- China

- /

- Electrical

- /

- SZSE:002335

3 Stocks That Investors May Be Undervaluing By Up To 37.5%

Reviewed by Simply Wall St

As global markets navigate a mix of rising treasury yields, fluctuating consumer confidence, and geopolitical tensions, investors are increasingly on the lookout for opportunities that may be flying under the radar. In this environment, identifying undervalued stocks can be crucial; these are often companies whose current market prices do not fully reflect their intrinsic value or growth potential amidst broader economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.8% |

| Wasion Holdings (SEHK:3393) | HK$7.13 | HK$14.19 | 49.7% |

| First Solar (NasdaqGS:FSLR) | US$176.24 | US$350.71 | 49.7% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7309.53 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.70 | 50% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7652.96 | 49.9% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.71 | 49.8% |

| ASMPT (SEHK:522) | HK$74.90 | HK$149.66 | 50% |

Here we highlight a subset of our preferred stocks from the screener.

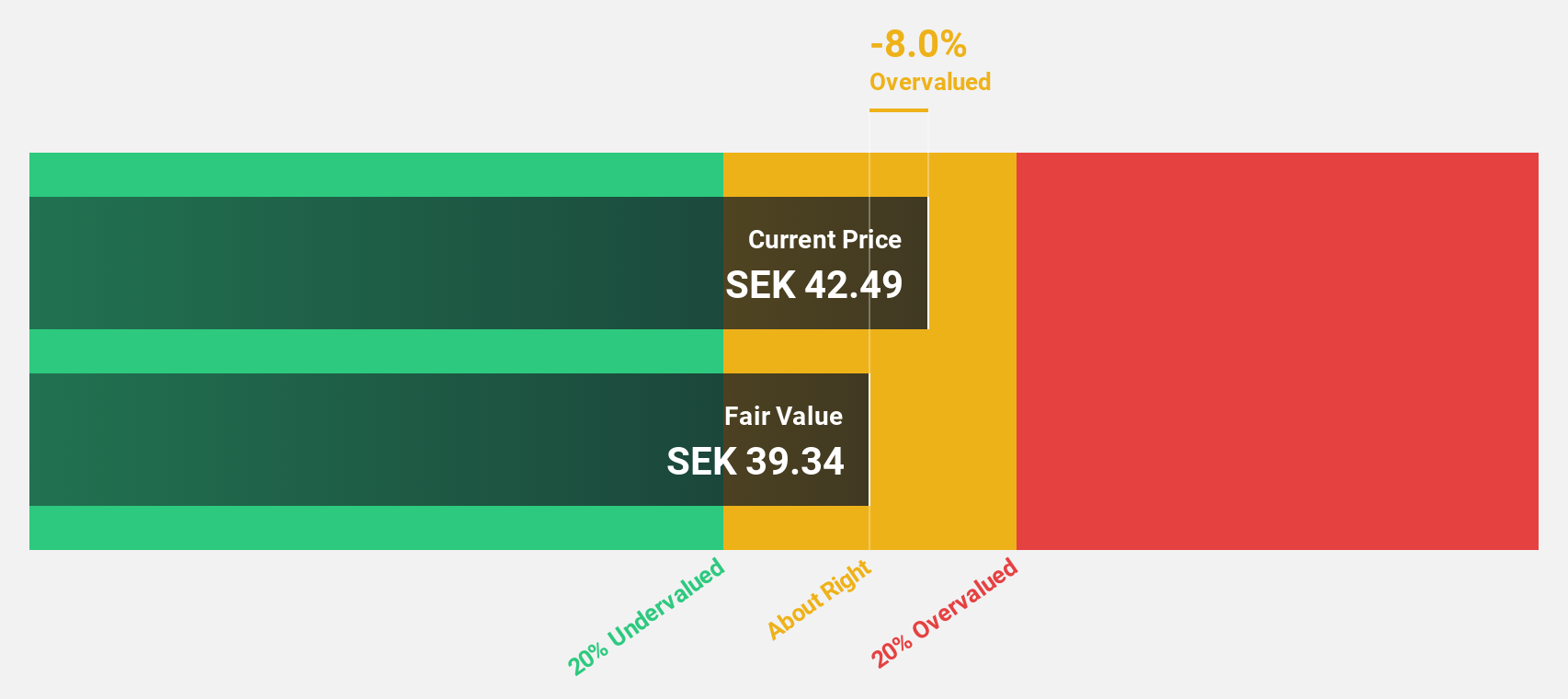

NIBE Industrier (OM:NIBE B)

Overview: NIBE Industrier AB (publ) is a company that develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control components across the Nordic countries, Europe, North America, and internationally with a market cap of approximately SEK87.17 billion.

Operations: NIBE Industrier's revenue is derived from three main segments: Stoves (SEK5.08 billion), Element (SEK13.24 billion), and Climate Solutions (SEK33.89 billion).

Estimated Discount To Fair Value: 22.8%

NIBE Industrier is trading at SEK43.24, significantly below its estimated fair value of SEK56, suggesting it may be undervalued based on cash flows. Despite a challenging year with declining sales and profits, the company is expected to outperform the Swedish market with forecasted revenue growth of 7.2% annually and substantial earnings growth of 56.5% per year over the next three years, highlighting potential for recovery and value appreciation.

- Our earnings growth report unveils the potential for significant increases in NIBE Industrier's future results.

- Dive into the specifics of NIBE Industrier here with our thorough financial health report.

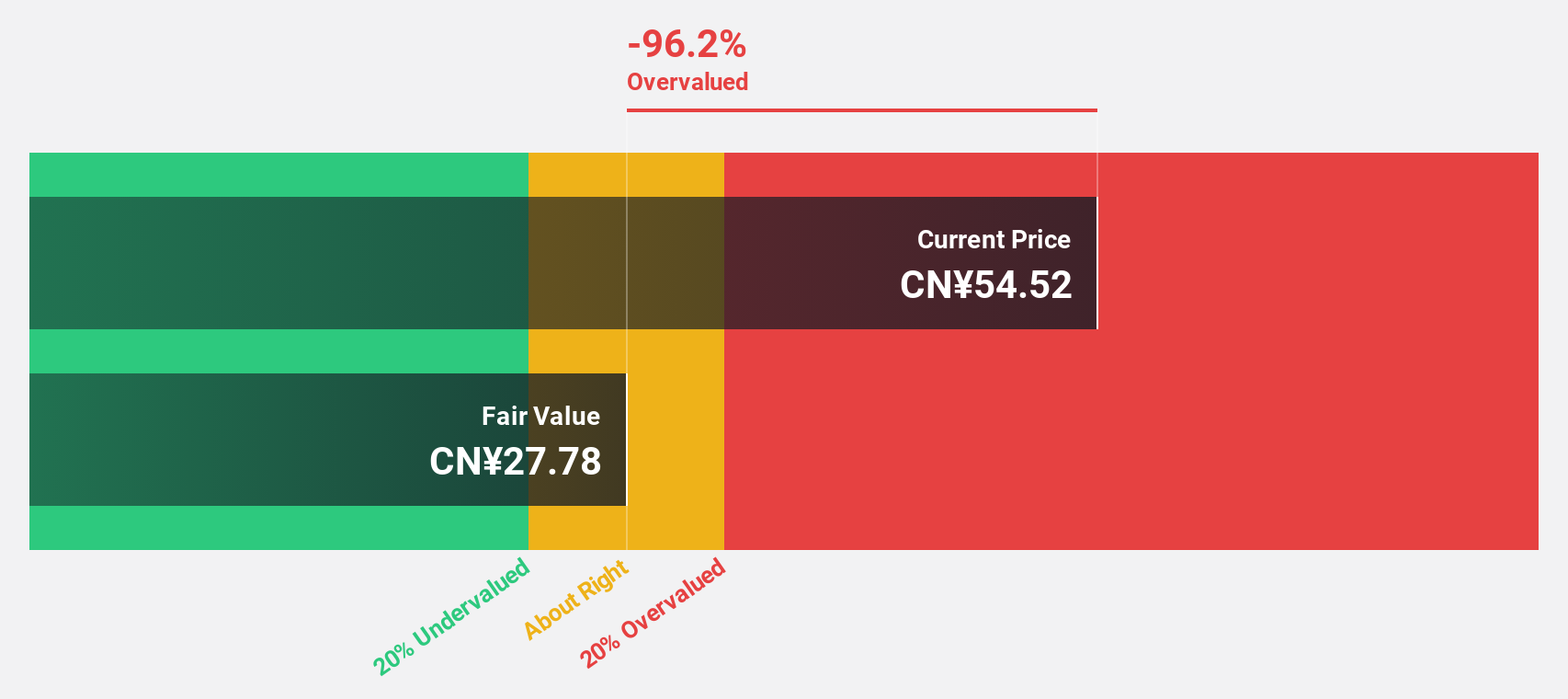

Kehua Data (SZSE:002335)

Overview: Kehua Data Co., Ltd. offers integrated solutions for power protection and energy conservation globally, with a market cap of CN¥13.35 billion.

Operations: Kehua Data's revenue segments include integrated solutions for power protection and energy conservation across international markets.

Estimated Discount To Fair Value: 37.5%

Kehua Data, priced at CN¥28.92, is considerably undervalued with its fair value estimated at CN¥46.28. Despite a recent decline in net income and sales for the nine months ending September 2024, the company is forecasted to achieve significant earnings growth of 42% annually over the next three years, surpassing market expectations. Revenue growth is also projected to outpace the Chinese market average, reinforcing its potential as an undervalued investment opportunity based on cash flows.

- Upon reviewing our latest growth report, Kehua Data's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Kehua Data with our comprehensive financial health report here.

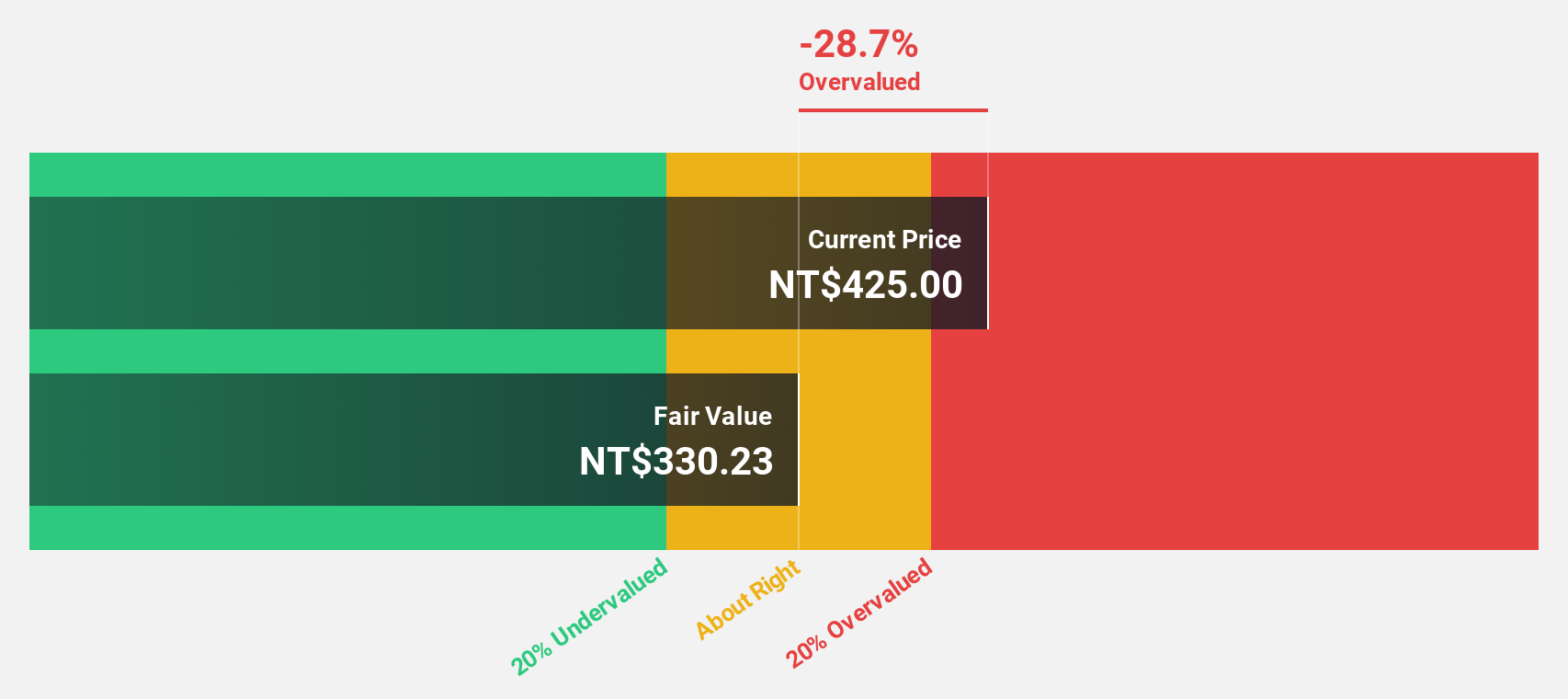

Chroma ATE (TWSE:2360)

Overview: Chroma ATE Inc. is engaged in the design, assembly, manufacturing, sales, repair, and maintenance of software/hardware for computers and peripherals as well as various electronic testing systems and power supplies across Taiwan, China, the United States, and internationally with a market cap of NT$173.28 billion.

Operations: The company's revenue segments include NT$30.84 billion from the Measuring Instruments Business and NT$1.69 billion from Automated Transport Engineering.

Estimated Discount To Fair Value: 13.2%

Chroma ATE, trading at NT$409, is undervalued relative to its fair value of NT$471.37. Despite recent volatility in share price, the company has demonstrated strong financial performance with Q3 2024 revenue rising to NT$5.63 billion and net income reaching NT$1.43 billion. Earnings are projected to grow significantly over the next three years at 24.93% annually, outpacing Taiwan's market average and highlighting its potential as an undervalued stock based on cash flows.

- The growth report we've compiled suggests that Chroma ATE's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Chroma ATE.

Next Steps

- Click this link to deep-dive into the 872 companies within our Undervalued Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kehua Data might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002335

Kehua Data

Provides integrated solutions for power protection and energy conservation in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives