- China

- /

- Energy Services

- /

- SZSE:300157

New JCM GroupLtd And 2 Other Promising Global Penny Stocks

Reviewed by Simply Wall St

As global markets show signs of easing trade tensions, U.S. equities have experienced a boost, driven by constructive headlines and better-than-expected corporate earnings. In such an evolving landscape, investors often seek opportunities that balance potential growth with manageable risk. Penny stocks, though sometimes seen as a relic from past market eras, continue to offer intriguing prospects for those willing to explore smaller or newer companies with solid financial underpinnings. This article will explore three penny stocks that may present compelling opportunities for investors seeking value and stability in the current market climate.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.415 | SGD168.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.20 | SGD8.66B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ✅ 4 ⚠️ 3 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.85 | MYR1.33B | ✅ 5 ⚠️ 2 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.37 | MYR1.03B | ✅ 4 ⚠️ 3 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.06 | HK$694.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.85 | £311.03M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £416.99M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.87 | £2.13B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,627 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

New JCM GroupLtd (SZSE:300157)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: New JCM Group Co., Ltd operates in the equipment manufacturing sector both within China and internationally, with a market capitalization of approximately CN¥1.93 billion.

Operations: New JCM Group Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥1.93B

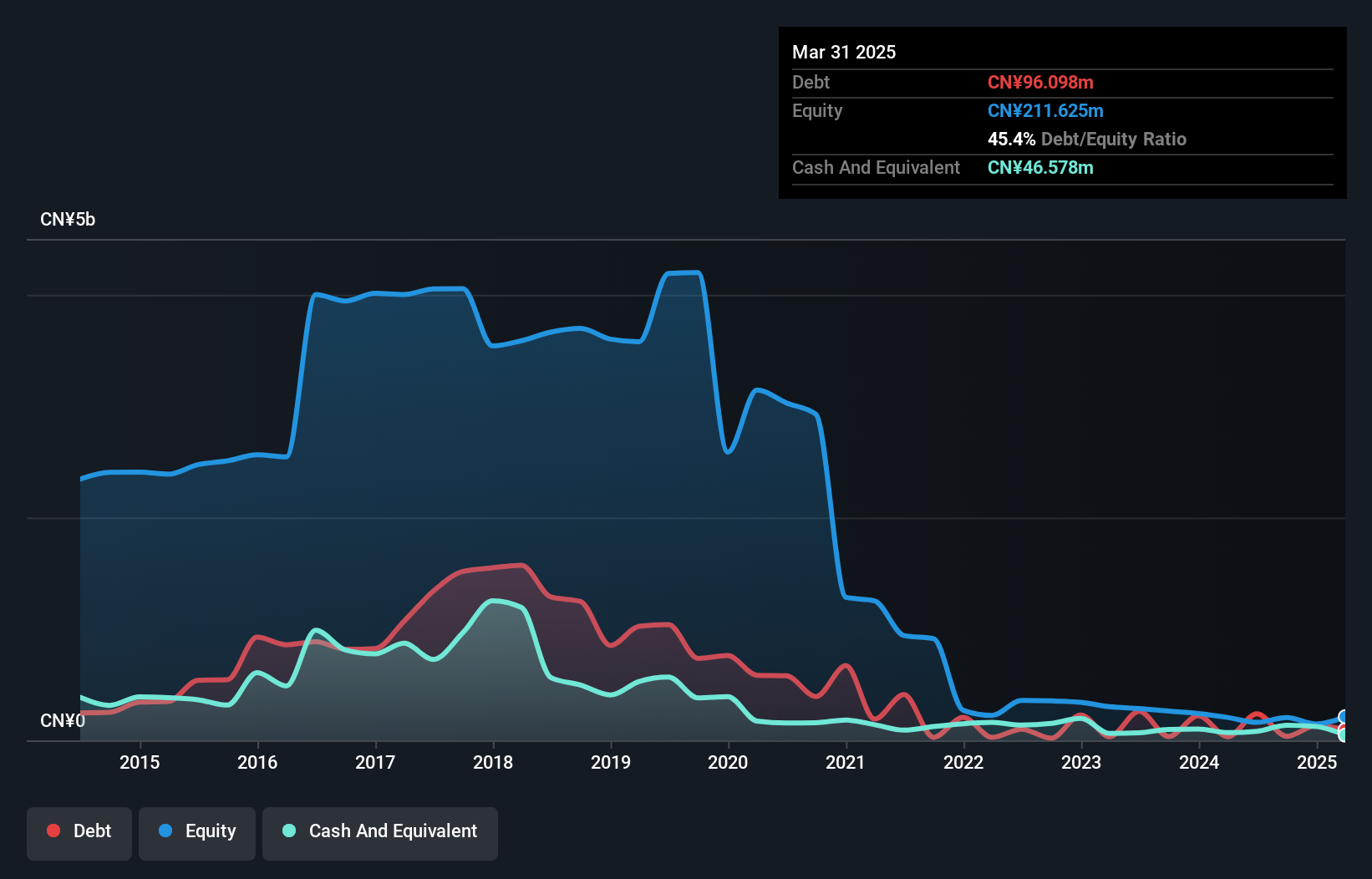

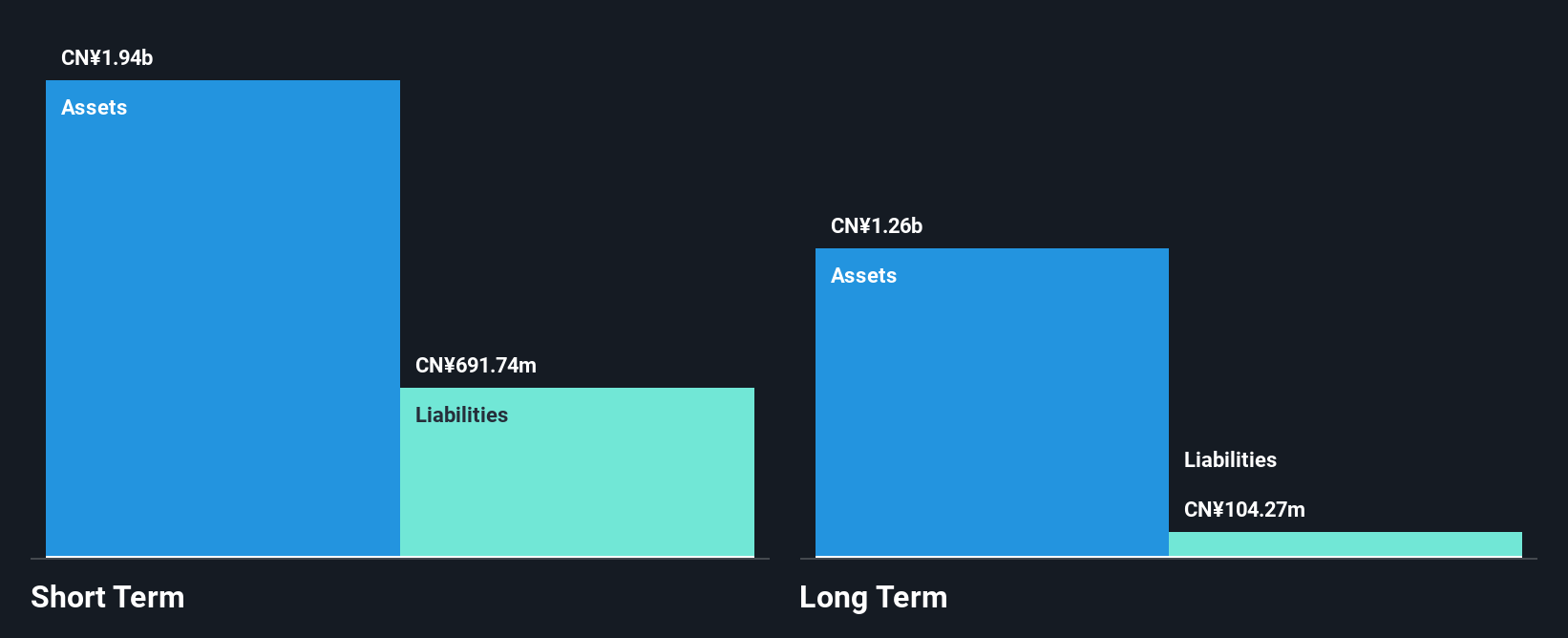

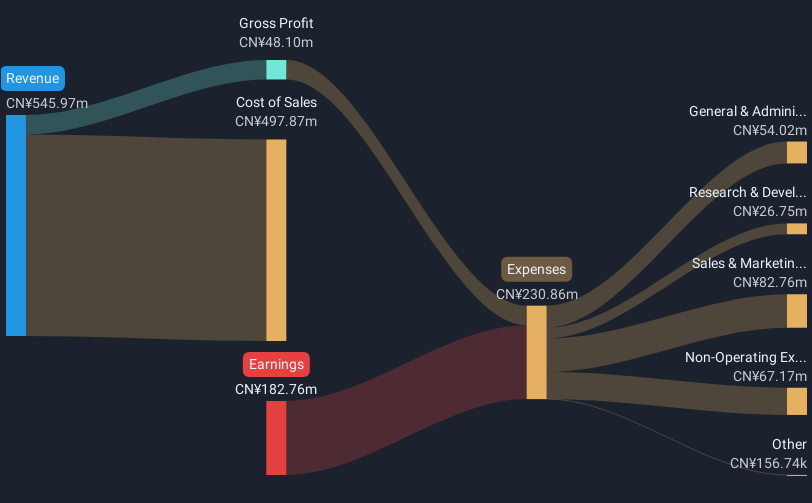

New JCM Group Ltd, with a market cap of CN¥1.93 billion, operates in the equipment manufacturing sector and reported sales of CN¥552.14 million for 2024, down from the previous year. Despite being unprofitable with a net loss of CN¥165.78 million, it has reduced losses over five years at a significant rate and maintains more cash than its total debt. The management team is experienced, and short-term assets cover long-term liabilities but not short-term ones. Shareholders have not faced dilution recently, although the stock's volatility remains high compared to most Chinese stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of New JCM GroupLtd.

- Understand New JCM GroupLtd's track record by examining our performance history report.

Jiangsu Wuyang Automation Control Technology (SZSE:300420)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Wuyang Automation Control Technology Co., Ltd. operates in the automation control industry with a market cap of CN¥3.32 billion.

Operations: Jiangsu Wuyang Automation Control Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.32B

Jiangsu Wuyang Automation Control Technology, with a market cap of CN¥3.32 billion, reported a decline in annual sales to CN¥1.01 billion for 2024 and experienced a net loss of CN¥87.22 million. Despite this, the company has more cash than its total debt and its short-term assets significantly exceed both short- and long-term liabilities. The management team is seasoned with an average tenure of 6.8 years, while the board also shows experience with 4.4 years on average per member. Recent share buybacks have been completed without significant dilution to shareholders, though profitability remains elusive as losses have increased over five years.

