- Hong Kong

- /

- Real Estate

- /

- SEHK:1908

Top Dividend Stocks For Steady Income In September 2024

Reviewed by Simply Wall St

As global markets celebrate the Federal Reserve's first rate cut in over four years, U.S. stocks have surged to new highs, reflecting a broad-based rally across major indices. With this optimistic backdrop, investors are increasingly looking for stable income sources, making dividend stocks an attractive option. In such a dynamic market environment, good dividend stocks are those that offer consistent payouts and have strong financial health to weather economic shifts. Here are three top dividend stocks to consider for steady income in September 2024.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.81% | ★★★★★★ |

| Globeride (TSE:7990) | 4.23% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.38% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.09% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 4.56% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.40% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.62% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.33% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 2047 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

C&D International Investment Group (SEHK:1908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: C&D International Investment Group Limited is an investment holding company involved in property development, real estate industry chain investment services, and industry investment activities across Mainland China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$25.54 billion.

Operations: The company's revenue segments include Property Development and Property Management and Other Related Services, which generated CN¥142.82 billion.

Dividend Yield: 9.1%

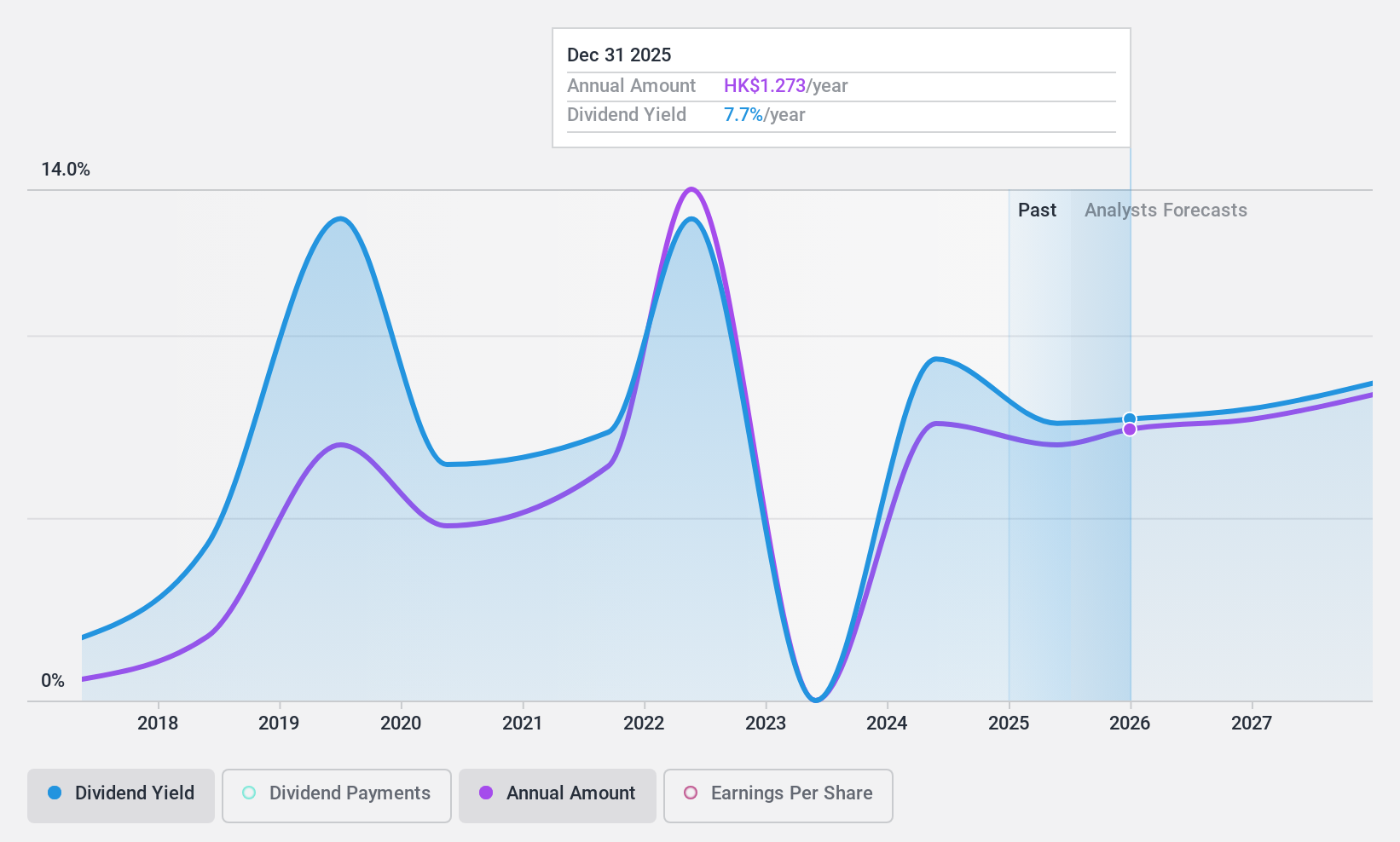

C&D International Investment Group's dividend yield is in the top 25% of Hong Kong market payers at 9.12%, but its payments have been volatile and not well covered by free cash flows. The payout ratio stands at a reasonable 52.6%, yet earnings and cash flows do not fully cover dividends, raising sustainability concerns. Recent financials show declining net income and diluted earnings per share, while debt coverage remains weak, indicating potential risks for dividend investors.

- Click here to discover the nuances of C&D International Investment Group with our detailed analytical dividend report.

- According our valuation report, there's an indication that C&D International Investment Group's share price might be on the cheaper side.

Kweichow Moutai (SHSE:600519)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kweichow Moutai Co., Ltd. produces and sells liquor products in China and internationally, with a market cap of approximately CN¥1.76 trillion.

Operations: Kweichow Moutai's primary revenue segment is its liquor products, generating CN¥160.05 billion.

Dividend Yield: 3.3%

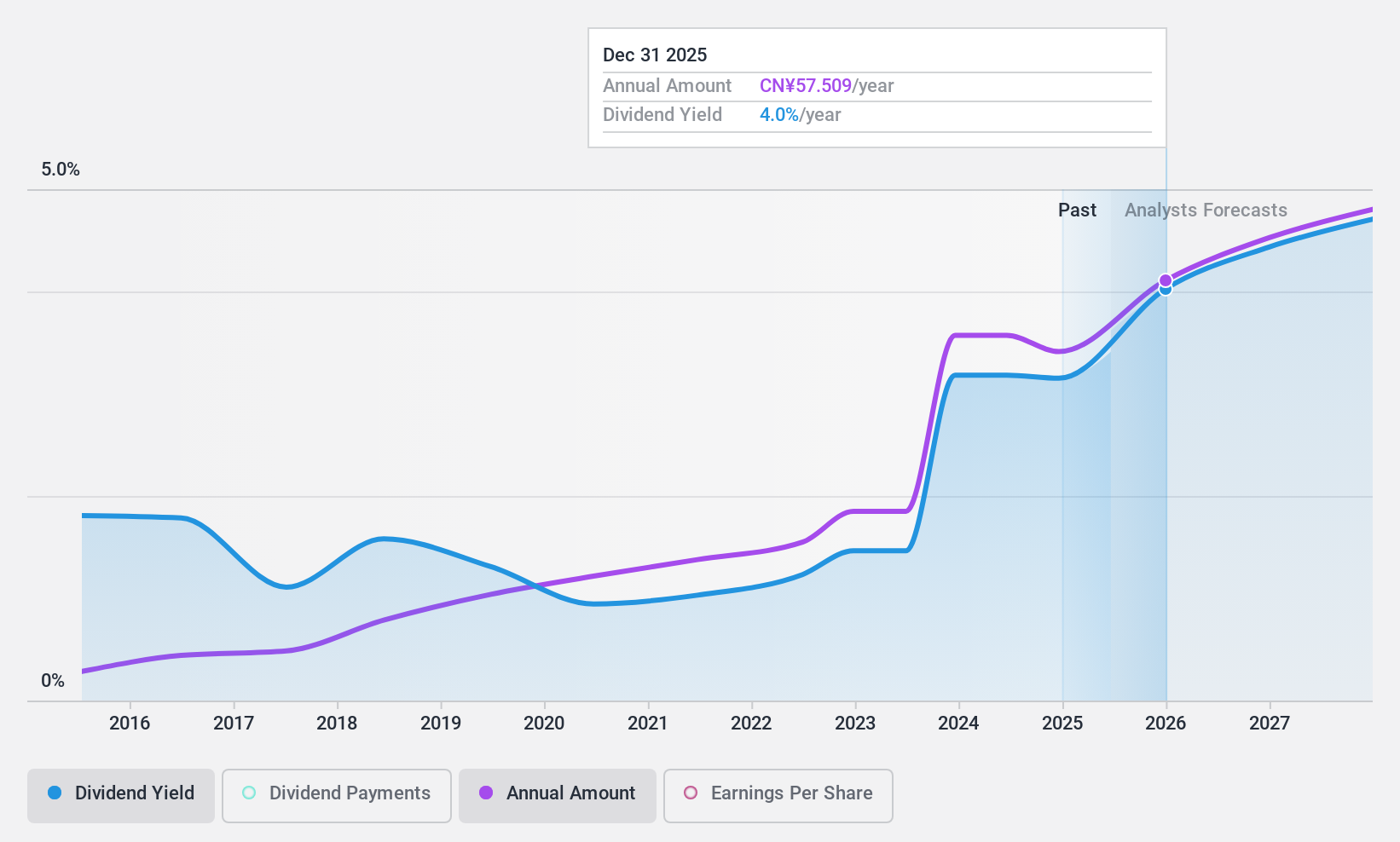

Kweichow Moutai offers stable and growing dividends, with a payout ratio of 48.2% covered by earnings and an 89.6% cash payout ratio. Over the past decade, dividends have been reliable and increased consistently. The company pays a high dividend yield of 3.27%, placing it in the top 25% of CN market payers. Recent news includes a CNY 6 billion share repurchase program, signaling confidence in its financial health despite high cash flow utilization for dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Kweichow Moutai.

- Our expertly prepared valuation report Kweichow Moutai implies its share price may be lower than expected.

BIEM.L.FDLKK GarmentLtd (SZSE:002832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BIEM.L.FDLKK Garment Co., Ltd. operates in the research, development, and design of branded apparel, along with brand promotion, marketing network construction, and supply chain management in China, with a market cap of CN¥10.45 billion.

Operations: BIEM.L.FDLKK Garment Co., Ltd. generates CN¥3.76 billion from its Clothing Apparel segment.

Dividend Yield: 5%

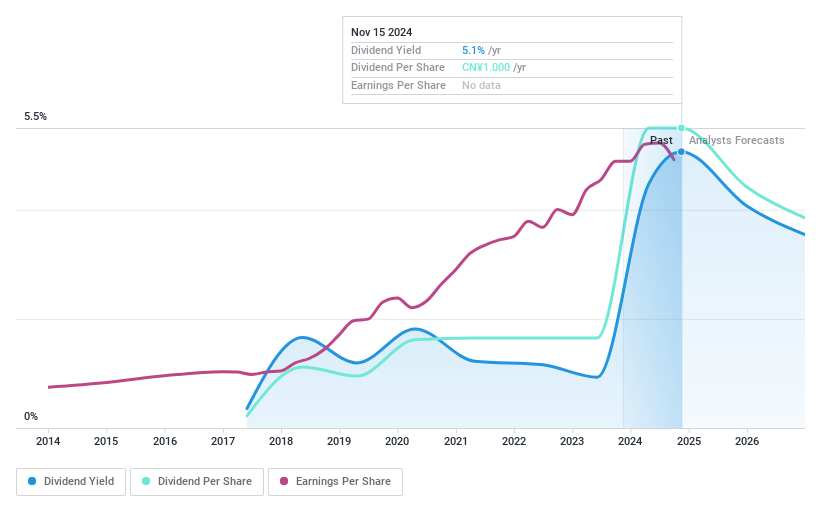

BIEM.L.FDLKK Garment Co.,Ltd. recently reported half-year sales of CNY 1.94 billion and net income of CNY 479.2 million, showing growth from the previous year. The company announced a final cash dividend of CNY 10 per 10 shares for 2023, reflecting its commitment to returning value to shareholders. With a payout ratio of 58.5% and a cash payout ratio of 70.5%, dividends are well-covered by earnings and cash flows, though the dividend history is less than ten years old.

- Take a closer look at BIEM.L.FDLKK GarmentLtd's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of BIEM.L.FDLKK GarmentLtd shares in the market.

Summing It All Up

- Explore the 2047 names from our Top Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1908

C&D International Investment Group

An investment holding company, engages in the property development, real estate industry chain investment services, and industry investment activities in Mainland China, Hong Kong, Macau, Taiwan, and internationally.

Very undervalued with adequate balance sheet and pays a dividend.