- Spain

- /

- Healthcare Services

- /

- BME:CBAV

Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets react to recent political shifts and economic policy changes, U.S. stocks have rallied to record highs, buoyed by expectations of growth-friendly policies and tax reforms. In this dynamic environment, dividend stocks can offer a stable income stream while potentially benefiting from favorable market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.15% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

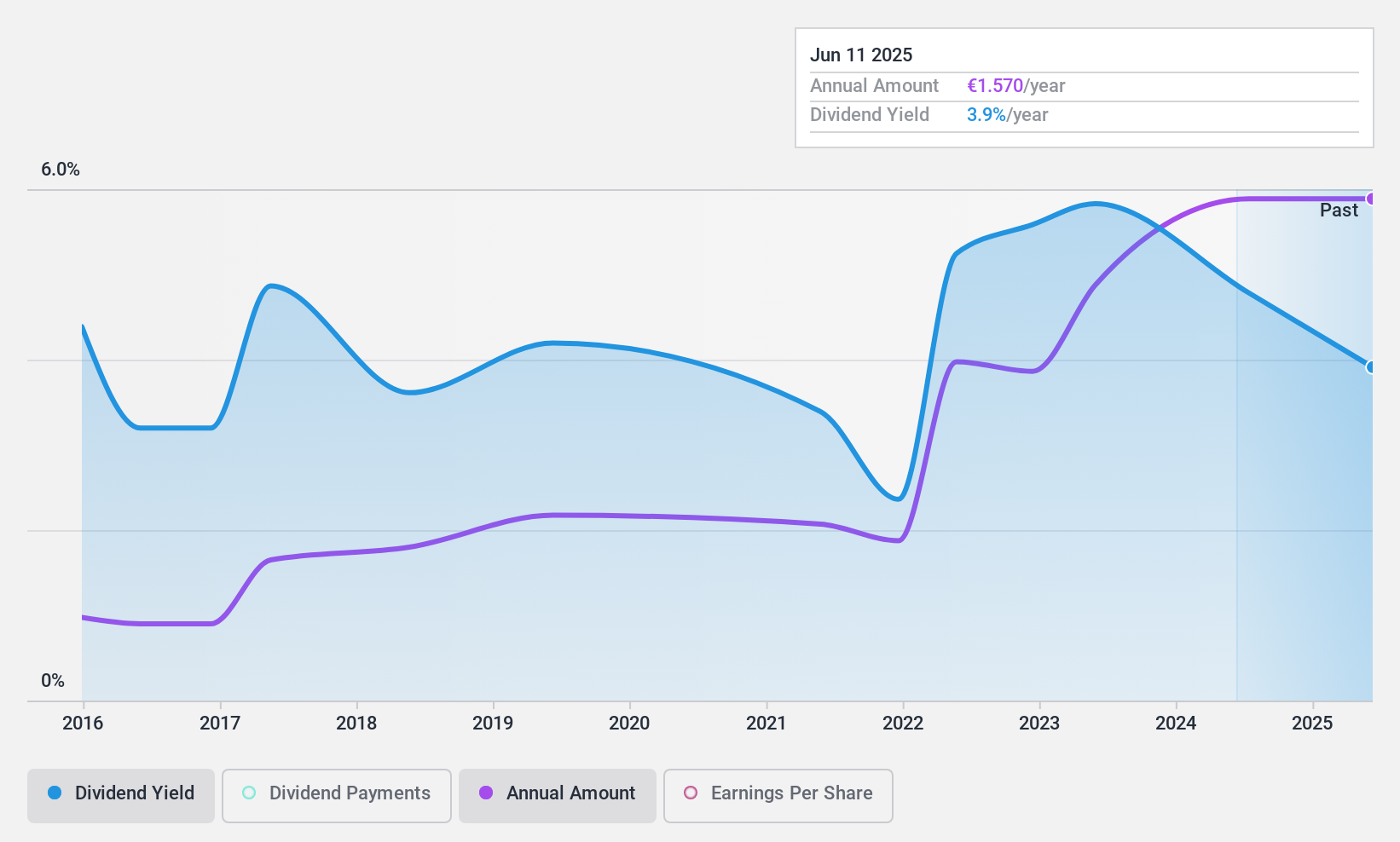

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics, with a market cap of €565.69 million.

Operations: Clínica Baviera, S.A. generates its revenue primarily from its ophthalmology segment, which accounts for €243.31 million.

Dividend Yield: 4.5%

Clínica Baviera's dividend payments are covered by both earnings and cash flows, with payout ratios of 66.6% and 65.5%, respectively, indicating sustainability despite a volatile dividend history over the past decade. While dividends have grown, they remain unreliable due to past volatility exceeding 20% annually. Trading at a significant discount to its estimated fair value, the stock offers potential value but features a lower yield than top Spanish market payers at 4.52%.

- Take a closer look at Clínica Baviera's potential here in our dividend report.

- Our valuation report unveils the possibility Clínica Baviera's shares may be trading at a discount.

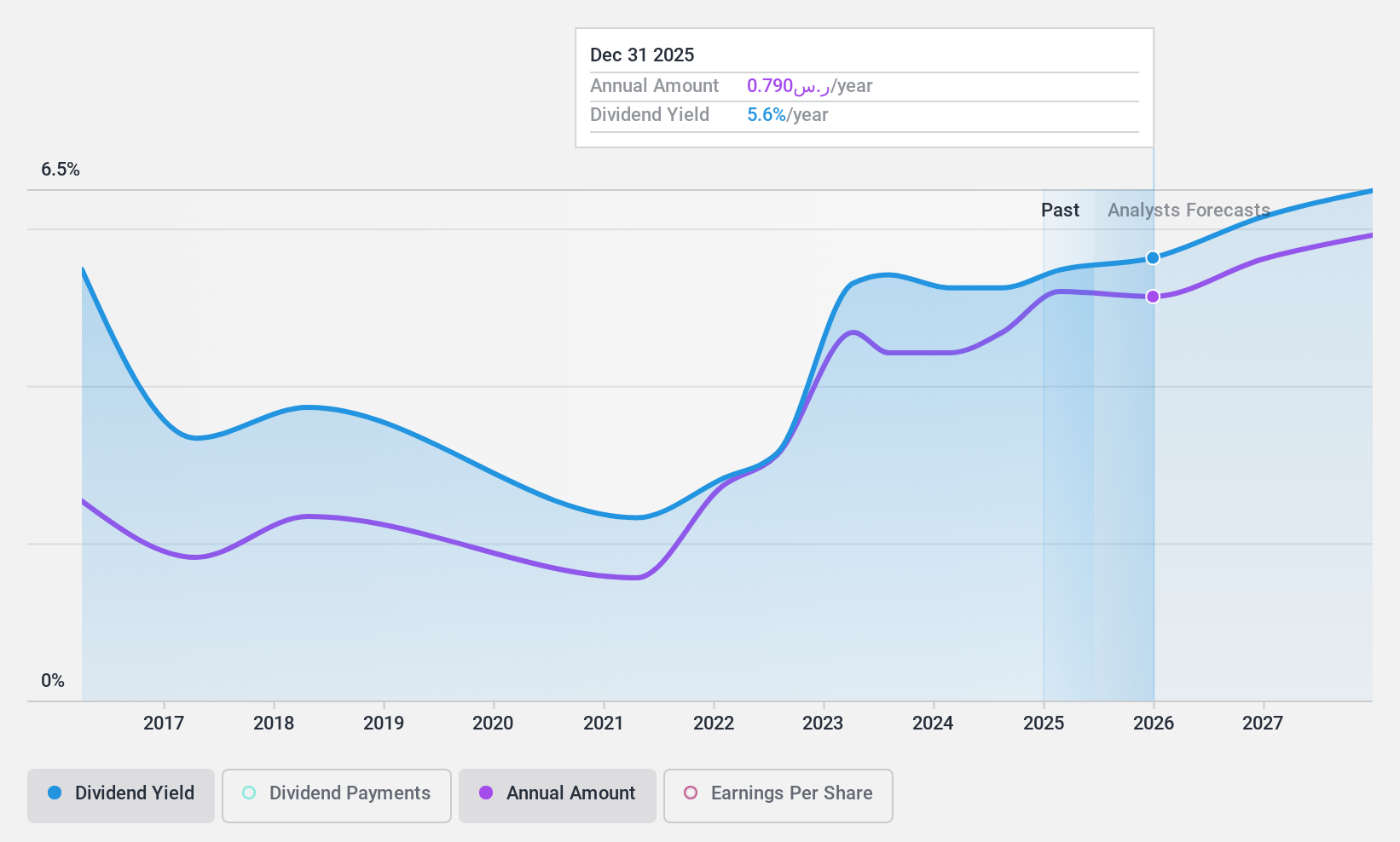

Saudi Investment Bank (SASE:1030)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Saudi Investment Bank offers commercial and retail banking services to individuals, small to medium-sized businesses, and corporate and institutional customers in the Kingdom of Saudi Arabia, with a market cap of SAR17.40 billion.

Operations: The Saudi Investment Bank's revenue segments include Retail Banking (SAR1.23 billion), Corporate Banking (SAR1.34 billion), Asset Management and Brokerage (SAR217.32 million), and Treasury and Investments, including Business Partners (SAR1.27 billion).

Dividend Yield: 5.2%

Saudi Investment Bank's dividend payments have been volatile over the past decade, although they have increased. The current payout ratio of 52% indicates dividends are covered by earnings and are expected to remain so in three years at 60.4%. Despite an unstable track record, the bank's dividend yield is among the top 25% in the Saudi market. Recent earnings show growth, with net income rising to SAR 517.84 million from SAR 461.64 million last year.

- Click here to discover the nuances of Saudi Investment Bank with our detailed analytical dividend report.

- Our valuation report here indicates Saudi Investment Bank may be overvalued.