- Click here to discover the nuances of Jiangsu Wuyang Automation Control Technology with our detailed analytical financial health report.

- Evaluate Jiangsu Wuyang Automation Control Technology's historical performance by accessing our past performance report.

Guangdong Wanlima Industry Ltd (SZSE:300591)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Wanlima Industry Ltd (SZSE:300591) is involved in designing, researching, producing, manufacturing, and marketing leather products in China with a market cap of CN¥2.02 billion.

Operations: No revenue segments have been reported for this company.

Market Cap: CN¥2.02B

Guangdong Wanlima Industry Ltd, with a market cap of CN¥2.02 billion, remains unprofitable as losses have widened over the past five years. The company reported a net loss of CN¥175.9 million for 2024, with sales decreasing to CN¥586.57 million from the previous year. Despite these challenges, its short-term assets comfortably cover both short- and long-term liabilities, and it maintains a satisfactory net debt to equity ratio of 2.2%. The management team is experienced with an average tenure of 7.3 years, and recent earnings announcements highlight ongoing financial pressures amidst volatility in share price performance.

- Dive into the specifics of Guangdong Wanlima Industry Ltd here with our thorough balance sheet health report.

- Gain insights into Guangdong Wanlima Industry Ltd's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Gain an insight into the universe of 5,627 Global Penny Stocks by clicking here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New JCM GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300157

New JCM GroupLtd

Engages in equipment manufacturing business in China and internationally.

Adequate balance sheet minimal.

Market Insights

Community Narratives