- Taiwan

- /

- Tech Hardware

- /

- TWSE:2376

Asian Market Highlights 3 Stocks That May Be Priced Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the Asian markets experience a positive shift due to the recent de-escalation in U.S.-China trade tensions, investor sentiment has seen a boost, with indices across the region showing signs of recovery. In this environment, identifying stocks that may be priced below their intrinsic value can present strategic opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shibaura Mechatronics (TSE:6590) | ¥7060.00 | ¥13902.24 | 49.2% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥22.73 | CN¥44.81 | 49.3% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥17.71 | CN¥34.32 | 48.4% |

| GEM (SZSE:002340) | CN¥6.23 | CN¥12.45 | 49.9% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.72 | CN¥26.81 | 48.8% |

| H.U. Group Holdings (TSE:4544) | ¥3071.00 | ¥6135.07 | 49.9% |

| Dive (TSE:151A) | ¥913.00 | ¥1813.84 | 49.7% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.84 | NZ$1.64 | 48.8% |

| BalnibarbiLtd (TSE:3418) | ¥1162.00 | ¥2312.87 | 49.8% |

| Medley (TSE:4480) | ¥3200.00 | ¥6199.68 | 48.4% |

Let's review some notable picks from our screened stocks.

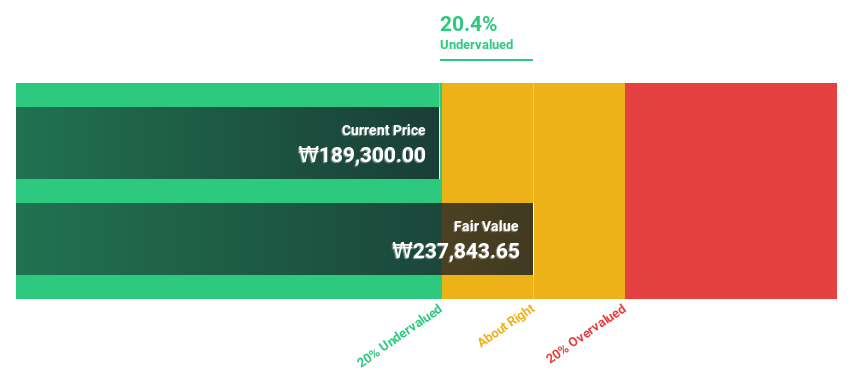

Celltrion (KOSE:A068270)

Overview: Celltrion, Inc., along with its subsidiaries, specializes in developing and producing protein-based drugs for oncology treatment in South Korea, with a market cap of ₩32.83 trillion.

Operations: The company's revenue is primarily derived from its biopharmaceutical segment, which accounts for ₩6.07 trillion, followed by chemical drugs contributing ₩531.39 billion.

Estimated Discount To Fair Value: 22.8%

Celltrion is trading at a significant discount, with its stock price 22.8% below fair value estimates of ₩199,569.57. Despite lower profit margins compared to last year, earnings are projected to grow substantially at 37.9% annually over the next three years, outpacing the Korean market's growth rate of 20.4%. Recent initiatives like share buybacks and product approvals bolster its cash flow potential amidst evolving pharmaceutical policies and competitive biosimilar offerings.

- In light of our recent growth report, it seems possible that Celltrion's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Celltrion's balance sheet health report.

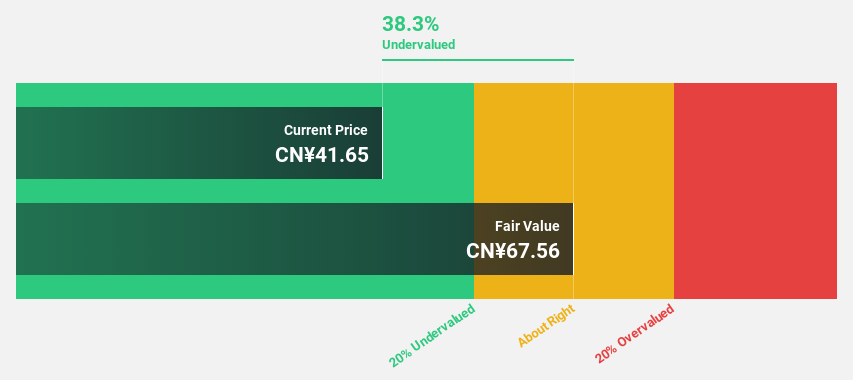

HMT (Xiamen) New Technical Materials (SHSE:603306)

Overview: HMT (Xiamen) New Technical Materials Co., Ltd. operates in the technical materials sector, focusing on innovative solutions, with a market cap of CN¥12 billion.

Operations: The company's revenue primarily comes from the Automobile Parts Manufacturing Industry, amounting to CN¥2.28 billion.

Estimated Discount To Fair Value: 39.9%

HMT (Xiamen) New Technical Materials is currently trading at a significant discount, with its stock price 39.9% below fair value estimates of CNY 67.43. The company has demonstrated strong financial performance, with earnings and revenue growing by 16% and forecasted to grow significantly over the next three years. Recent share buybacks totaling CNY 746.76 million further enhance its cash flow potential, positioning it favorably against the broader Chinese market's growth projections.

- Our expertly prepared growth report on HMT (Xiamen) New Technical Materials implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of HMT (Xiamen) New Technical Materials with our comprehensive financial health report here.

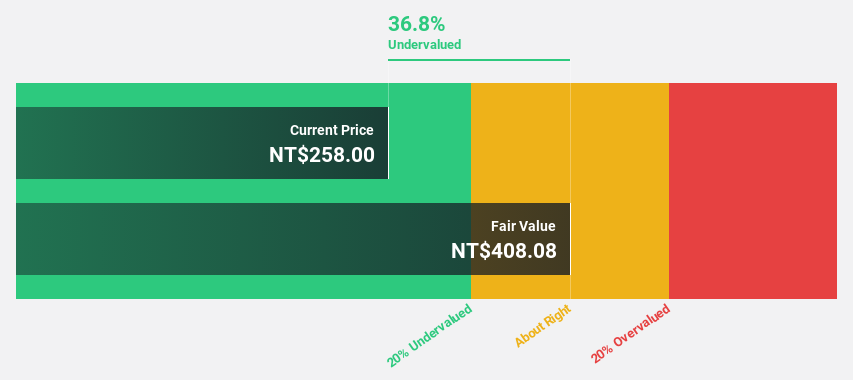

Giga-Byte Technology (TWSE:2376)

Overview: Giga-Byte Technology Co., Ltd. and its subsidiaries engage in the manufacturing, processing, and trading of computer peripherals and component parts across Taiwan, Europe, the United States, Canada, China, and other international markets with a market cap of NT$171.83 billion.

Operations: The company's revenue is primarily derived from its Brand Business Division, which accounts for NT$274.76 billion.

Estimated Discount To Fair Value: 43%

Giga-Byte Technology's stock is trading at NT$256.5, significantly below its estimated fair value of NT$450.15, representing a 43% discount. Despite high non-cash earnings, the company's profits grew by 89.5% last year and are expected to continue growing at 14.55% annually, outpacing Taiwan's market average. Recent financials show substantial revenue growth from TWD 55 billion to TWD 65 billion in Q1 2025, reflecting strong operational performance despite a dividend not fully covered by free cash flows.

- Our growth report here indicates Giga-Byte Technology may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Giga-Byte Technology.

Key Takeaways

- Investigate our full lineup of 292 Undervalued Asian Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2376

Giga-Byte Technology

Manufactures, processes, and trades in computer peripherals and component parts in Taiwan, Europe, the United States, Canada, China, and internationally.

Very undervalued with solid track record.

Market Insights

Community Narratives