As global markets navigate the challenges posed by rising U.S. Treasury yields and a cautious economic outlook, investors are increasingly seeking stability in dividend stocks. In such an environment, selecting stocks with strong dividend yields can be a prudent strategy for those looking to balance income generation with potential market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.30% | ★★★★★★ |

| Globeride (TSE:7990) | 4.26% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.14% | ★★★★★★ |

| Innotech (TSE:9880) | 4.73% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.61% | ★★★★★★ |

Click here to see the full list of 2030 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Abu Dhabi Commercial Bank PJSC (ADX:ADCB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi Commercial Bank PJSC, with a market cap of AED65.64 billion, operates in consumer banking, wholesale banking, and treasury and investment services both within the United Arab Emirates and internationally.

Operations: Abu Dhabi Commercial Bank PJSC generates revenue from several segments, including Retail Banking (AED4.69 billion), Property Management (AED745.08 million), Investments and Treasury (AED5.04 billion), and Corporate and Investment Banking (AED5.71 billion).

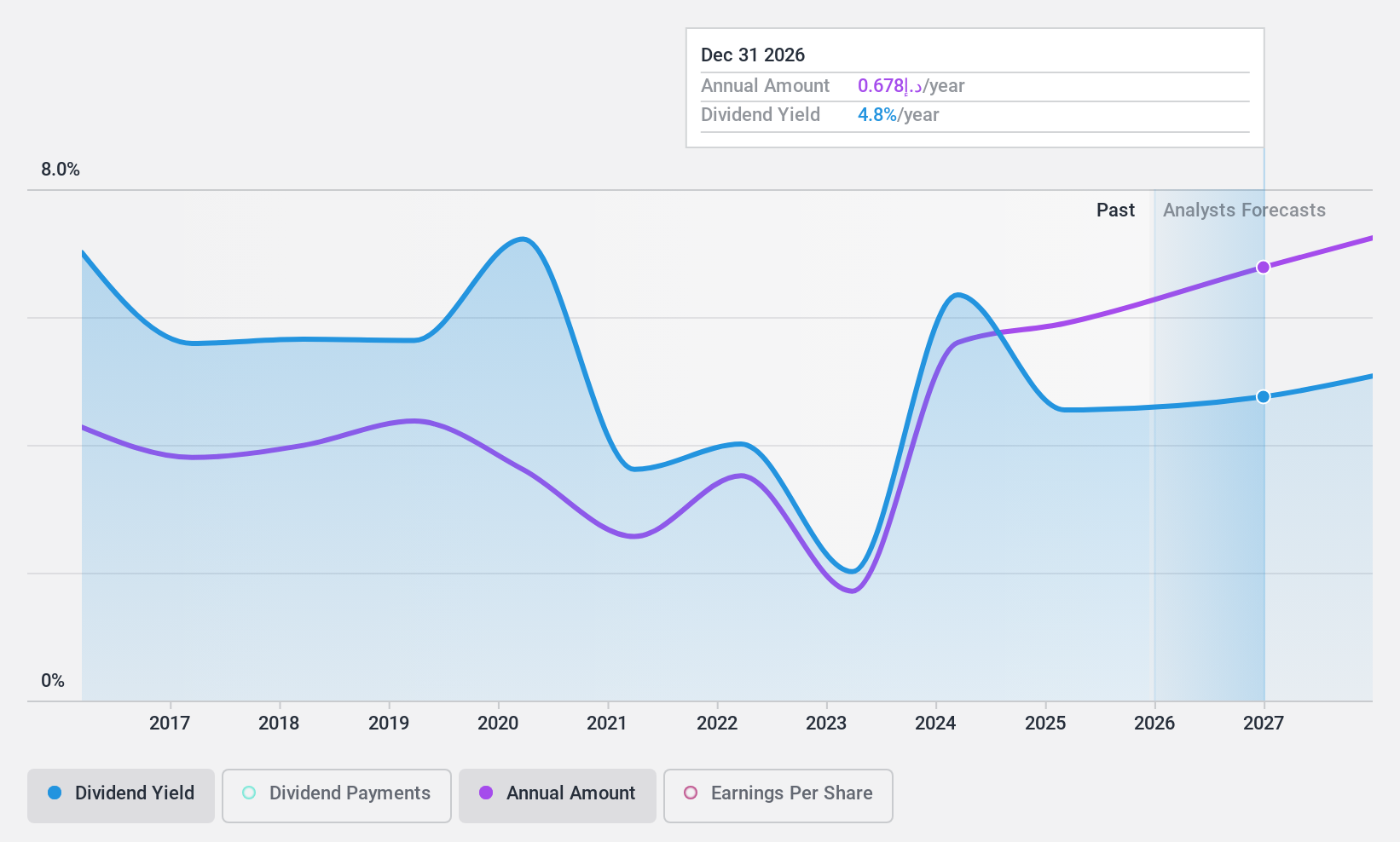

Dividend Yield: 6.2%

Abu Dhabi Commercial Bank PJSC offers a dividend yield of 6.24%, slightly below the top quartile in the AE market. Its dividends are well covered by earnings with a payout ratio of 46.9%, expected to remain sustainable at 48% in three years. However, its dividend history is volatile and unreliable over the past decade. Recent earnings show improved net income, indicating potential stability for future payouts despite high bad loan levels at 2.6%.

