Exploring Three Undiscovered Gems In Asia For Savvy Investors

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious optimism and economic recalibrations, the Asian market presents intriguing opportunities for investors. With small-cap stocks gaining traction amid hopes for interest rate cuts and evolving economic indicators, identifying promising companies requires a keen eye on growth potential and resilience in the face of shifting macroeconomic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou | 17.36% | -10.02% | 57.60% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| House of Investments | 18.23% | 14.46% | 47.47% | ★★★★★☆ |

| Advancetek EnterpriseLtd | 60.69% | 28.66% | 48.38% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| YFY | 69.02% | -0.89% | -31.10% | ★★★★☆☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Ningbo DonlyLtd (SZSE:002164)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Donly Co., Ltd specializes in the R&D, manufacturing, sales, and technical consultation of transmission equipment, door control systems, and industrial automatic control systems globally with a market cap of CN¥8.01 billion.

Operations: Ningbo Donly Co., Ltd generates revenue primarily from the sale of transmission equipment, door control systems, and industrial automatic control systems. The company's financial performance is highlighted by a net profit margin that provides insight into its profitability.

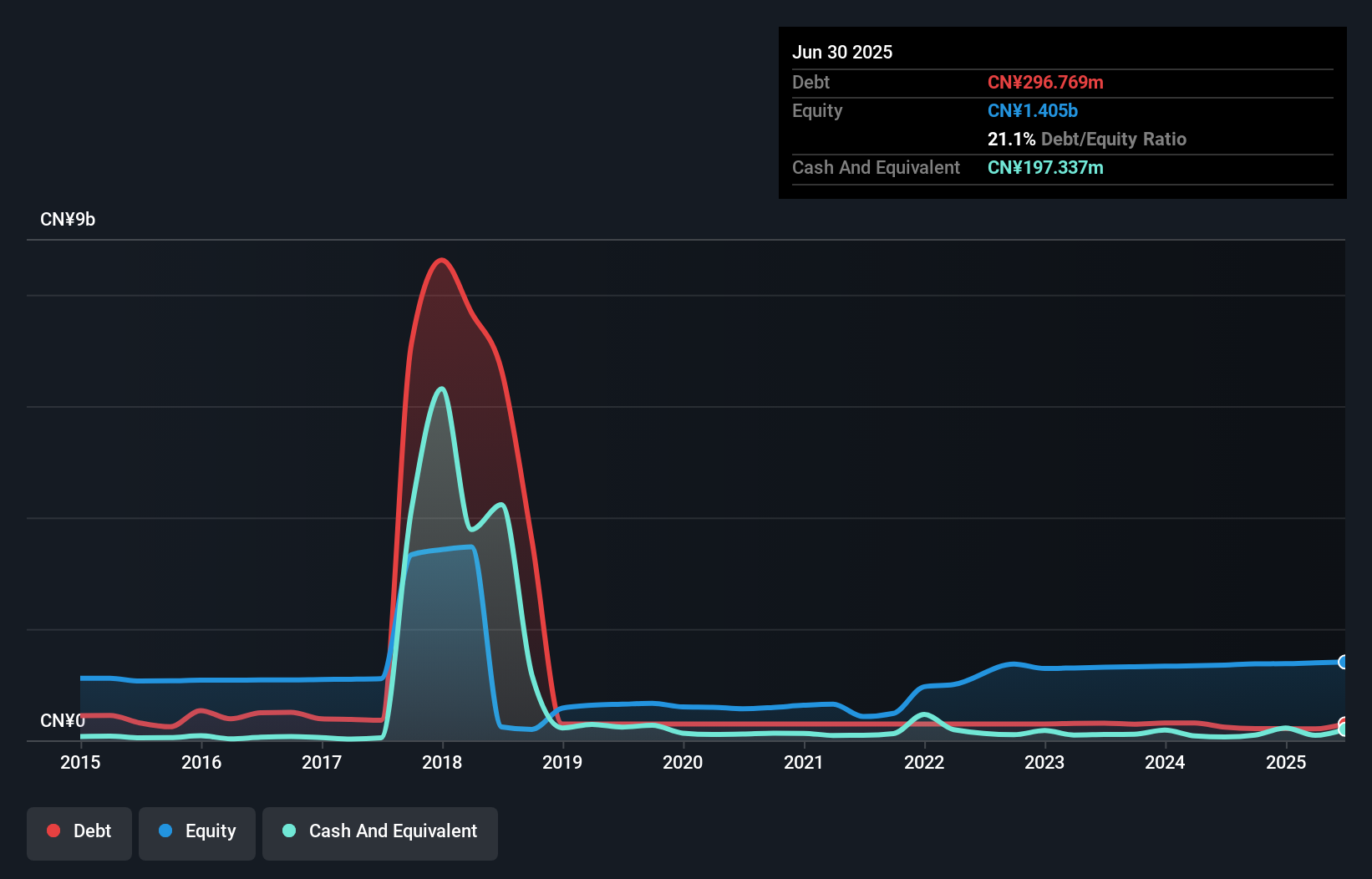

Ningbo Donly Ltd, a vibrant player in the machinery sector, is making waves with its impressive financial health and growth trajectory. The company's debt to equity ratio has impressively reduced from 49.8% to 20% over the last five years, indicating prudent financial management. Earnings surged by 16.8% in the past year, outpacing the industry average of 6.1%, showcasing robust performance. Net income for nine months ended September 2025 was CNY 58.46 million compared to CNY 42.72 million a year ago, reflecting strong profitability despite not being free cash flow positive currently due to strategic capital expenditures and acquisitions impacting cash flows recently.

- Take a closer look at Ningbo DonlyLtd's potential here in our health report.

Understand Ningbo DonlyLtd's track record by examining our Past report.

Ruida FuturesLtd (SZSE:002961)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ruida Futures Co., Ltd. operates as a futures company in China with a market capitalization of CN¥13.08 billion.

Operations: Ruida Futures generates revenue primarily from its futures trading services. The company's net profit margin is 24.5%.

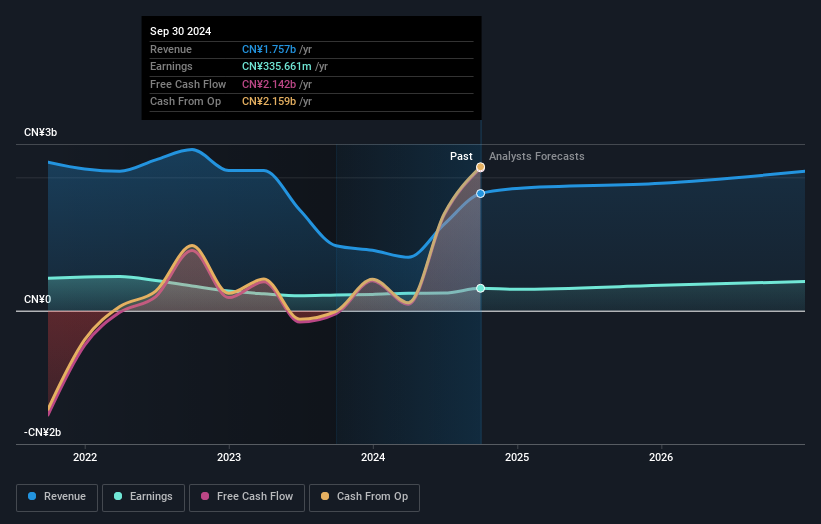

Ruida Futures, a dynamic player in the Asian market, has seen its debt-to-equity ratio improve significantly from 46.3% to 27.2% over five years, indicating better financial health. Despite revenue dipping slightly to CNY 1.62 billion for the nine months ending September 2025, net income rose impressively to CNY 385.8 million from CNY 271.4 million the previous year, reflecting robust operational efficiency with a basic EPS of CNY 0.87 compared to last year's CNY 0.61. However, its earnings growth of 48% lagged behind industry peers at 73%, suggesting room for improvement in competitive positioning within capital markets.

- Dive into the specifics of Ruida FuturesLtd here with our thorough health report.

Examine Ruida FuturesLtd's past performance report to understand how it has performed in the past.

Zhejiang JW Precision MachineryLtd (SZSE:300984)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang JW Precision Machinery Co., Ltd. specializes in the research, development, production, and sale of bearing rings both domestically and internationally, with a market cap of CN¥8.40 billion.

Operations: JW Precision Machinery generates revenue primarily from the sale of bearing ferrules, amounting to CN¥1.18 billion. The company's market cap stands at approximately CN¥8.40 billion.

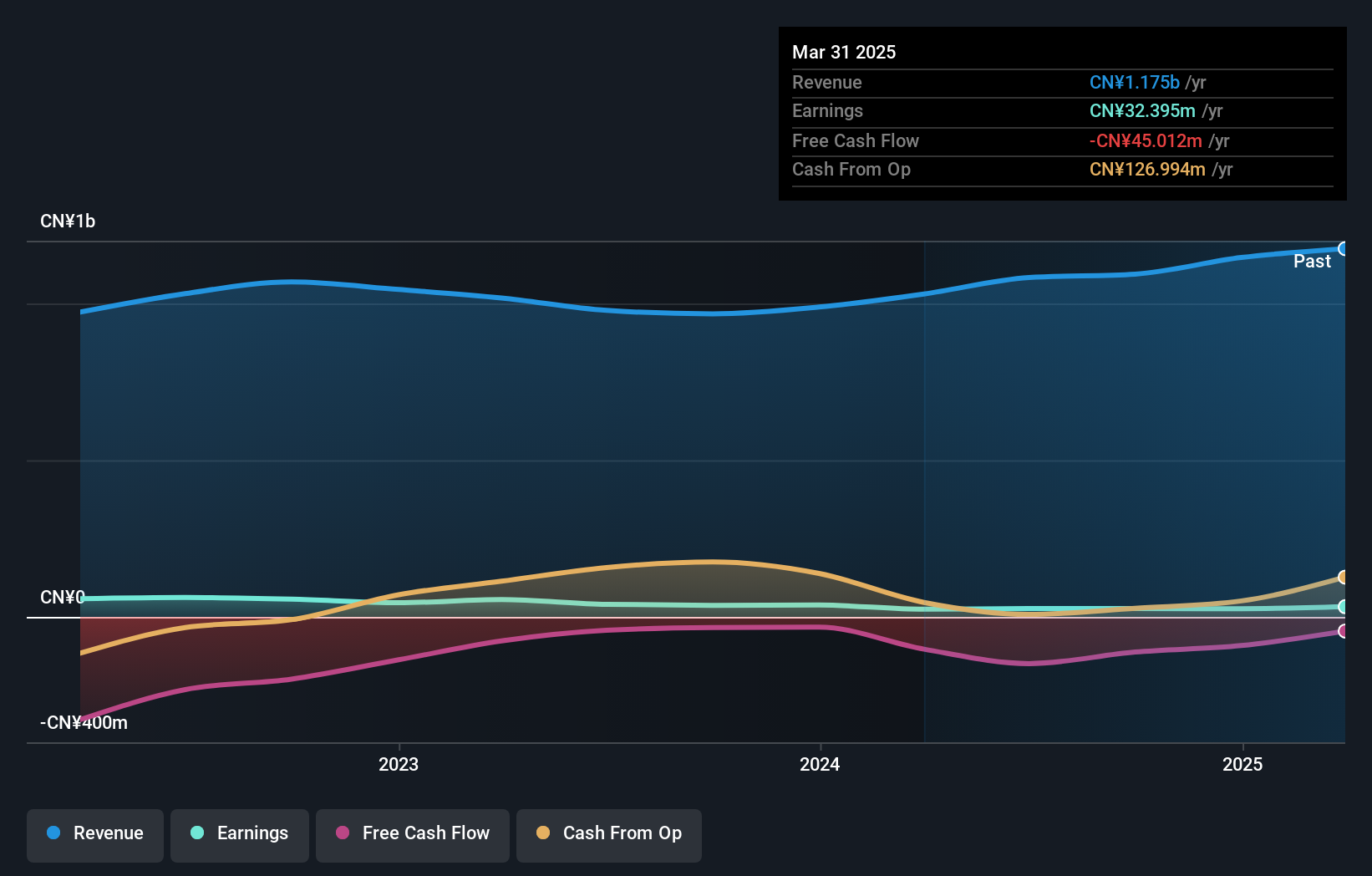

Zhejiang JW Precision Machinery, a small player in the machinery industry, has demonstrated robust performance with earnings growth of 59% over the past year, outpacing the industry's 6.1%. The company's net debt to equity ratio stands at a satisfactory 14.6%, reflecting prudent financial management. Interest payments are well covered by EBIT at seven times coverage, indicating strong operational efficiency. Recent earnings reports show an increase in net income to CNY 37 million from CNY 21 million last year and sales rising to CNY 930 million from CNY 841 million. Despite negative free cash flow trends, high-quality earnings suggest resilience and potential for future growth.

Turning Ideas Into Actions

- Explore the 2497 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ningbo DonlyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002164

Ningbo DonlyLtd

Engages in the research and development, manufacture, sale, and technical consultation of transmission equipment, door control systems, and industrial automatic control systems in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)