Zhejiang Weixing Industrial Development (SZSE:002003) Strong Profits May Be Masking Some Underlying Issues

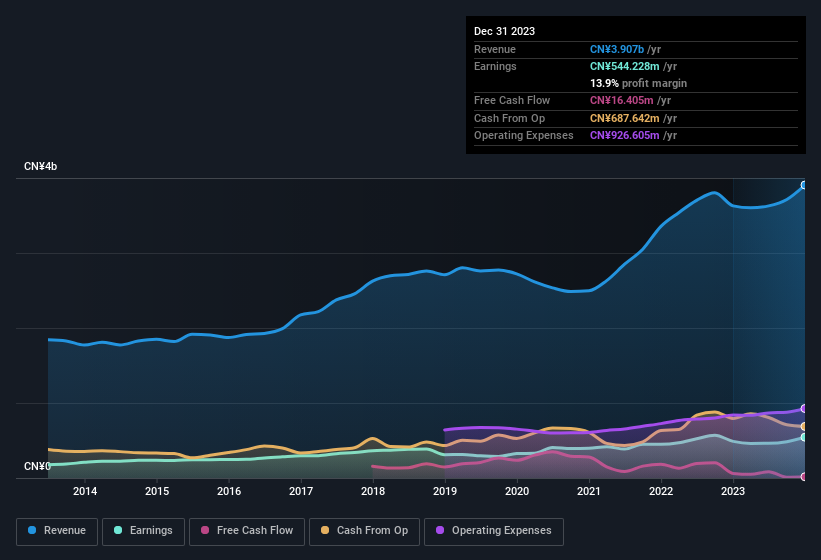

Zhejiang Weixing Industrial Development Co., Ltd. (SZSE:002003) just released a solid earnings report, and the stock displayed some strength. Despite this, our analysis suggests that there are some factors weakening the foundations of those good profit numbers.

View our latest analysis for Zhejiang Weixing Industrial Development

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Zhejiang Weixing Industrial Development issued 13% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Zhejiang Weixing Industrial Development's EPS by clicking here.

A Look At The Impact Of Zhejiang Weixing Industrial Development's Dilution On Its Earnings Per Share (EPS)

Zhejiang Weixing Industrial Development has improved its profit over the last three years, with an annualized gain of 37% in that time. And over the last 12 months, the company grew its profit by 11%. On the other hand, earnings per share are only up 9.4% in that time. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Zhejiang Weixing Industrial Development can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Zhejiang Weixing Industrial Development's Profit Performance

Zhejiang Weixing Industrial Development shareholders should keep in mind how many new shares it is issuing, because, dilution clearly has the power to severely impact shareholder returns. Therefore, it seems possible to us that Zhejiang Weixing Industrial Development's true underlying earnings power is actually less than its statutory profit. Nonetheless, it's still worth noting that its earnings per share have grown at 32% over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you want to do dive deeper into Zhejiang Weixing Industrial Development, you'd also look into what risks it is currently facing. In terms of investment risks, we've identified 2 warning signs with Zhejiang Weixing Industrial Development, and understanding them should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Zhejiang Weixing Industrial Development's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhejiang Weixing Industrial Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002003

Zhejiang Weixing Industrial Development

Zhejiang Weixing Industrial Development Co., Ltd.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)