- China

- /

- Capital Markets

- /

- SHSE:601108

Insufficient Growth At Caitong Securities Co.,Ltd. (SHSE:601108) Hampers Share Price

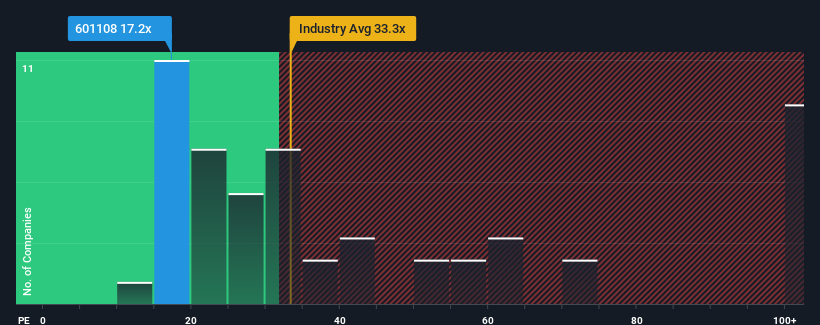

Caitong Securities Co.,Ltd.'s (SHSE:601108) price-to-earnings (or "P/E") ratio of 17.2x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 73x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Caitong SecuritiesLtd as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Caitong SecuritiesLtd

How Is Caitong SecuritiesLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Caitong SecuritiesLtd's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 18% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 24% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings growth is heading into negative territory, declining 1.8% over the next year. With the market predicted to deliver 38% growth , that's a disappointing outcome.

With this information, we are not surprised that Caitong SecuritiesLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Caitong SecuritiesLtd's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Caitong SecuritiesLtd maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Caitong SecuritiesLtd with six simple checks on some of these key factors.

If you're unsure about the strength of Caitong SecuritiesLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601108

Caitong SecuritiesLtd

Provides securities brokerage services in China and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives