- China

- /

- Electronic Equipment and Components

- /

- SHSE:688322

Spotlight On 3 Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a complex landscape with mixed economic signals, such as declining U.S. consumer confidence and fluctuating stock indices, investors are increasingly attentive to growth stocks that exhibit resilience and potential in uncertain times. In this context, companies with high insider ownership often stand out due to the alignment of interests between management and shareholders, suggesting confidence in the company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that develops long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩16.49 trillion.

Operations: The company's revenue is derived from its biotechnology segment, amounting to ₩74.38 billion.

Insider Ownership: 25.9%

Revenue Growth Forecast: 84.2% p.a.

Alteogen is poised for significant growth, with earnings forecast to grow 140.63% annually and revenue expected to increase by 84.2% per year, outpacing the KR market. Despite recent shareholder dilution and high share price volatility, the company trades at a substantial discount to its estimated fair value. A recent exclusive license agreement with Daiichi Sankyo for ALT-B4 could enhance profitability through upfront payments, milestones, and royalties, supporting its transition to profitability within three years.

- Unlock comprehensive insights into our analysis of ALTEOGEN stock in this growth report.

- Our valuation report here indicates ALTEOGEN may be overvalued.

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

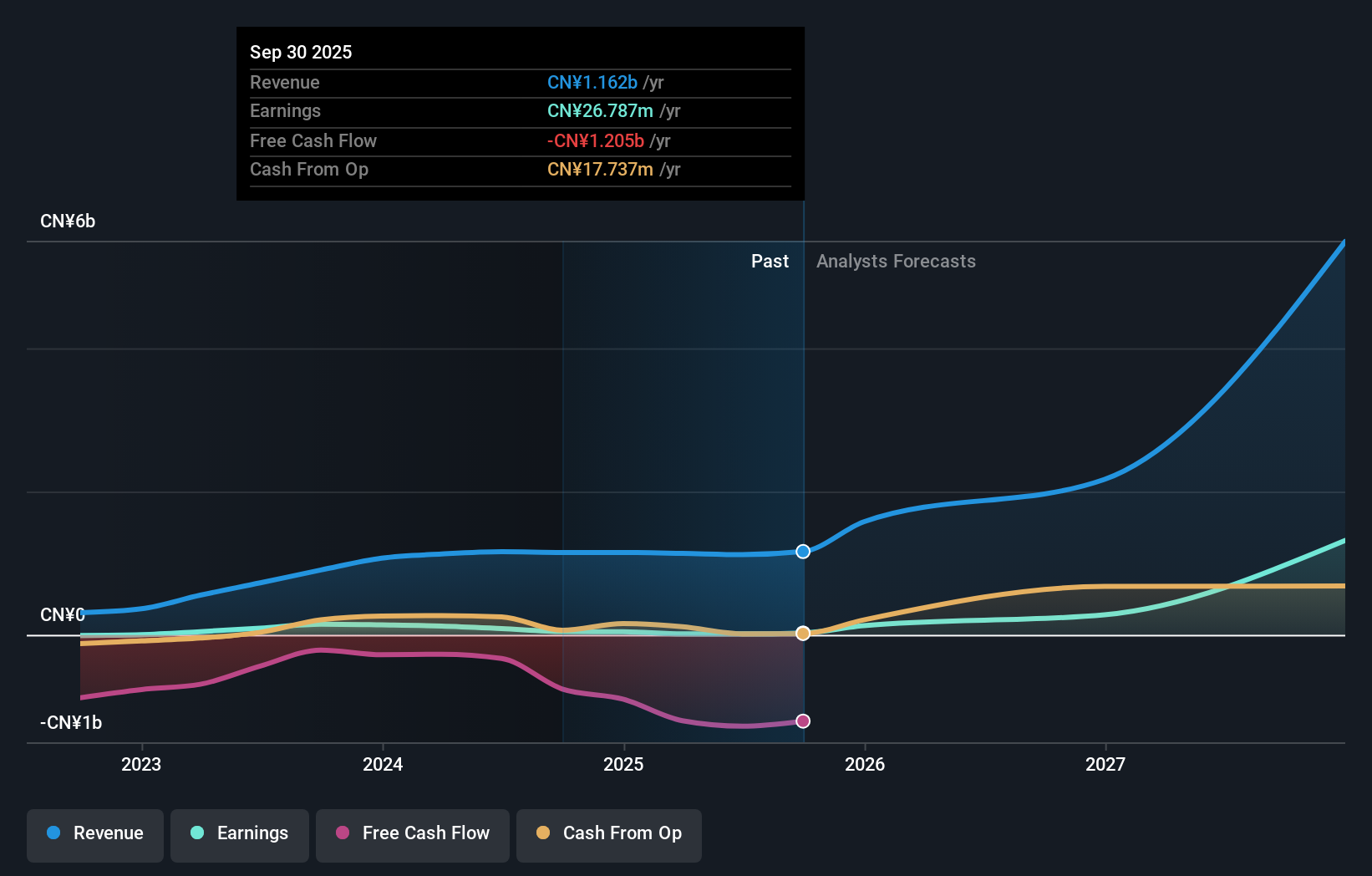

Overview: Orbbec Inc. designs, manufactures, and sells 3D vision sensors with a market capitalization of CN¥18.55 billion.

Operations: Revenue segments for the company include 3D vision sensors.

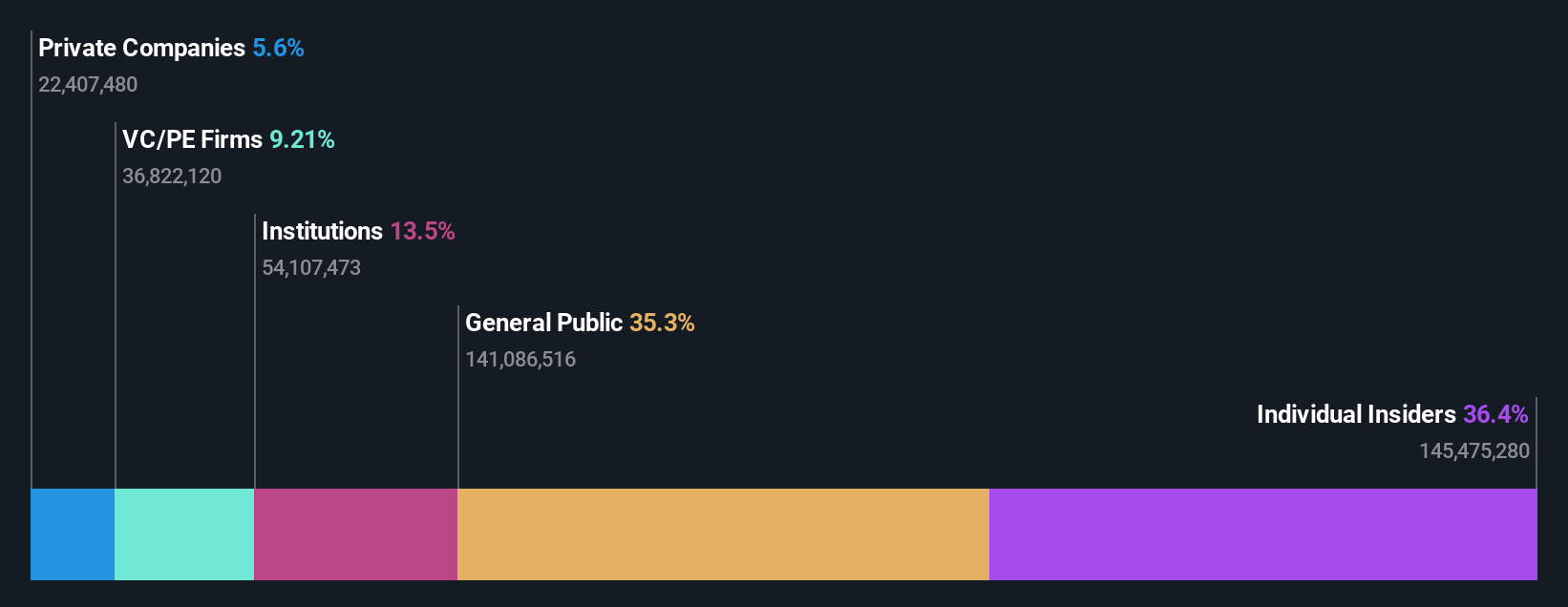

Insider Ownership: 36.5%

Revenue Growth Forecast: 39.9% p.a.

Orbbec is on track for robust growth, with revenue projected to rise by 39.9% annually, surpassing the CN market's pace. Despite a volatile share price and current unprofitability, earnings are expected to grow significantly at 123.38% per year, reaching profitability within three years. Recent financials show improved performance with sales increasing to CNY 350.86 million and net losses narrowing substantially from last year. The company completed a share buyback worth CNY 33.83 million in September 2024, signaling confidence in its valuation amidst high insider ownership levels.

- Dive into the specifics of Orbbec here with our thorough growth forecast report.

- Our valuation report unveils the possibility Orbbec's shares may be trading at a premium.

Qingdao Huicheng Environmental Technology Group (SZSE:300779)

Simply Wall St Growth Rating: ★★★★★★

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. (SZSE:300779) operates in the environmental technology sector, focusing on providing solutions for pollution control and environmental protection, with a market cap of CN¥19.04 billion.

Operations: Qingdao Huicheng Environmental Technology Group generates its revenue primarily through solutions in pollution control and environmental protection.

Insider Ownership: 31.8%

Revenue Growth Forecast: 34.5% p.a.

Qingdao Huicheng Environmental Technology Group is poised for substantial growth, with revenue expected to increase by 34.5% annually, outpacing the broader Chinese market. Earnings are forecasted to grow significantly at 65.23% per year, although recent financials show a decline in net income from CNY 136.28 million to CNY 43.44 million over the past nine months. High insider ownership is underscored by Zhang Min's acquisition of a 5% stake for CNY 300 million in October 2024.

- Click to explore a detailed breakdown of our findings in Qingdao Huicheng Environmental Technology Group's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Qingdao Huicheng Environmental Technology Group shares in the market.

Next Steps

- Reveal the 1501 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688322

High growth potential with excellent balance sheet.