- China

- /

- Construction

- /

- SZSE:002586

Global Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

Global markets are currently navigating a complex landscape marked by renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, which have contributed to recent declines in major stock indices. Amidst this backdrop, investors are increasingly seeking opportunities that combine potential growth with financial resilience. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still offer significant opportunities when supported by strong fundamentals and solid financials.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.52 | HK$971.08M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.63 | A$407.87M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.585 | MYR297.46M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.30 | SGD526.88M | ✅ 4 ⚠️ 1 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.33 | MYR534.07M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.20 | SGD12.59B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.535 | $311.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,563 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Zhejiang Reclaim Construction Group (SZSE:002586)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Reclaim Construction Group Co., Ltd. operates in the construction industry and has a market cap of CN¥4.34 billion.

Operations: The company's revenue is primarily derived from Building Construction, which accounts for CN¥2.20 billion, followed by Design and Technical Services contributing CN¥247.53 million.

Market Cap: CN¥4.34B

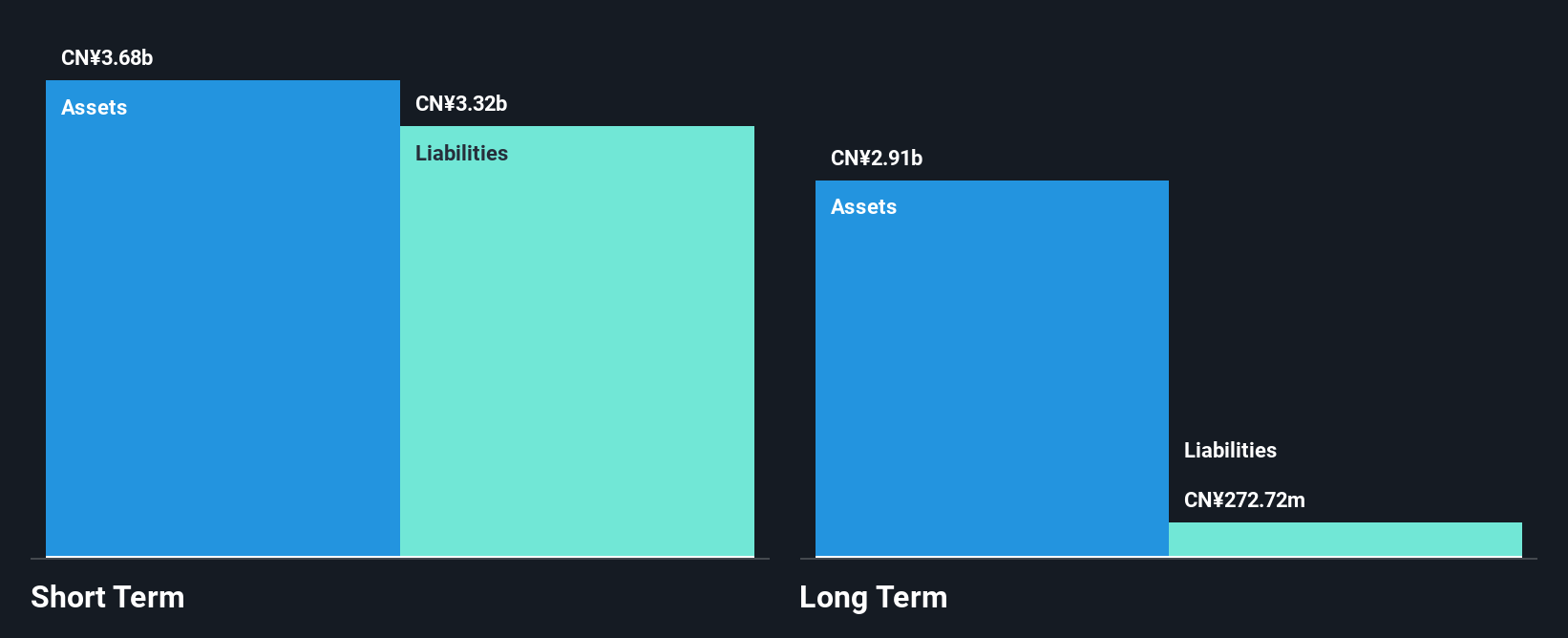

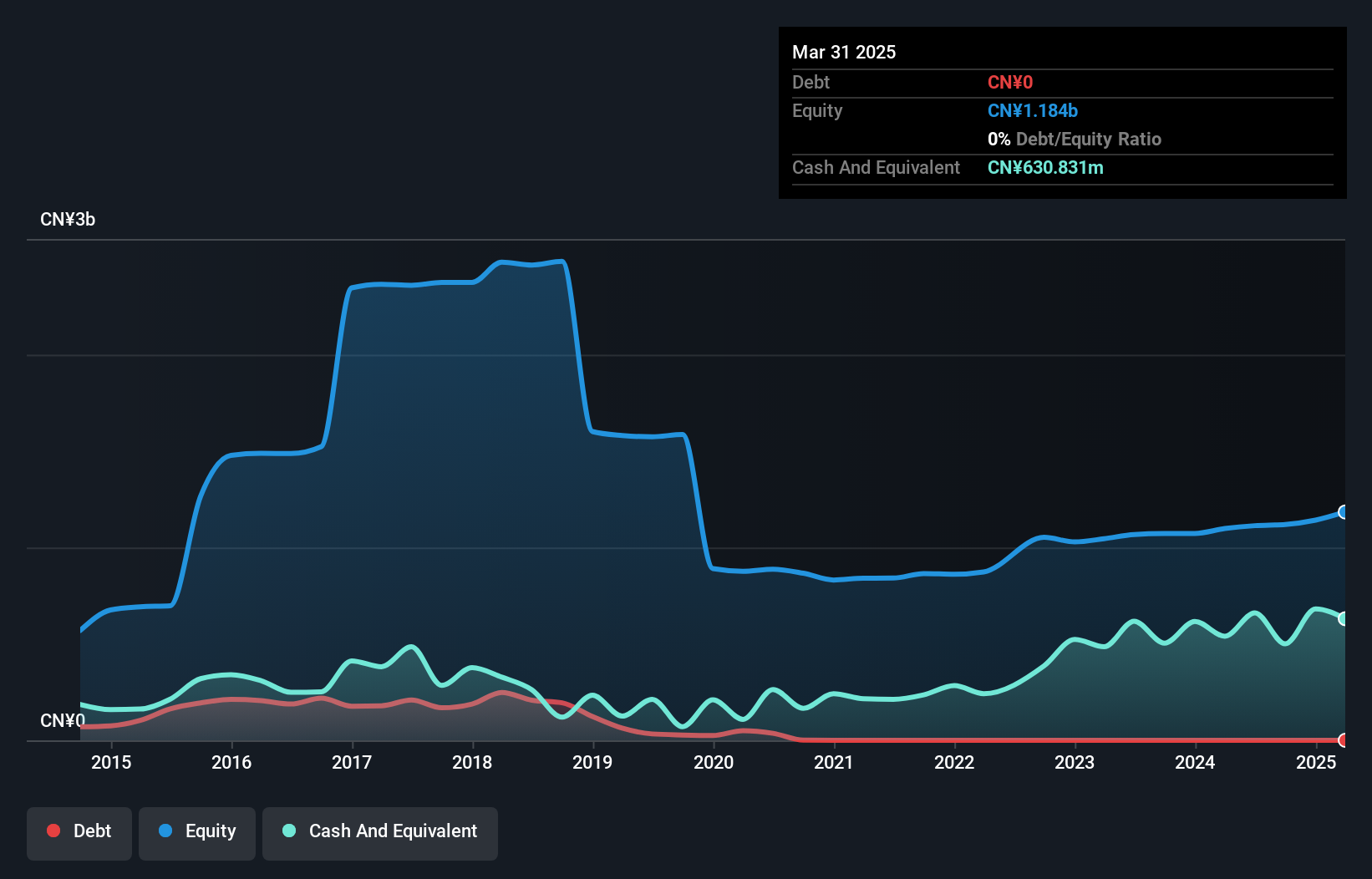

Zhejiang Reclaim Construction Group, with a market cap of CN¥4.34 billion, has shown signs of financial stability despite being unprofitable. The company has reduced its losses by 45.1% annually over the past five years and recently reported a net income of CN¥8.33 million for the half-year ended June 2025, reversing a previous loss. The company's short-term assets cover both its short- and long-term liabilities, and it maintains more cash than total debt. However, challenges remain with negative return on equity and an inexperienced board averaging three years in tenure.

- Take a closer look at Zhejiang Reclaim Construction Group's potential here in our financial health report.

- Explore historical data to track Zhejiang Reclaim Construction Group's performance over time in our past results report.

Hainan RuiZe New Building MaterialLtd (SZSE:002596)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan RuiZe New Building Material Co., Ltd operates in the production and sale of commercial concrete and municipal sanitation services in China, with a market cap of CN¥4.52 billion.

Operations: The company generates revenue of CN¥1.19 billion from its operations in China.

Market Cap: CN¥4.52B

Hainan RuiZe New Building Material Co., Ltd, with a market cap of CN¥4.52 billion, faces financial challenges despite having short-term assets of CN¥2.5 billion that cover its liabilities. The company remains unprofitable with a negative return on equity of -43.02% and has seen an increase in net losses over recent years, including a net loss of CN¥68.03 million for the half-year ended June 2025. While it has sufficient cash runway for over three years due to positive free cash flow, concerns persist regarding its high debt levels and an inexperienced board averaging 1.3 years in tenure.

- Navigate through the intricacies of Hainan RuiZe New Building MaterialLtd with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Hainan RuiZe New Building MaterialLtd's track record.

Youngy Health (SZSE:300247)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Youngy Health Co., Ltd. is a Chinese company that manufactures, exports, and sells sauna products, with a market capitalization of CN¥3.47 billion.

Operations: Youngy Health Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.47B

Youngy Health Co., Ltd. has demonstrated strong financial performance, with earnings growth of 92% over the past year and a net profit margin improvement from 5.8% to 8.3%. The company is debt-free, which reduces financial risk, and its short-term assets significantly exceed both short- and long-term liabilities, indicating solid liquidity. Despite a relatively inexperienced board with an average tenure of 2.8 years, the management team is seasoned with an average tenure of 6.2 years. Recent amendments to the company's articles of association suggest ongoing governance enhancements that may impact future operations positively.

- Click here to discover the nuances of Youngy Health with our detailed analytical financial health report.

- Evaluate Youngy Health's historical performance by accessing our past performance report.

Key Takeaways

- Discover the full array of 3,563 Global Penny Stocks right here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhejiang Reclaim Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002586

Zhejiang Reclaim Construction Group

Zhejiang Reclaim Construction Group Co., Ltd.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)