, and its parts division, contributing NT$438.77 million.

Dividend Yield: 5.1%

Sporton International's dividend yield is among the top 25% in Taiwan, yet its sustainability is questionable due to a high cash payout ratio of 108.2%, indicating dividends are not well covered by free cash flows. Despite stable and growing dividends over the past decade, recent earnings show a decline in net income for both Q3 and the first nine months of 2024, which may affect future payouts if trends continue without improvement.

- Click here and access our complete dividend analysis report to understand the dynamics of Sporton International.

- The valuation report we've compiled suggests that Sporton International's current price could be inflated.

Key Takeaways

- Unlock our comprehensive list of 1964 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603883

Undervalued with adequate balance sheet and pays a dividend.