- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

February 2025's Top Asian Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the complexities of geopolitical tensions and evolving trade policies, Asia's stock markets have shown resilience, with China's indices buoyed by strong performances in the technology sector. In this climate, growth companies with high insider ownership can offer unique insights into investor confidence and strategic alignment, making them compelling considerations for those analyzing market opportunities.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Sineng ElectricLtd (SZSE:300827) | 36.3% | 41.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 92.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.2% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 32.9% | 53.5% |

| UTour Group (SZSE:002707) | 24.1% | 32.8% |

| Bioneer (KOSDAQ:A064550) | 15.9% | 104.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Oscotec (KOSDAQ:A039200) | 21.2% | 132.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Here we highlight a subset of our preferred stocks from the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

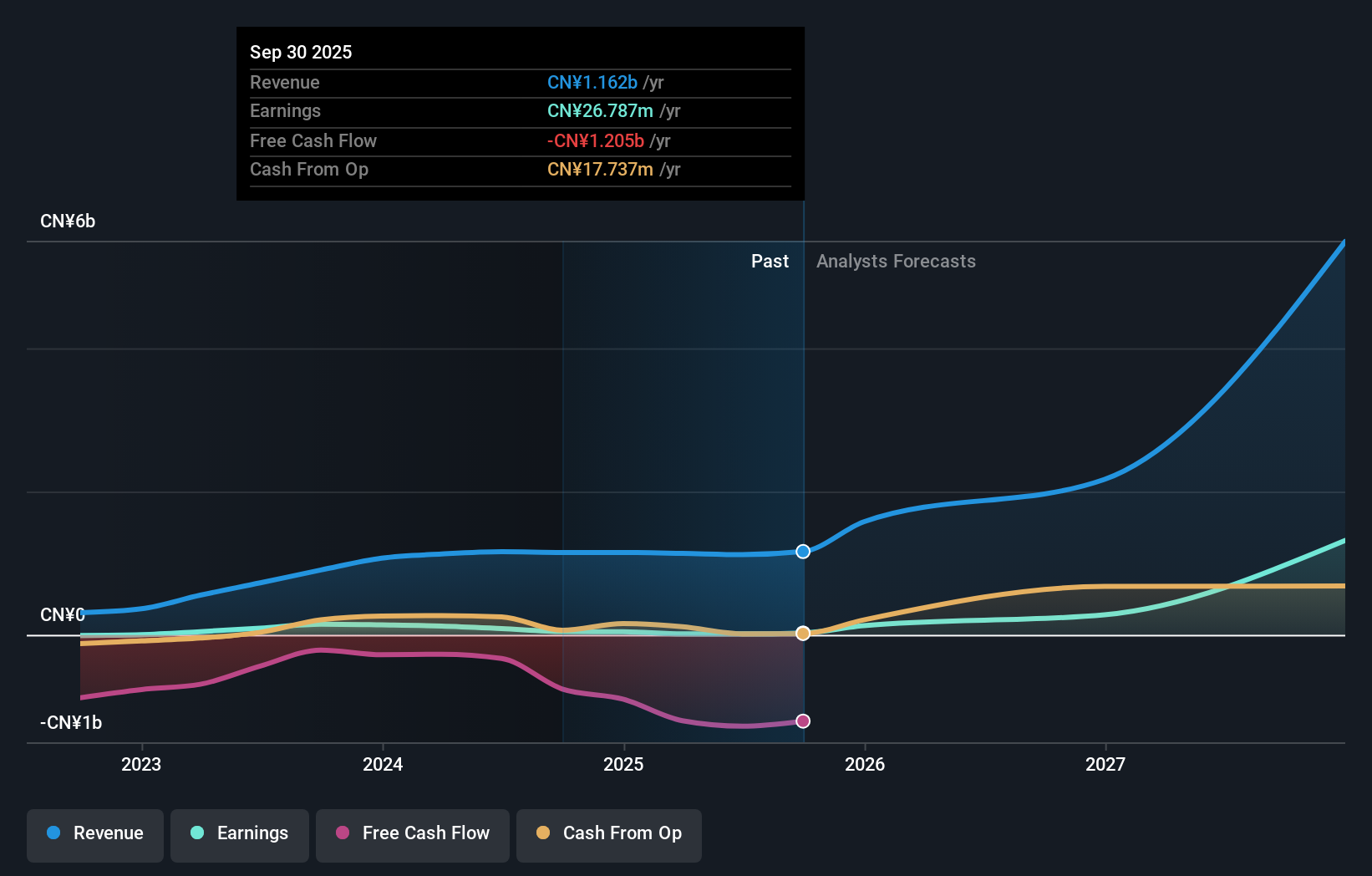

Overview: ALTEOGEN Inc. is a biotechnology company that specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of approximately ₩21.40 trillion.

Operations: The company's revenue is primarily derived from its biotechnology segment, totaling approximately ₩74.38 billion.

Insider Ownership: 25.9%

Return On Equity Forecast: 68% (2027 estimate)

ALTEOGEN, with significant insider ownership, is poised for substantial growth. Its revenue is projected to surge 84.2% annually, outpacing the Korean market's average. The company anticipates becoming profitable within three years with a robust earnings growth forecast of 140.63% per year and an impressive return on equity predicted at 67.6%. Recent private placements raised approximately KRW 155 billion, indicating strong institutional interest and support from prominent investment trusts and securities firms in Asia.

- Dive into the specifics of ALTEOGEN here with our thorough growth forecast report.

- The analysis detailed in our ALTEOGEN valuation report hints at an inflated share price compared to its estimated value.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★★

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company focused on the research, development, and commercialization of innovative pharmaceuticals, with a market cap of CN¥22.01 billion.

Operations: Suzhou Zelgen Biopharmaceuticals Co., Ltd. generates its revenue from the development and sale of innovative pharmaceutical products.

Insider Ownership: 29.4%

Return On Equity Forecast: 20% (2027 estimate)

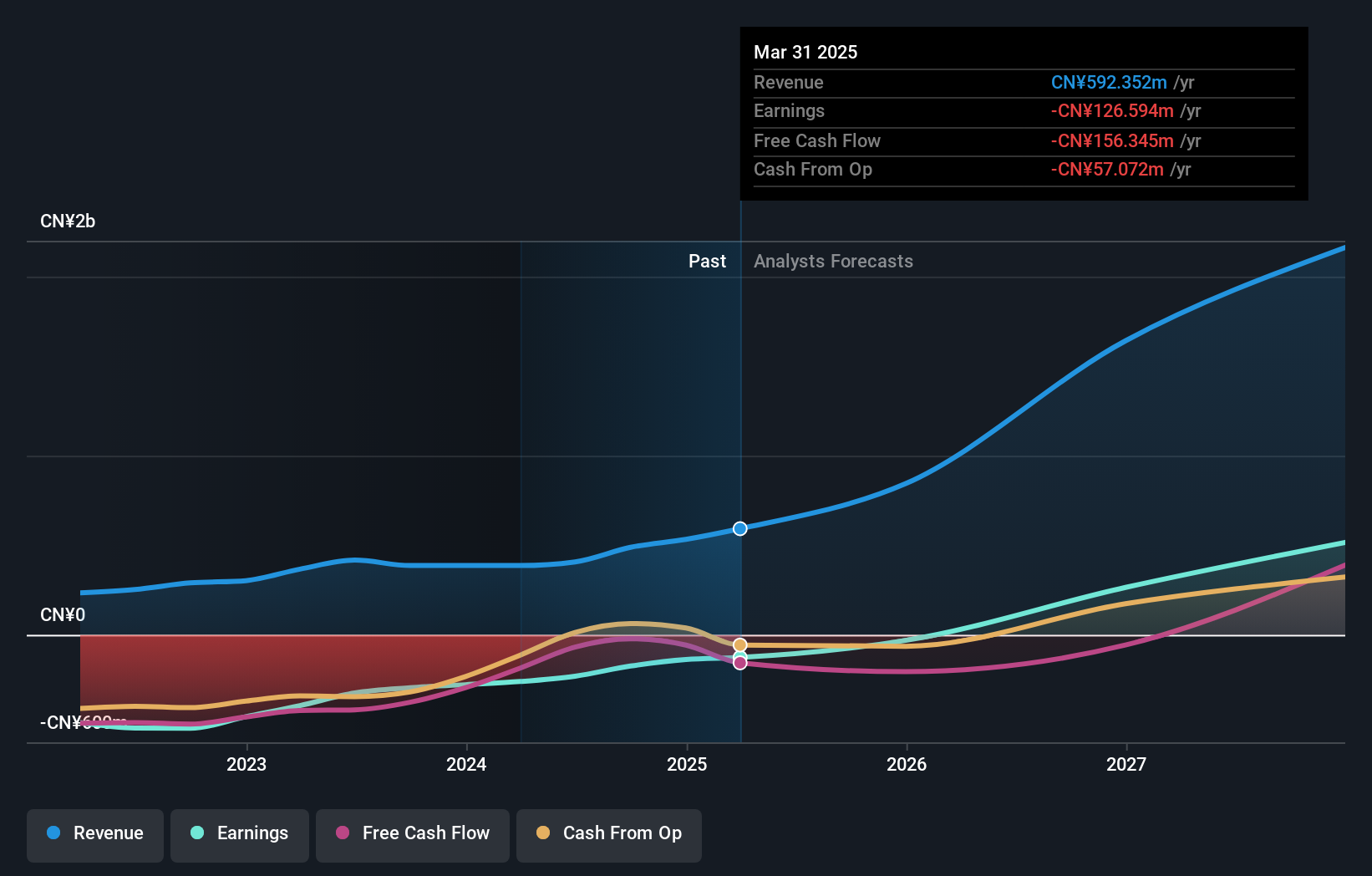

Suzhou Zelgen Biopharmaceuticals, with strong insider ownership, is positioned for significant growth. The company's revenue grew to CNY 533.91 million in 2024 from CNY 386.44 million the previous year, and it reduced its net loss substantially. Forecasts suggest a rapid annual revenue increase of 57.5%, surpassing the Chinese market average, with profitability expected within three years and a projected return on equity of 20.2%.

- Navigate through the intricacies of Suzhou Zelgen BiopharmaceuticalsLtd with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Suzhou Zelgen BiopharmaceuticalsLtd's share price might be too optimistic.

Qingdao Huicheng Environmental Technology Group (SZSE:300779)

Simply Wall St Growth Rating: ★★★★★★

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. (SZSE:300779) operates in the environmental technology sector and has a market cap of CN¥23.73 billion.

Operations: Qingdao Huicheng Environmental Technology Group Co., Ltd. generates its revenue from various segments within the environmental technology sector.

Insider Ownership: 31.8%

Return On Equity Forecast: 23% (2027 estimate)

Qingdao Huicheng Environmental Technology Group is poised for robust growth, with its revenue expected to increase by 34.5% annually, outpacing the Chinese market average. Earnings are projected to grow significantly at 65.2% per year, although current profit margins have declined from last year's figures. Despite challenges in covering interest payments through earnings, the company maintains a high forecasted return on equity of 23.1%. Recent share buybacks totaling CNY 60.11 million indicate strong financial management and confidence in future performance.

- Delve into the full analysis future growth report here for a deeper understanding of Qingdao Huicheng Environmental Technology Group.

- The valuation report we've compiled suggests that Qingdao Huicheng Environmental Technology Group's current price could be inflated.

Summing It All Up

- Embark on your investment journey to our 640 Fast Growing Asian Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives