As global markets grapple with rising U.S. Treasury yields, small-cap stocks have struggled compared to their larger counterparts. In this context, penny stocks—often seen as smaller or newer companies—remain a relevant investment area for those willing to explore beyond the mainstream. While traditionally viewed with caution, these stocks can offer unique opportunities when backed by strong financials and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.585 | MYR2.91B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.735 | MYR127.31M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.85 | £183.45M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR305.39M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.255 | £307.76M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.38 | MYR2.45B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.08 | £405.78M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,800 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

CnlightLtd (SZSE:002076)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cnlight Co., Ltd is a Chinese company that manufactures and sells lighting products, with a market cap of CN¥2.17 billion.

Operations: The company generates revenue from Electrical Machinery and Equipment Manufacturing, contributing CN¥90.23 million, and Other Industries, adding CN¥71.71 million.

Market Cap: CN¥2.17B

Cnlight Co., Ltd, a Chinese lighting manufacturer with a market cap of CN¥2.17 billion, has shown signs of financial improvement despite being unprofitable. The company reported half-year revenue growth to CN¥70.1 million and achieved a net income of CN¥0.996 million compared to a previous loss. Its short-term assets cover both short- and long-term liabilities, and it holds more cash than debt, indicating prudent financial management. However, the management team and board are relatively inexperienced with average tenures below industry norms. Recent shareholder meetings discussed potential strategic acquisitions which could impact future growth trajectories.

- Dive into the specifics of CnlightLtd here with our thorough balance sheet health report.

- Gain insights into CnlightLtd's past trends and performance with our report on the company's historical track record.

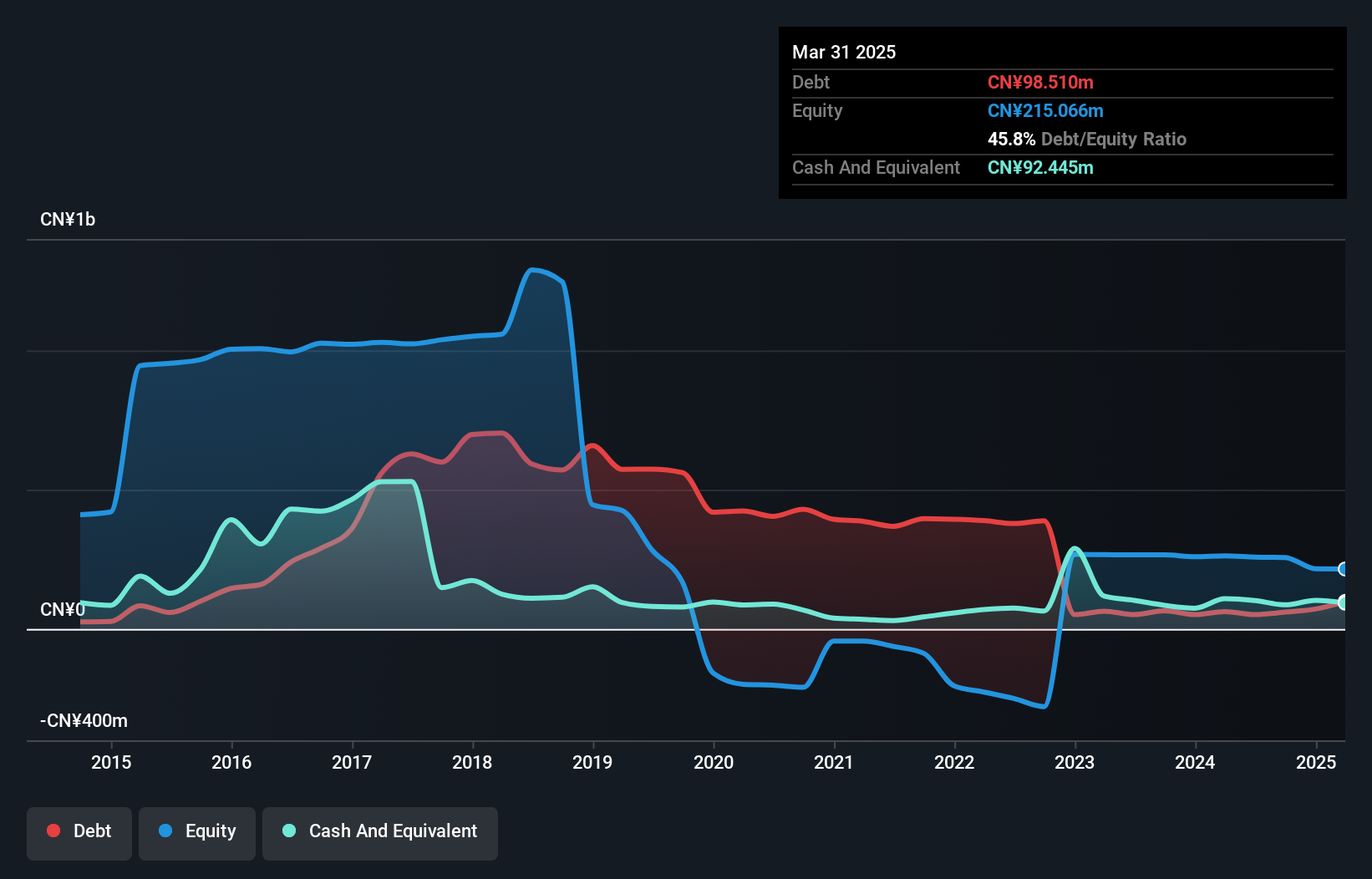

Zhejiang Renzhi (SZSE:002629)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Renzhi Co., Ltd. offers professional services in the oil and gas drilling and engineering sectors mainly in China, with a market cap of CN¥1.16 billion.

Operations: The company's revenue from its operations in China amounts to CN¥205.25 million.

Market Cap: CN¥1.16B

Zhejiang Renzhi Co., Ltd. operates in the oil and gas drilling sector with a market cap of CN¥1.16 billion, yet remains unprofitable. Recent earnings for the half-year showed a slight revenue decrease to CN¥90.64 million, with net losses narrowing from CN¥25.7 million to CN¥17.59 million year-over-year, reflecting efforts to reduce losses by 69.6% annually over five years despite shareholder dilution and limited cash runway under one year if trends persist. The company is debt-free but relies on short-term assets exceeding liabilities for financial stability, while its management team shows experience with an average tenure of 4.8 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Renzhi.

- Review our historical performance report to gain insights into Zhejiang Renzhi's track record.

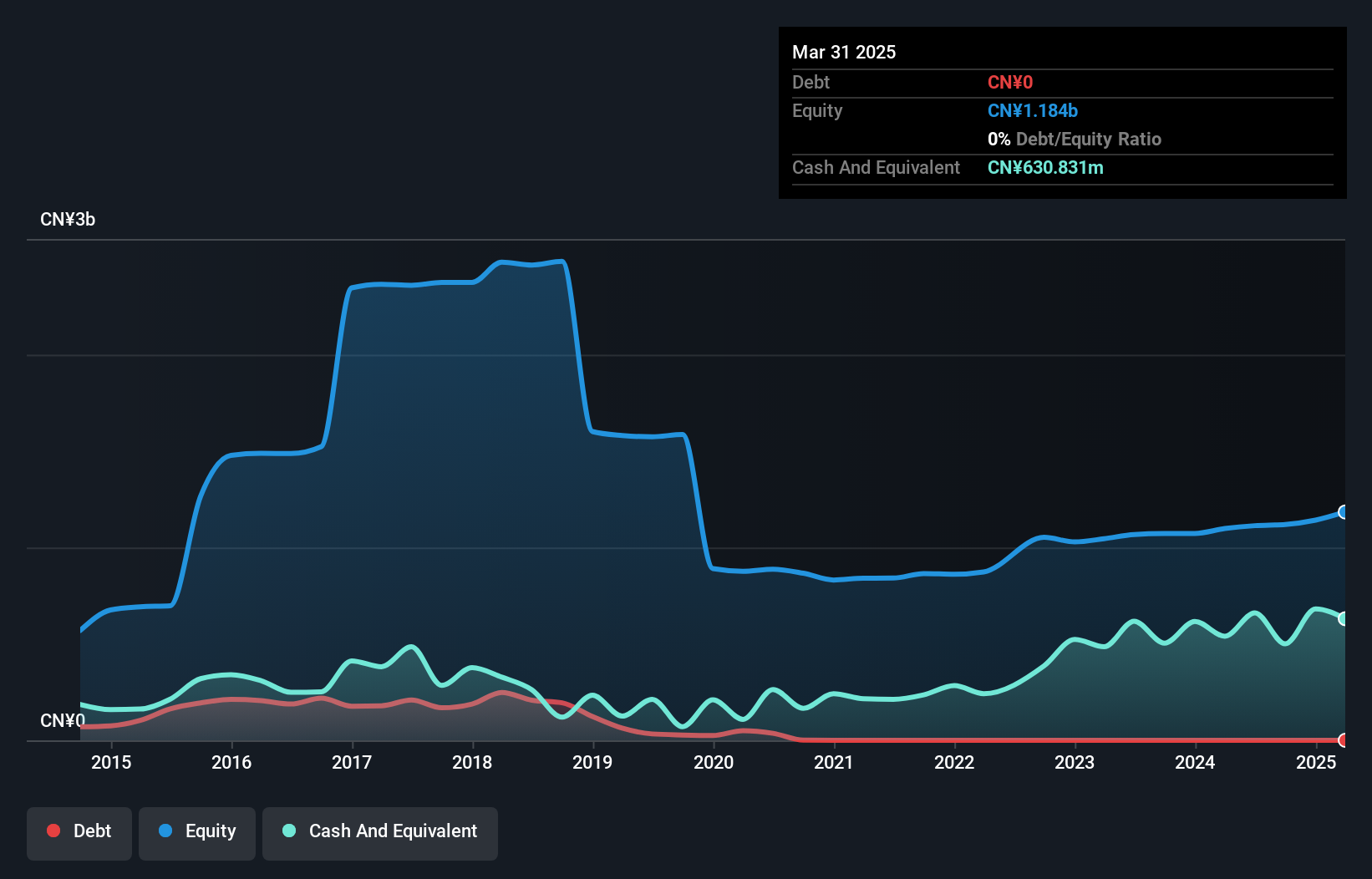

Youngy Health (SZSE:300247)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Youngy Health Co., Ltd. is a Chinese company specializing in the manufacture, export, and sale of sauna products with a market cap of CN¥2.89 billion.

Operations: There are no specific revenue segments reported for the company.

Market Cap: CN¥2.89B

Youngy Health Co., Ltd. has shown significant financial growth, with earnings increasing by a very large margin of 169.9% over the past year, surpassing industry trends. The company's net profit margin improved to 5.9% from 2.7%, supported by stable weekly volatility and effective interest coverage due to its cash reserves exceeding total debt. Despite a large one-off gain impacting recent results, Youngy Health maintains strong financial health with short-term assets covering both short and long-term liabilities comfortably. Its experienced management team and board contribute to the company's strategic direction without shareholder dilution in the past year.

- Get an in-depth perspective on Youngy Health's performance by reading our balance sheet health report here.

- Understand Youngy Health's track record by examining our performance history report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 5,800 Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300247

Youngy Health

Engages in the manufacture, export, and sale of sauna products in China.

Flawless balance sheet with proven track record.