- China

- /

- Food and Staples Retail

- /

- SHSE:603883

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets grapple with trade policy uncertainties and inflation concerns, Asian markets have shown resilience, with China's recent economic targets and stimulus signals providing a boost to investor sentiment. In this environment, dividend stocks in Asia can offer a stable income stream and potential portfolio enhancement by focusing on companies with strong fundamentals and consistent payout histories.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.49% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.04% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.13% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.09% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.85% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.34% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.83% | ★★★★★★ |

Click here to see the full list of 1137 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

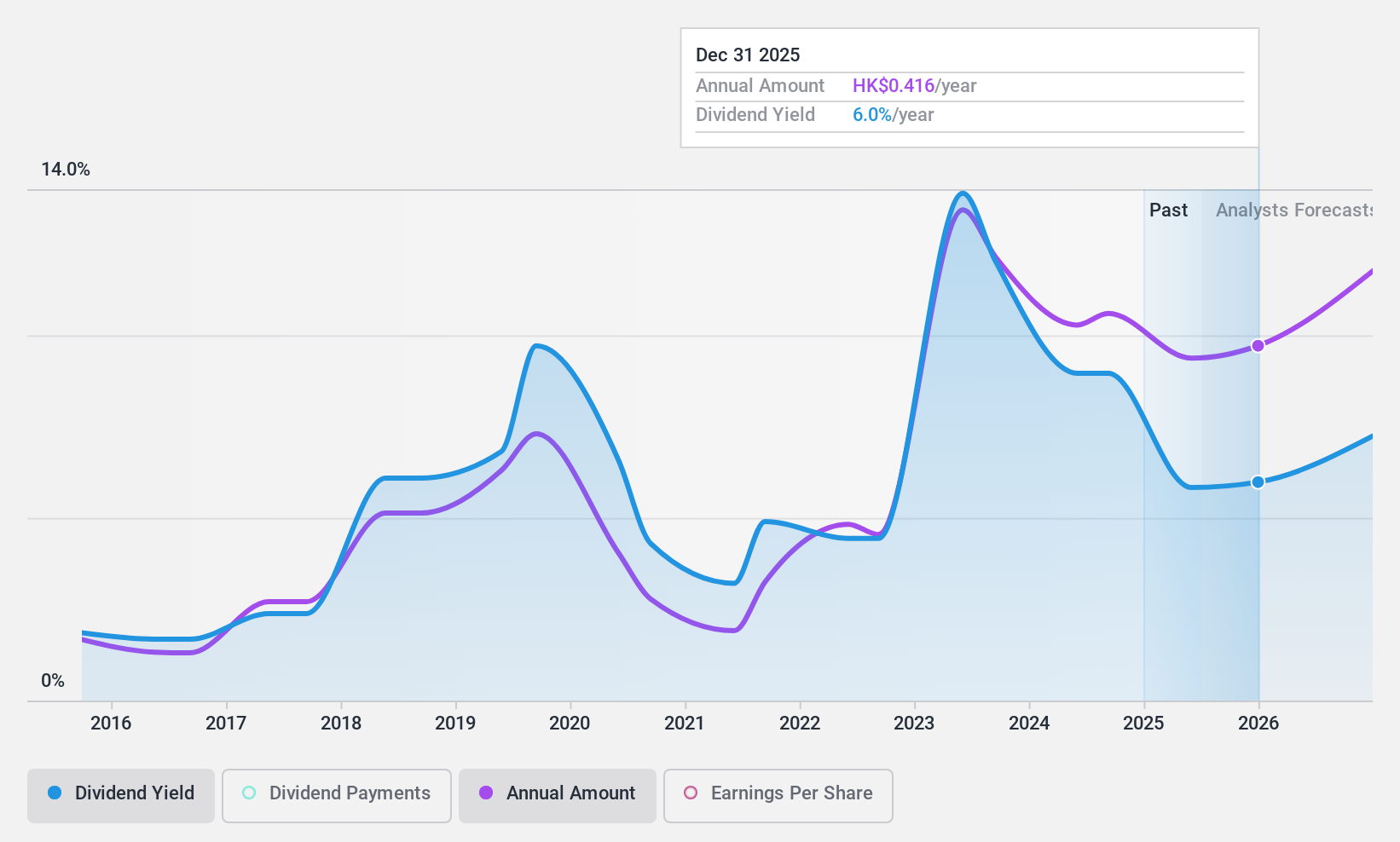

Fufeng Group (SEHK:546)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fufeng Group Limited is an investment holding company that manufactures and sells fermentation-based food additives, as well as biochemical and starch-based products, operating both in the People's Republic of China and internationally, with a market cap of HK$14.54 billion.

Operations: Fufeng Group Limited generates revenue from various segments, including CN¥13.85 billion from Food Additives, CN¥9 billion from Animal Nutrition, CN¥2.22 billion from High-End Amino Acid, and CN¥2.09 billion from Colloid products.

