- China

- /

- Professional Services

- /

- SZSE:002620

Top Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the global markets wrapped up the year with mixed signals, including a dip in U.S. consumer confidence and moderate gains in major stock indexes, investors are keeping a close eye on potential opportunities. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area for those looking to explore beyond established market giants. While the term may seem outdated, these stocks can offer significant value when backed by strong financials and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Country Group Holdings (SET:CGH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Country Group Holdings Public Company Limited, with a market cap of THB2.82 billion, primarily operates in the securities business through its subsidiaries in Thailand.

Operations: The company's revenue is primarily derived from Securities and Derivatives Brokerage (THB959.57 million), followed by Securities and Derivatives Trading (THB319.71 million), and Investment Banking (THB29.11 million).

Market Cap: THB2.82B

Country Group Holdings has shown a significant turnaround, reporting THB 611.33 million in third-quarter revenue, up from THB 303.42 million the previous year, and achieving profitability with a net income of THB 117.52 million compared to a prior loss. Despite shareholder dilution and low return on equity at 2.6%, the company benefits from stable weekly volatility and cash exceeding total debt, suggesting financial resilience. Its seasoned management team further supports operational stability while its price-to-earnings ratio of 15.4x indicates it is valued below industry average, potentially appealing to value-focused investors in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Country Group Holdings.

- Evaluate Country Group Holdings' historical performance by accessing our past performance report.

Shenzhen Ruihe Construction Decoration (SZSE:002620)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Ruihe Construction Decoration Co., Ltd. operates in the construction and decoration industry, with a market cap of CN¥1.69 billion.

Operations: The company generates revenue of CN¥950.31 million from its operations in China.

Market Cap: CN¥1.69B

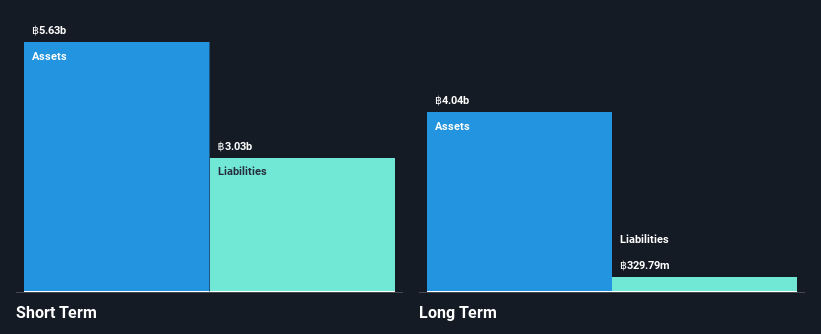

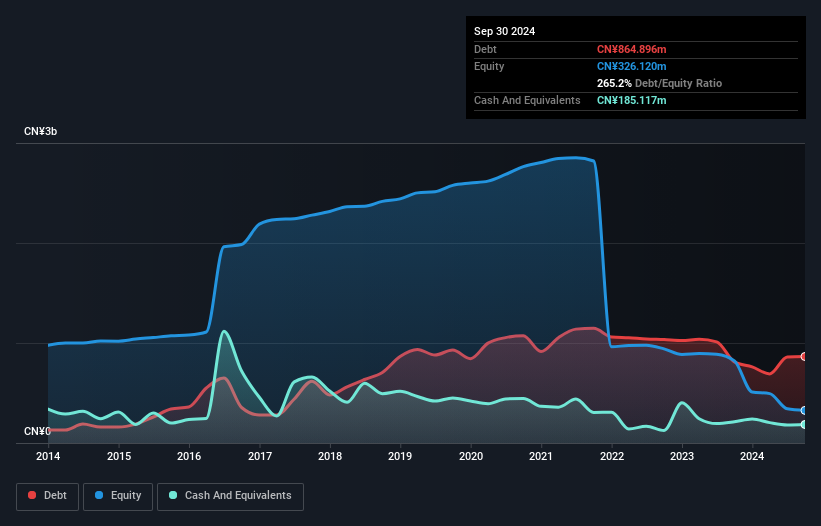

Shenzhen Ruihe Construction Decoration Co., Ltd. faces challenges with declining revenue, reporting CN¥588.22 million for the first nine months of 2024, down from CN¥1.19 billion a year earlier, and increasing net losses of CN¥108.34 million. Despite its unprofitability and a high net debt to equity ratio of 162.3%, the company maintains sufficient liquidity with short-term assets exceeding liabilities and a cash runway extending over three years due to positive free cash flow growth. The board's inexperience may impact strategic decisions, while stable weekly volatility suggests some consistency in stock performance amidst financial difficulties.

- Navigate through the intricacies of Shenzhen Ruihe Construction Decoration with our comprehensive balance sheet health report here.

- Understand Shenzhen Ruihe Construction Decoration's track record by examining our performance history report.

Jiangsu Huasheng Tianlong PhotoelectricLtd (SZSE:300029)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Huasheng Tianlong Photoelectric Co., Ltd. operates in the photoelectric industry and has a market cap of CN¥1 billion.

Operations: The company generates CN¥274.75 million in revenue from its industrial segment.

Market Cap: CN¥1B

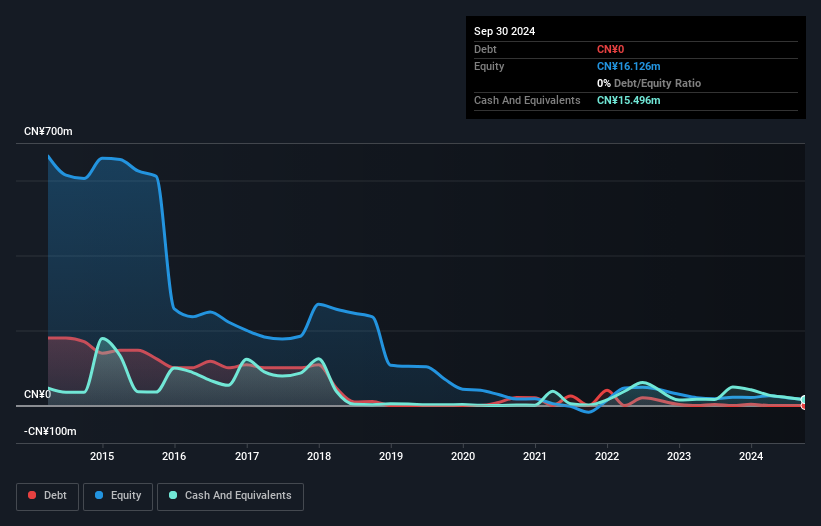

Jiangsu Huasheng Tianlong Photoelectric Co., Ltd. is navigating financial hurdles with its revenue for the first nine months of 2024 falling to CN¥123.05 million from CN¥216.69 million a year earlier, while net losses have narrowed slightly to CN¥5.1 million. Despite being debt-free and having short-term assets that cover both short- and long-term liabilities, the company faces challenges with less than a year of cash runway and unprofitability affecting its return on equity negatively at -37.4%. The board's limited experience may influence strategic outcomes, though shareholder dilution has not been significant recently.

- Click to explore a detailed breakdown of our findings in Jiangsu Huasheng Tianlong PhotoelectricLtd's financial health report.

- Explore historical data to track Jiangsu Huasheng Tianlong PhotoelectricLtd's performance over time in our past results report.

Key Takeaways

- Investigate our full lineup of 5,815 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002620

Shenzhen Ruihe Construction Decoration

Shenzhen Ruihe Construction Decoration Co., Ltd.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives