- China

- /

- Commercial Services

- /

- SZSE:003027

Tongxing Environmental Protection Technology Co.,Ltd's (SZSE:003027) 28% Price Boost Is Out Of Tune With Earnings

Those holding Tongxing Environmental Protection Technology Co.,Ltd (SZSE:003027) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

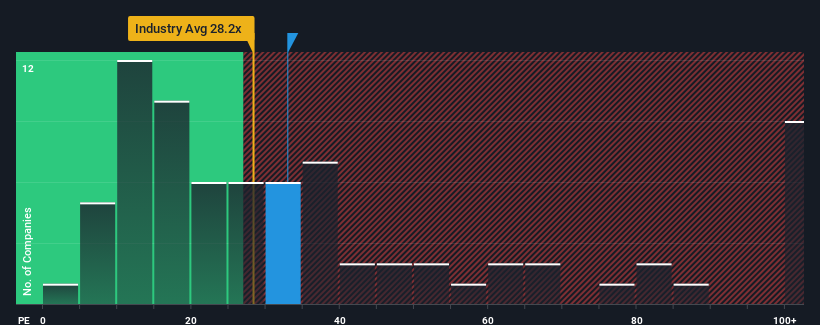

Although its price has surged higher, you could still be forgiven for feeling indifferent about Tongxing Environmental Protection TechnologyLtd's P/E ratio of 32.9x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Tongxing Environmental Protection TechnologyLtd's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Tongxing Environmental Protection TechnologyLtd

Is There Some Growth For Tongxing Environmental Protection TechnologyLtd?

There's an inherent assumption that a company should be matching the market for P/E ratios like Tongxing Environmental Protection TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 43% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 73% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's somewhat alarming that Tongxing Environmental Protection TechnologyLtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Key Takeaway

Tongxing Environmental Protection TechnologyLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Tongxing Environmental Protection TechnologyLtd revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 5 warning signs we've spotted with Tongxing Environmental Protection TechnologyLtd (including 3 which don't sit too well with us).

You might be able to find a better investment than Tongxing Environmental Protection TechnologyLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tongxing Environmental Protection TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003027

Tongxing Environmental Protection TechnologyLtd

Provides environmental protection project general contracting services in China.

Adequate balance sheet low.