- China

- /

- Communications

- /

- SHSE:688143

3 Growth Companies Insiders Back With Up To 46% Revenue Growth

Reviewed by Simply Wall St

As global markets continue to navigate mixed performances, with major U.S. indexes hitting record highs and growth stocks outpacing value shares, investors are keenly observing the potential impacts of economic data and geopolitical events. In this environment of cautious optimism, identifying growth companies with high insider ownership can be particularly appealing, as it often signals confidence from those closest to the business in its long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.5% | 65.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YG Entertainment Inc. operates as an entertainment company in South Korea, Japan, and internationally with a market cap of ₩843.88 billion.

Operations: The company generates revenue of ₩415.71 billion from its entertainment-related activities across South Korea, Japan, and international markets.

Insider Ownership: 23.2%

Revenue Growth Forecast: 24.7% p.a.

YG Entertainment's revenue is projected to grow at a robust 24.7% annually, outpacing the Korean market's 9%. Despite this, recent financials reveal a challenging period with net losses of KRW 157.99 million in Q3 and KRW 1,731.78 million over nine months. Earnings are expected to surge by a significant 97.5% per year ahead, although profit margins have declined from last year’s figures. Return on equity remains forecasted at a modest level in three years.

- Click here and access our complete growth analysis report to understand the dynamics of YG Entertainment.

- In light of our recent valuation report, it seems possible that YG Entertainment is trading beyond its estimated value.

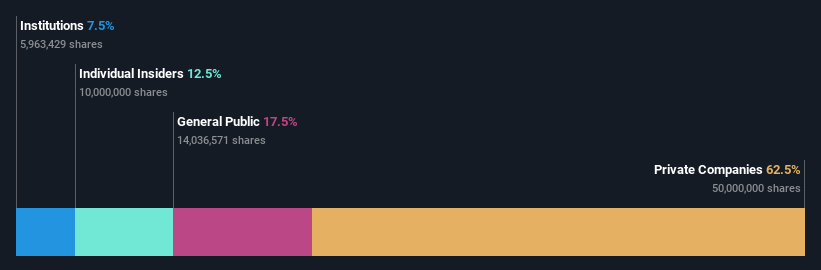

Yangtze Optical Electronic (SHSE:688143)

Simply Wall St Growth Rating: ★★★★★☆

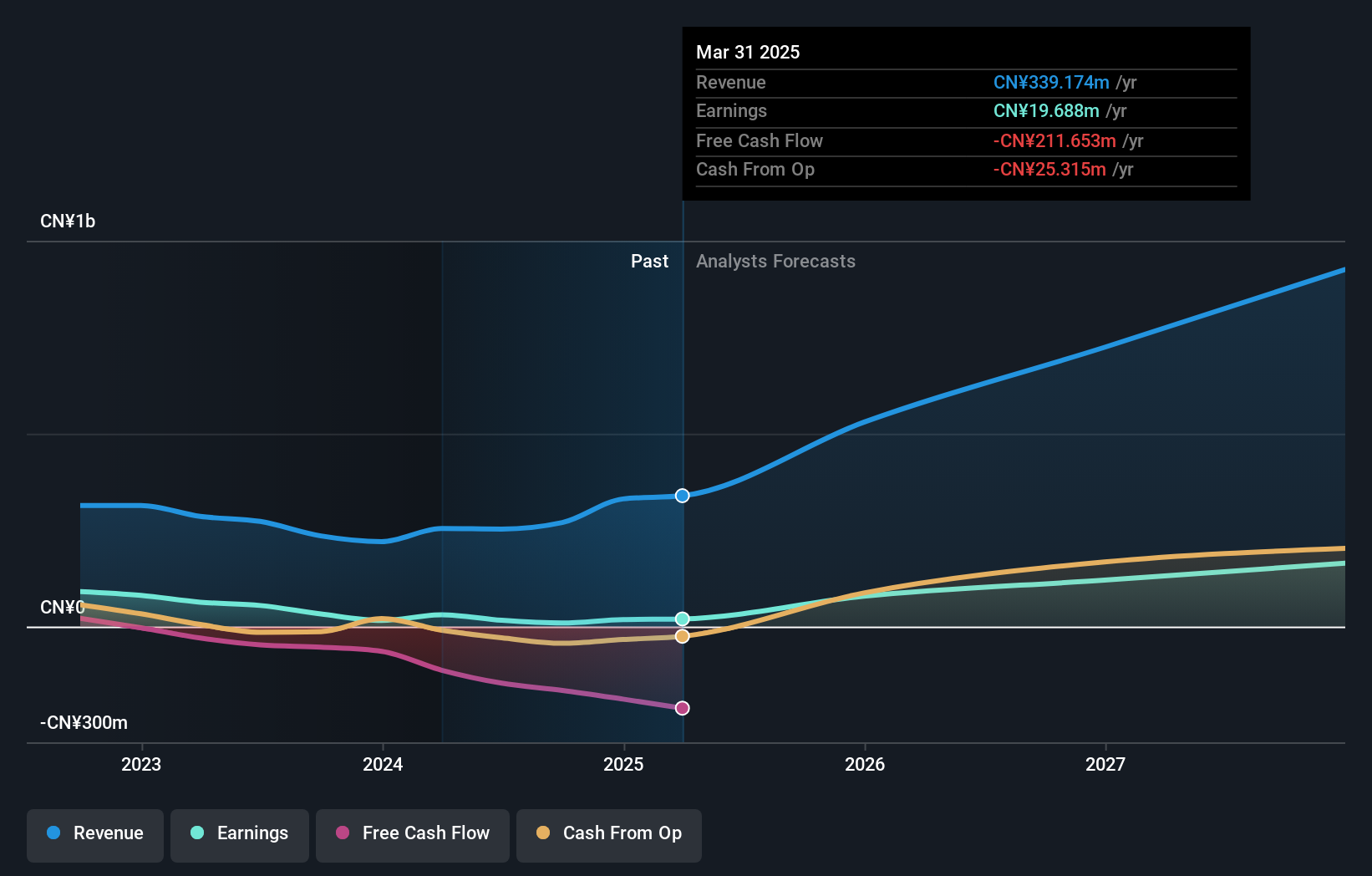

Overview: Yangtze Optical Electronic Co., Ltd. focuses on the R&D, production, and sale of special optical fibers and cables, photoelectric systems, and related products in China with a market cap of CN¥3.09 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, amounting to CN¥269.51 million.

Insider Ownership: 27.8%

Revenue Growth Forecast: 47% p.a.

Yangtze Optical Electronic's revenue increased by 14.7% over the past year, yet the company reported a net loss of CNY 3.69 million for the nine months ending September 2024, compared to a profit last year. Despite volatile share prices and declining profit margins from 13.8% to 3.4%, earnings are forecasted to grow significantly at 71.42% annually, surpassing market averages. Recent private placements and share buybacks indicate strategic financial maneuvers amidst high expected revenue growth of 47%.

- Take a closer look at Yangtze Optical Electronic's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Yangtze Optical Electronic shares in the market.

Zhejiang Fengmao Technology (SZSE:301459)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Fengmao Technology Co., Ltd. specializes in the research, development, manufacture, and sale of belt-driven systems, fluid pipelines, and rubber sealing systems in China with a market capitalization of CN¥3.23 billion.

Operations: The company's revenue is primarily derived from its Machinery & Industrial Equipment segment, which generated CN¥867.35 million.

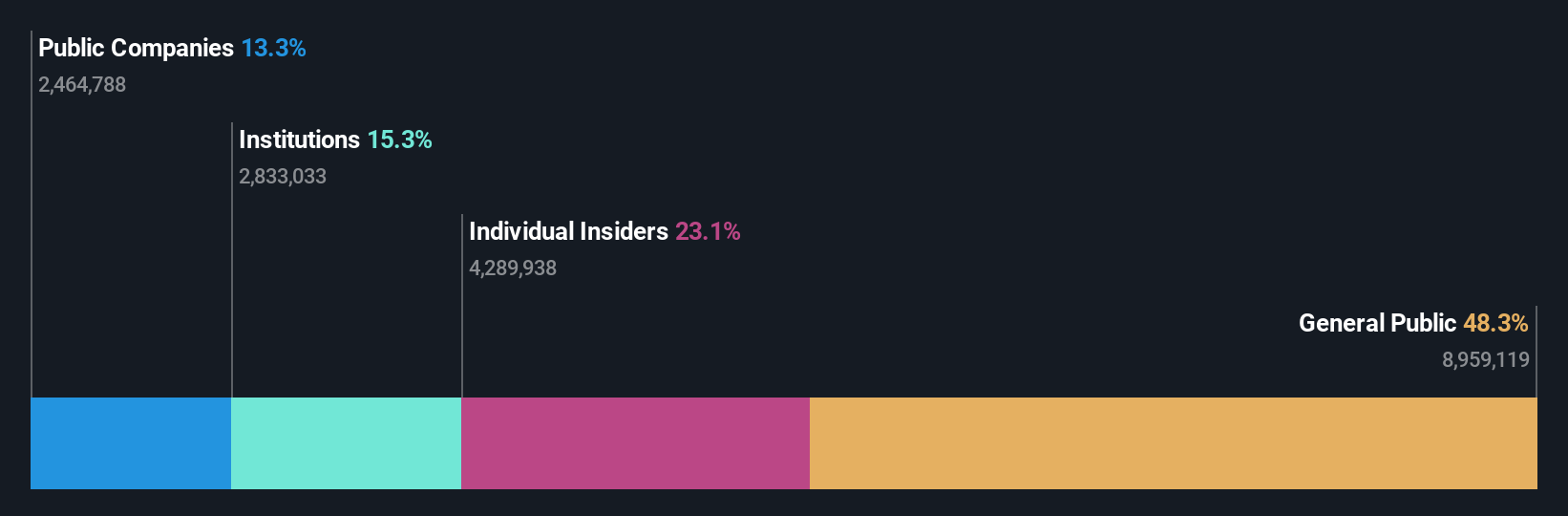

Insider Ownership: 12.5%

Revenue Growth Forecast: 27.6% p.a.

Zhejiang Fengmao Technology's earnings are forecast to grow significantly at 29.38% annually, outpacing the CN market average. Revenue growth is also expected to be robust at 27.6% per year, surpassing market rates. Despite a low forecasted return on equity of 11.1%, the company offers good value with a price-to-earnings ratio of 24.4x compared to the market's 38x. Recent earnings showed modest net income growth and stable insider trading activity over three months.

- Unlock comprehensive insights into our analysis of Zhejiang Fengmao Technology stock in this growth report.

- Our valuation report unveils the possibility Zhejiang Fengmao Technology's shares may be trading at a premium.

Taking Advantage

- Get an in-depth perspective on all 1515 Fast Growing Companies With High Insider Ownership by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688143

Yangtze Optical Electronic

Engages in the research and development, production, and sale of special optical fibers and cables, photoelectric systems, special optical devices, new materials, high-end equipment, and optoelectronic systems in China.

High growth potential with mediocre balance sheet.