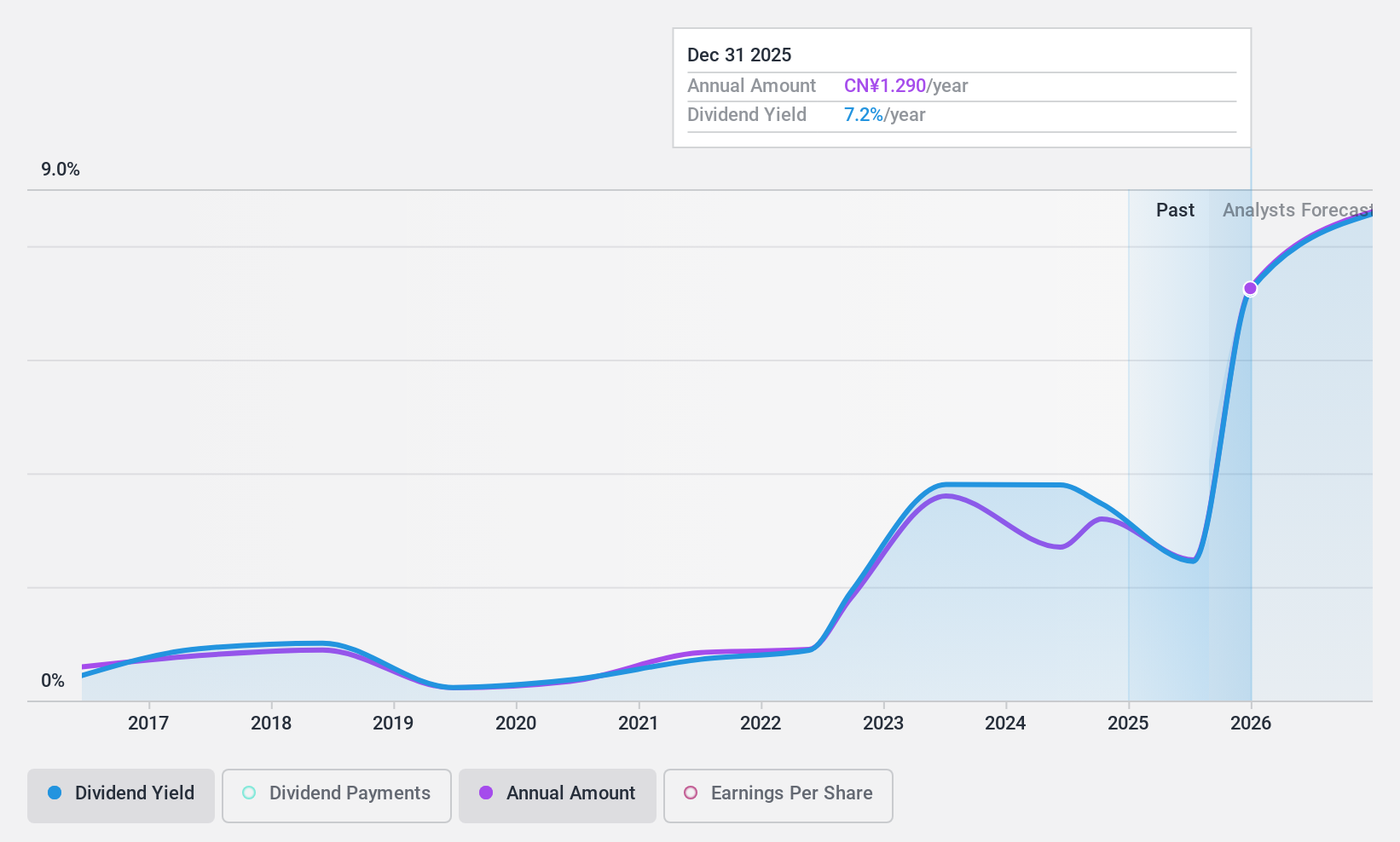

Beijing Sanlian Hope Shin-Gosen Technical Service (SZSE:300384)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Sanlian Hope Shin-Gosen Technical Service Co., Ltd. operates in the technical service sector with a market cap of CN¥5.38 billion.

Operations: I'm sorry, but the provided text does not include any specific revenue segment data for Beijing Sanlian Hope Shin-Gosen Technical Service Co., Ltd. If you have more detailed information on their revenue segments, I would be happy to help summarize it for you.

Dividend Yield: 3.4%

Beijing Sanlian Hope Shin-Gosen Technical Service's dividend yield is in the top 25% of the CN market, with a payout ratio of 71.7%, indicating dividends are covered by earnings. However, its dividend history is unstable and has been volatile over the past decade. Recent earnings growth supports potential future payouts, with net income rising to CNY 260.74 million for the nine months ended September 2024, up from CNY 211.23 million last year.

- Dive into the specifics of Beijing Sanlian Hope Shin-Gosen Technical Service here with our thorough dividend report.

- Our valuation report here indicates Beijing Sanlian Hope Shin-Gosen Technical Service may be undervalued.

Where To Now?

- Embark on your investment journey to our 1940 Top Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Clínica Baviera, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CBAV

Clínica Baviera

A medical company, operates a network of ophthalmology clinics in Spain and Europe.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives