- China

- /

- Consumer Durables

- /

- SZSE:300217

Slammed 25% Zhenjiang Dongfang Electric Heating Technology Co.,Ltd (SZSE:300217) Screens Well Here But There Might Be A Catch

The Zhenjiang Dongfang Electric Heating Technology Co.,Ltd (SZSE:300217) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 13% in that time.

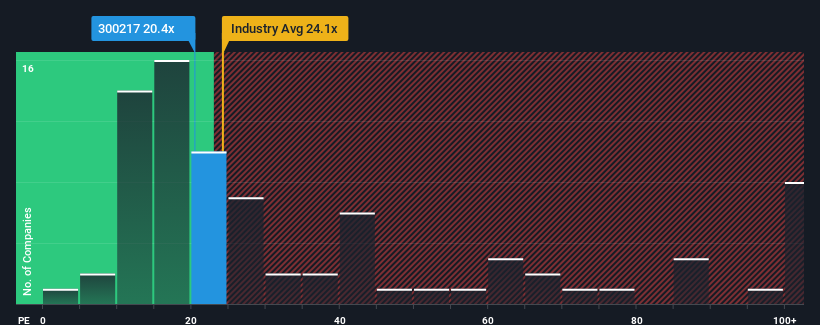

In spite of the heavy fall in price, Zhenjiang Dongfang Electric Heating TechnologyLtd's price-to-earnings (or "P/E") ratio of 20.4x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 36x and even P/E's above 70x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times haven't been advantageous for Zhenjiang Dongfang Electric Heating TechnologyLtd as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Zhenjiang Dongfang Electric Heating TechnologyLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhenjiang Dongfang Electric Heating TechnologyLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 48%. Still, the latest three year period has seen an excellent 232% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 35% over the next year. That's shaping up to be similar to the 38% growth forecast for the broader market.

With this information, we find it odd that Zhenjiang Dongfang Electric Heating TechnologyLtd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

The softening of Zhenjiang Dongfang Electric Heating TechnologyLtd's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Zhenjiang Dongfang Electric Heating TechnologyLtd currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about these 3 warning signs we've spotted with Zhenjiang Dongfang Electric Heating TechnologyLtd.

If you're unsure about the strength of Zhenjiang Dongfang Electric Heating TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhenjiang Dongfang Electric Heating TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300217

Zhenjiang Dongfang Electric Heating TechnologyLtd

Designs, manufactures, and sells various electric heaters in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives