In recent weeks, Chinese stocks have experienced a notable surge as optimism surrounding Beijing's comprehensive support measures has bolstered market sentiment, despite ongoing challenges in factory activity and real estate. As investors navigate these dynamic conditions, dividend stocks in China present an intriguing opportunity for those seeking stability and income amidst broader market fluctuations.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

| Midea Group (SZSE:000333) | 3.83% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.12% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.07% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.05% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.34% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.34% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.29% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.75% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.94% | ★★★★★★ |

Click here to see the full list of 194 stocks from our Top Chinese Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

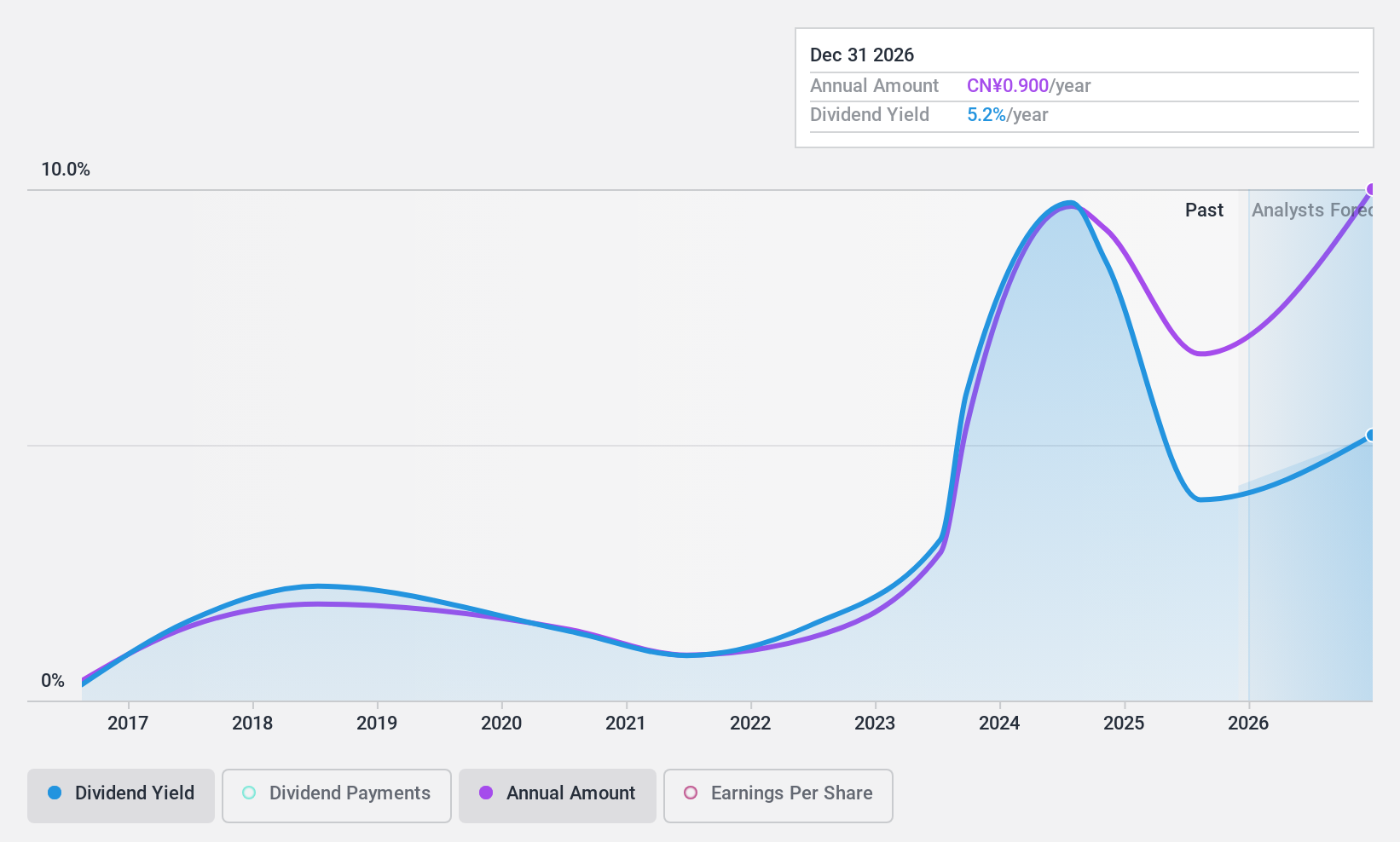

Cofco Sugar HoldingLTD (SHSE:600737)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cofco Sugar Holding Co., Ltd. operates in sugar and tomato processing both in China and internationally, with a market cap of CN¥22.80 billion.

Operations: Cofco Sugar Holding Co., Ltd. generates revenue from its operations in sugar and tomato processing across domestic and international markets.

Dividend Yield: 8.2%

Cofco Sugar Holding LTD offers an attractive dividend yield of 8.16%, ranking in the top 25% among Chinese dividend payers, though its track record has been volatile over the past decade. The company's dividends are well-covered by earnings (81.9% payout ratio) and cash flows (47% cash payout ratio). Recent earnings growth of 145.4% and a favorable P/E ratio of 10.5x suggest good value, but investors should be cautious about historical dividend reliability issues.

- Click to explore a detailed breakdown of our findings in Cofco Sugar HoldingLTD's dividend report.

- Our comprehensive valuation report raises the possibility that Cofco Sugar HoldingLTD is priced lower than what may be justified by its financials.

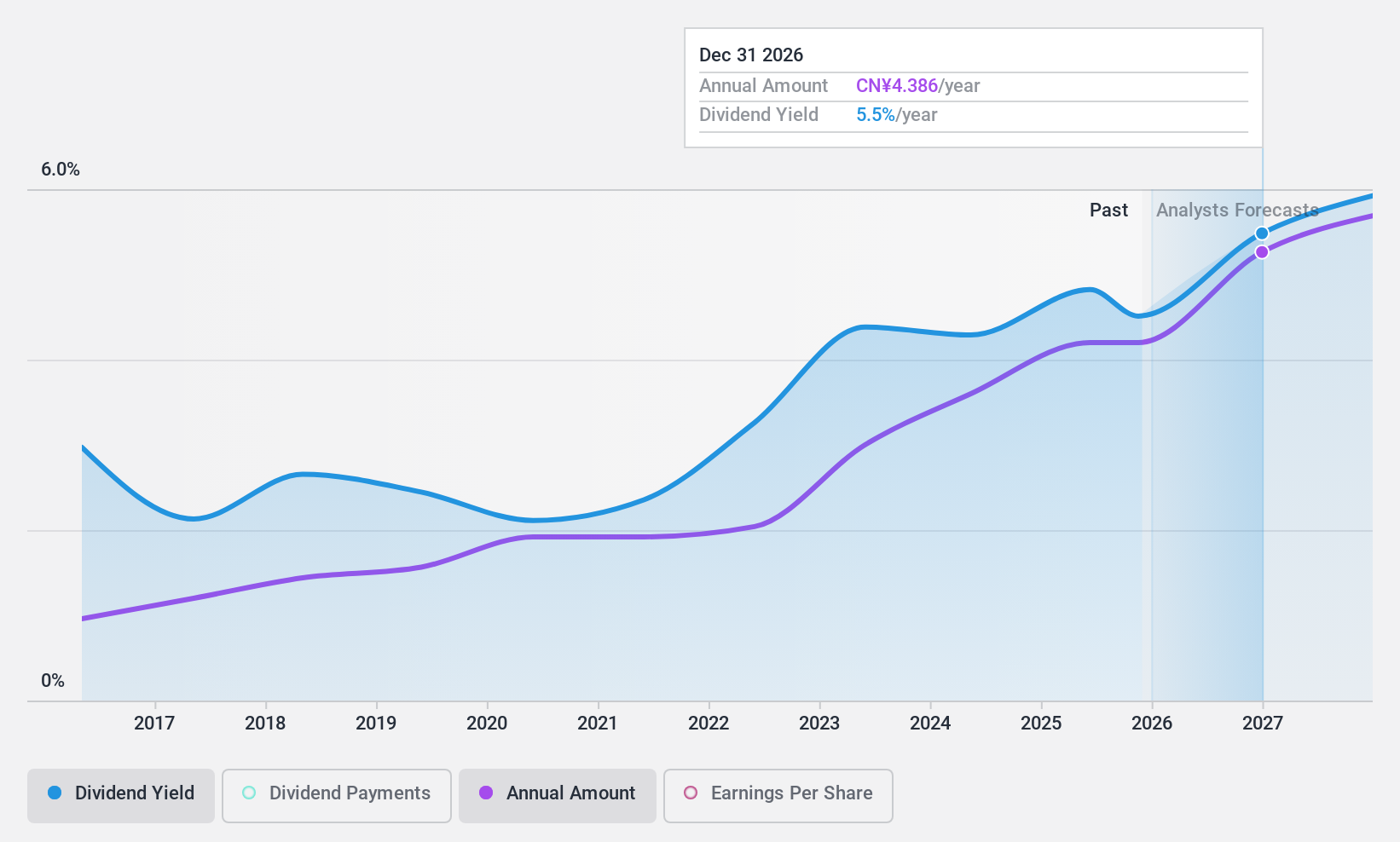

Midea Group (SZSE:000333)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Midea Group Co., Ltd. operates in the manufacturing and sale of home appliances and robotic and automation systems both in China and internationally, with a market cap of approximately CN¥595.70 billion.

Operations: Midea Group's revenue is primarily derived from its Heating & Ventilation, as Well as Air-Conditioner segment at CN¥191.93 billion, followed by Consumer Appliances at CN¥156.39 billion, and Robotics and Automation System at CN¥33.53 billion.

Dividend Yield: 3.8%

Midea Group offers a reliable dividend yield of 3.83%, placing it in the top 25% of Chinese dividend payers. Its dividends are well-covered by earnings (56.8% payout ratio) and cash flows (42% cash payout ratio), with a stable growth history over the past decade. Recent earnings growth and a favorable P/E ratio of 16.5x indicate potential value, though recent shareholder dilution from an HK$31 billion equity offering may impact future payouts.

- Navigate through the intricacies of Midea Group with our comprehensive dividend report here.

- Our expertly prepared valuation report Midea Group implies its share price may be too high.

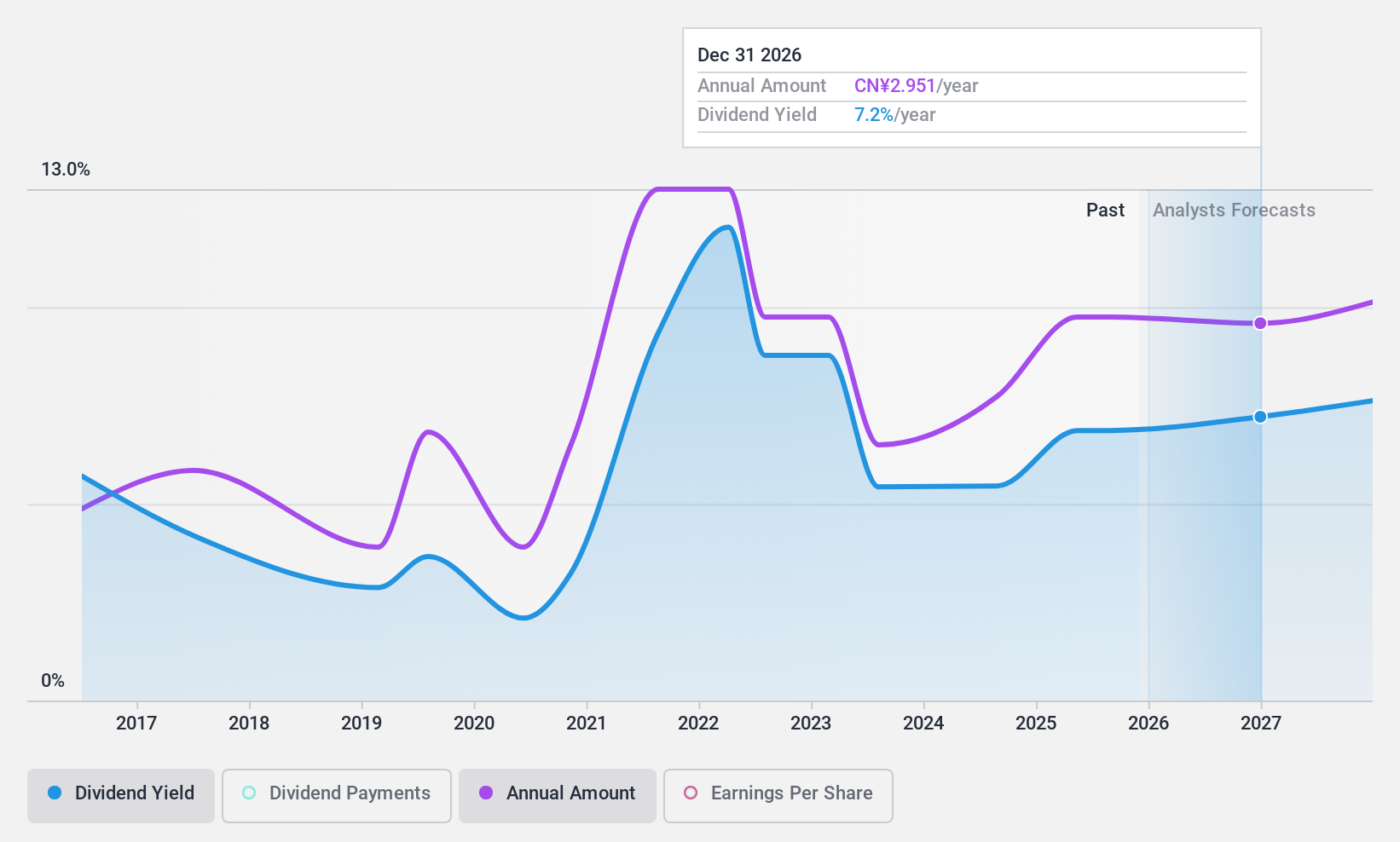

Gree Electric Appliances of Zhuhai (SZSE:000651)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gree Electric Appliances, Inc. of Zhuhai is a Chinese company that manufactures and sells air-conditioners, home appliances, and accessories with a market cap of CN¥274.16 billion.

Operations: Gree Electric Appliances, Inc. of Zhuhai generates revenue primarily from its manufacturing industry segment, amounting to CN¥182.78 billion.

Dividend Yield: 4.8%

Gree Electric Appliances has shown recent earnings growth, with net income rising to CNY 14.14 billion for the first half of 2024. Despite a volatile dividend history over the past decade, recent increases and a high yield of 4.79% place it among China's top dividend payers. Dividends are well-covered by earnings and cash flows, with payout ratios at 43.1% and 50.8%, respectively, suggesting sustainability despite past inconsistencies in payment stability.

- Get an in-depth perspective on Gree Electric Appliances of Zhuhai's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Gree Electric Appliances of Zhuhai is trading behind its estimated value.

Key Takeaways

- Discover the full array of 194 Top Chinese Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600737

Cofco Sugar HoldingLTD

Engages in the sugar and tomato processing activities in China and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026