- Take a closer look at Abu Dhabi Commercial Bank PJSC's potential here in our dividend report.

- Our valuation report here indicates Abu Dhabi Commercial Bank PJSC may be undervalued.

Oppein Home Group (SHSE:603833)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oppein Home Group Inc. is a cabinetry manufacturer operating in Asia with a market capitalization of CN¥40.92 billion.

Operations: Oppein Home Group Inc.'s revenue from its Building Products segment amounts to CN¥20.10 billion.

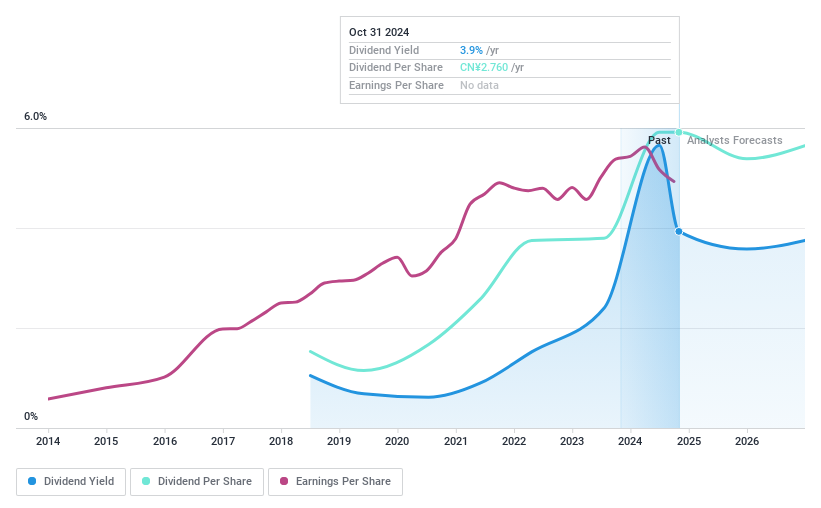

Dividend Yield: 4.1%

Oppein Home Group's dividend yield of 4.09% ranks in the top quartile of CN market payers, supported by a payout ratio of 61.1%. Despite this, its dividend history is unstable and volatile over six years, with payments not consistently growing. The company trades below estimated fair value and has completed a share buyback worth CNY 78.93 million. Recent earnings show declining sales and net income, raising concerns about future dividend reliability despite current coverage by cash flows at an 82.2% ratio.

- Navigate through the intricacies of Oppein Home Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Oppein Home Group shares in the market.

Matrix IT (TASE:MTRX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Matrix IT Ltd., along with its subsidiaries, offers information technology solutions and services across Israel, the United States, Europe, and internationally, with a market cap of ₪4.85 billion.

Operations: Matrix IT Ltd.'s revenue segments include Training and Implementation (₪168.61 million), Cloud and Computing Infrastructure (₪1.54 billion), Marketing and Support of Software Products (₪404.38 million), Information Technology Solutions and Services in the United States (₪493.73 million), and Consulting and Management services in Israel (₪3.05 billion).