Dividend Yield: 6.4%

Fufeng Group's dividend strategy presents a mixed outlook. While dividends are well-covered by earnings with a payout ratio of 33%, the cash payout ratio of 78.2% suggests less robust coverage. Dividend payments have been volatile over the past decade, indicating unreliability. Despite trading at good value, with shares priced 23.5% below estimated fair value, its dividend yield of 6.38% is lower than top-tier payers in Hong Kong, and historical volatility raises concerns about sustainability.

- Get an in-depth perspective on Fufeng Group's performance by reading our dividend report here.

- Our valuation report unveils the possibility Fufeng Group's shares may be trading at a discount.

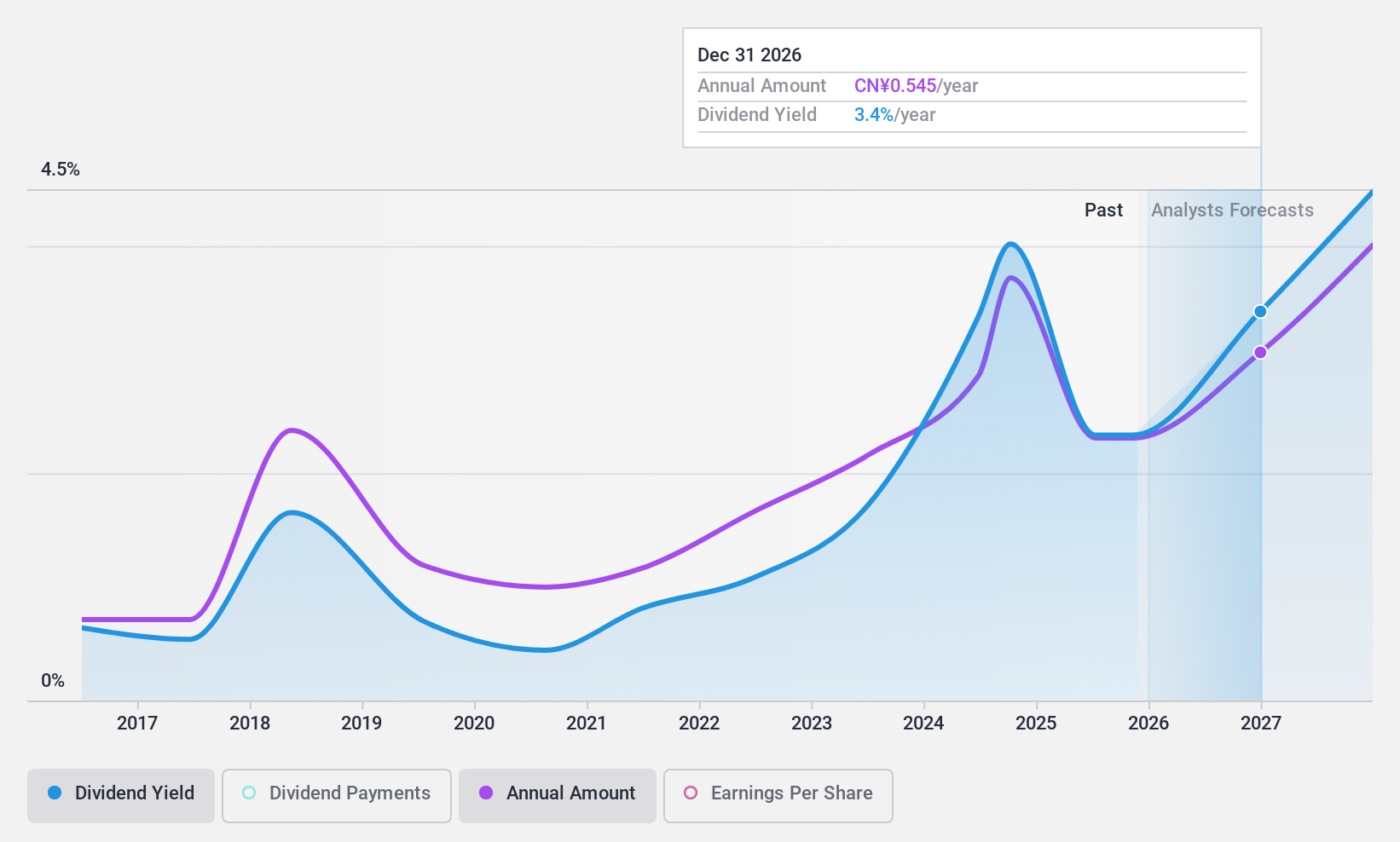

LBX Pharmacy Chain (SHSE:603883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LBX Pharmacy Chain Joint Stock Company operates a pharmacy store chain in China with a market cap of CN¥13.13 billion.

Operations: LBX Pharmacy Chain Joint Stock Company generates revenue through its pharmacy store chain operations in China.

Dividend Yield: 3.8%

LBX Pharmacy Chain's dividend payments are well-supported by cash flows, with a low cash payout ratio of 27.1%, and earnings coverage at 75.3%. Despite this solid backing, its dividend history is less stable, having been paid for only nine years with volatility in annual payments. Trading significantly below its estimated fair value enhances its appeal, yet the inconsistent dividend track record may concern some investors despite a yield in the top 25% of China's market.

- Click here to discover the nuances of LBX Pharmacy Chain with our detailed analytical dividend report.

- According our valuation report, there's an indication that LBX Pharmacy Chain's share price might be on the cheaper side.

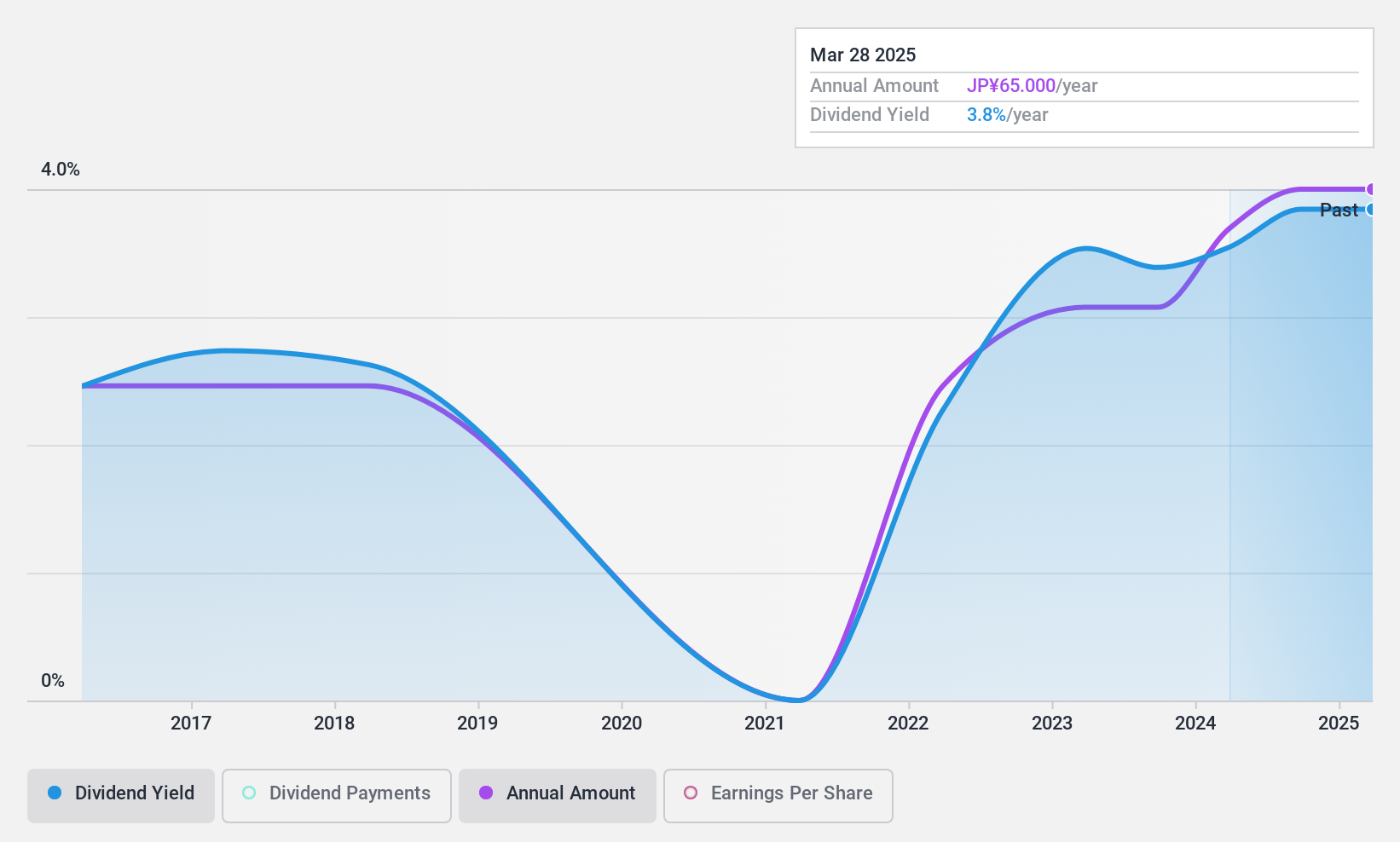

Nice (TSE:8089)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nice Corporation imports, distributes, and sells building materials for housing both in Japan and internationally, with a market cap of ¥19.27 billion.

Operations: Nice Corporation generates revenue primarily from its Building Materials segment, which accounts for ¥179.61 billion, followed by the Housing segment at ¥50.83 billion.

Dividend Yield: 4%

Nice Corporation's dividend yield is among the top 25% in Japan, yet its payments have been volatile over the past decade. Despite a reasonable payout ratio of 52.2%, dividends are not supported by free cash flows, raising sustainability concerns. Recent guidance forecasts net sales of ¥238 billion and profit attributable to owners at ¥3.2 billion for FY2025, but lower profit margins and large one-off items impact financial results, affecting dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Nice.

- The valuation report we've compiled suggests that Nice's current price could be inflated.

Where To Now?

- Embark on your investment journey to our 1137 Top Asian Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade LBX Pharmacy Chain, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603883

Undervalued with adequate balance sheet and pays a dividend.