- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600738

Undiscovered Gems Promising Stocks to Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, major U.S. stock indexes have shown mixed results with growth stocks leading the charge while small-cap indices like the Russell 2000 have experienced recent declines. This divergence highlights the importance of identifying promising opportunities within smaller companies that may be overlooked amidst broader market trends. In this environment, a good stock is often characterized by its potential for growth and resilience in sectors currently favored by market conditions, such as consumer discretionary and information technology.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 15.90% | 6.43% | -13.73% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Kangping Technology (Suzhou) | 28.70% | 2.21% | 3.71% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Shanghai Sanmao Enterprise (Group) (SHSE:600689)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Sanmao Enterprise (Group) Co., Ltd. operates in various sectors and has a market capitalization of approximately CN¥1.94 billion.

Operations: Sanmao Enterprise generates revenue from diverse sectors. The company has a market capitalization of approximately CN¥1.94 billion, reflecting its varied business operations.

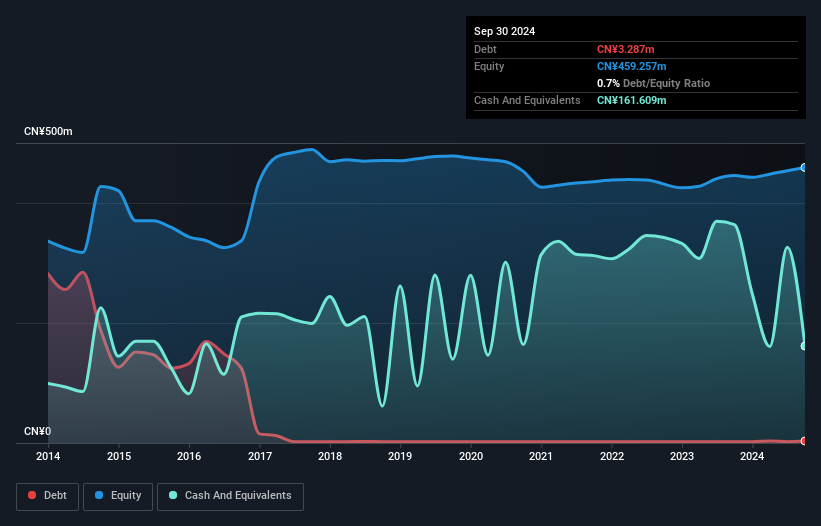

Shanghai Sanmao Enterprise, a modestly-sized player, has shown notable growth with earnings surging by 150% over the past year, outpacing the Luxury industry's 3.3%. Despite this impressive performance, net income for the first nine months of 2024 was CN¥16.34 million, slightly down from CN¥20.34 million in the previous year. The company reported sales of CN¥813.22 million compared to last year's CN¥797.96 million, indicating steady revenue growth amidst challenges. A significant one-off gain of CN¥6.7 million influenced recent financial results, and while debt levels have risen slightly over five years to a debt-to-equity ratio of 0.7%, cash reserves exceed total debt.

Lanzhou Lishang Guochao Industrial GroupLtd (SHSE:600738)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lanzhou Lishang Guochao Industrial Group Co., Ltd operates department stores in China and internationally, with a market capitalization of CN¥4.34 billion.

Operations: Lanzhou Lishang Guochao Industrial Group Ltd generates revenue primarily through its department store operations. The company's financial performance is reflected in its market capitalization of CN¥4.34 billion.

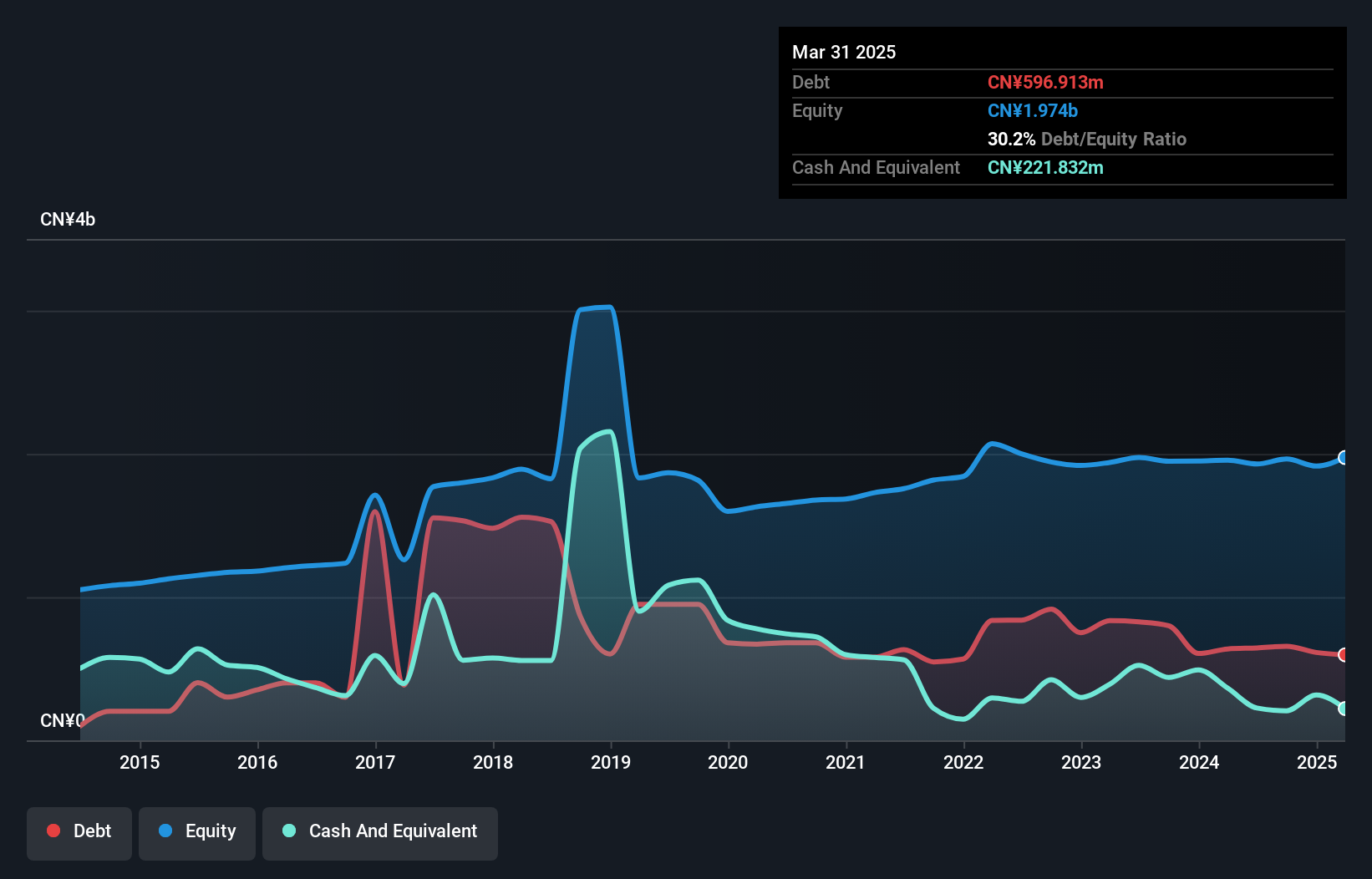

Lanzhou Lishang Guochao Industrial Group Ltd, a smaller player in the industry, has shown notable financial dynamics recently. The company's net income for the first nine months of 2024 reached CNY 107.48 million, up from CNY 78 million in the previous year, despite sales dropping to CNY 516.2 million from CNY 694.67 million. Its price-to-earnings ratio stands at a favorable 38.4x compared to the industry average of 51.6x, suggesting potential undervaluation within its sector context. Furthermore, with interest payments well covered by EBIT at a ratio of 10.9x and a satisfactory net debt to equity ratio of 22.9%, financial stability is evident amidst challenges such as declining earnings over five years by an annual rate of approximately -29%.

- Click to explore a detailed breakdown of our findings in Lanzhou Lishang Guochao Industrial GroupLtd's health report.

Understand Lanzhou Lishang Guochao Industrial GroupLtd's track record by examining our Past report.

Anhui Anli Material Technology (SZSE:300218)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Anli Material Technology Co., Ltd. focuses on the R&D, production, sale, and servicing of ecological functional polyurethane synthetic leather and polymer composite materials in China with a market cap of CN¥3.49 billion.

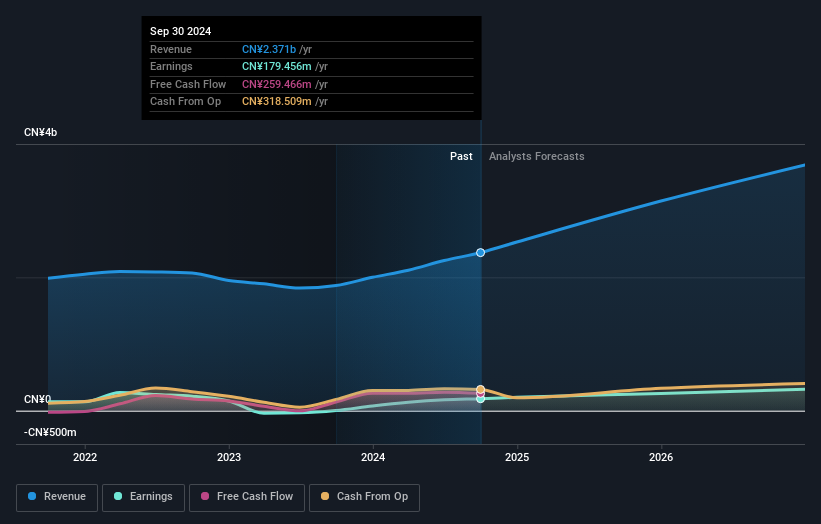

Operations: Anli Material Technology generates revenue primarily from the artificial leather synthetic leather industry, amounting to CN¥2.37 billion. The company's financial performance is characterized by its gross profit margin, which reflects its ability to manage production costs relative to sales.

Anhui Anli Material Technology, a smaller player in its industry, has shown impressive financial performance with net income jumping to CNY 150.26 million from CNY 41.63 million over the past year. The company's earnings per share rose to CNY 0.70 from CNY 0.19, indicating strong profitability growth and high-quality earnings. Trading at an attractive valuation, it's currently priced at about 24% below fair value estimates, suggesting potential upside for investors seeking value opportunities in niche markets. With a debt-to-equity ratio reduced significantly over five years to just 10.8%, the company appears financially robust with ample cash coverage on its obligations.

Seize The Opportunity

- Click this link to deep-dive into the 4622 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600738

Lanzhou Lishang Guochao Industrial GroupLtd

Operates department stores in China and internationally.

Proven track record with adequate balance sheet.