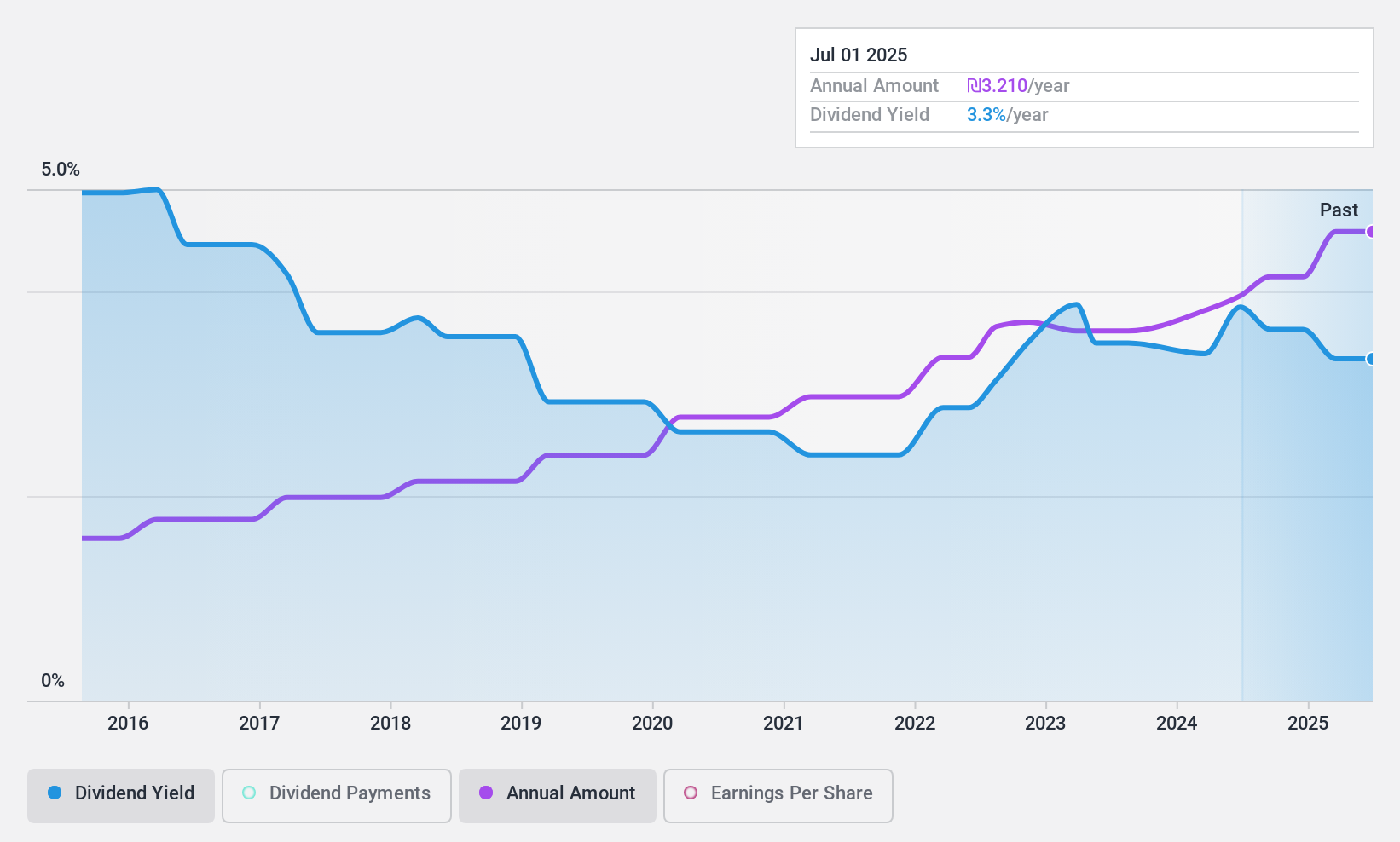

Dividend Yield: 3.8%

Matrix IT offers a stable dividend history over the past decade, with payments well-supported by earnings and cash flows. The current payout ratio of 74.9% and cash payout ratio of 35.9% indicate sustainability, although its 3.79% yield is below top-tier IL market payers. Recent earnings reveal growth in both sales (ILS 1.33 billion) and net income (ILS 69.5 million) for Q2, reflecting robust financial health which supports ongoing dividend reliability despite its relatively modest yield compared to peers.

- Get an in-depth perspective on Matrix IT's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Matrix IT's share price might be too pessimistic.

Taking Advantage

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 2027 more companies for you to explore.Click here to unveil our expertly curated list of 2030 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MTRX

Matrix IT

Through with its subsidiaries, provides information technology solutions and services in Israel, the United States, Europe, internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives