As global markets experience varied movements, with the S&P 500 advancing and small-cap indices outperforming, investors are keenly observing opportunities across different market segments. Despite the vintage feel of the term "penny stocks," these investments remain relevant as they often represent smaller or newer companies with potential for significant growth. When backed by strong financials, penny stocks can offer a unique chance to uncover hidden value at lower price points, making them an intriguing option for those seeking growth in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.585 | MYR2.93B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.735 | MYR129.91M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.39 | CN¥2.11B | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £183.45M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR307.05M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.235 | £307.76M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.065 | £405.78M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,800 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

LifeTech Scientific (SEHK:1302)

Simply Wall St Financial Health Rating: ★★★★★★

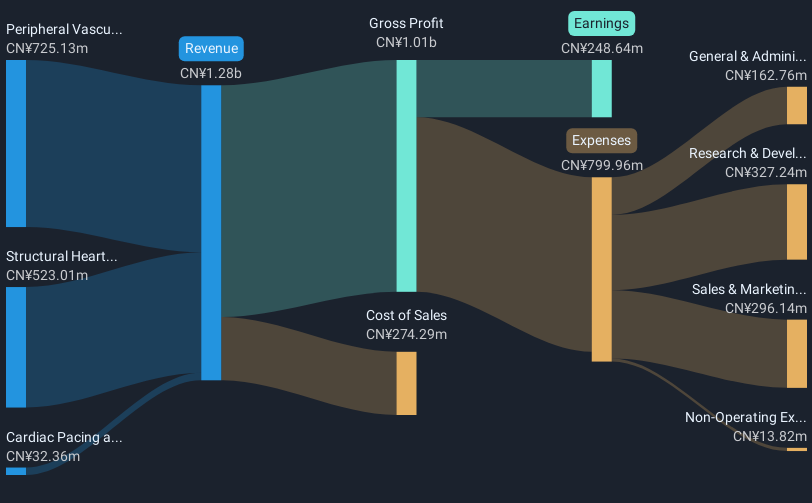

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$6.20 billion.

Operations: The company generates its revenue from three main segments: Structural Heart Diseases Business (CN¥523.01 million), Peripheral Vascular Diseases Business (CN¥725.13 million), and Cardiac Pacing and Electrophysiology Business (CN¥32.36 million).

Market Cap: HK$6.2B

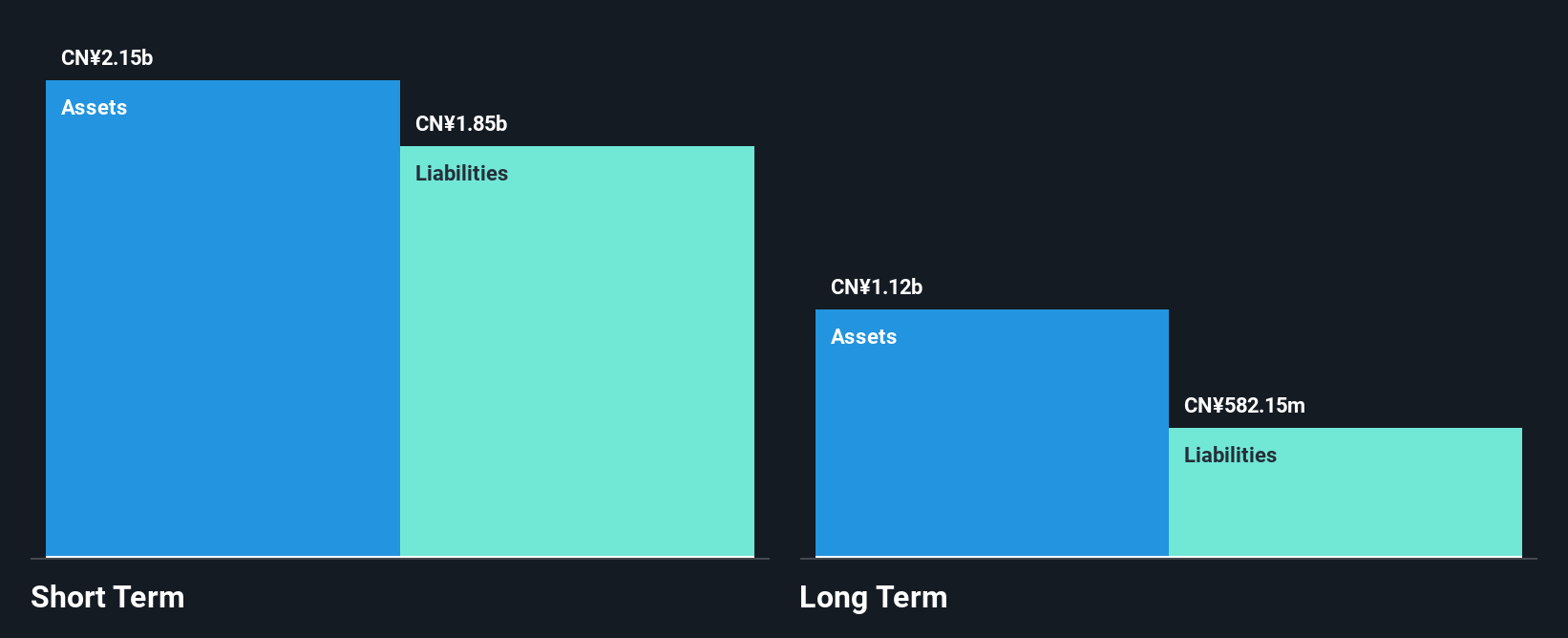

LifeTech Scientific Corporation's financial health appears robust, with short-term assets (CN¥2.2 billion) surpassing both its short-term liabilities (CN¥826.5 million) and long-term liabilities (CN¥602.8 million). The company's cash flow comfortably covers its debt, and it holds more cash than total debt, indicating strong liquidity. Despite a reduction in profit margins from 28% to 19.4%, LifeTech's earnings are forecasted to grow by 29.5% annually, suggesting potential future growth. However, recent performance showed negative earnings growth of -24.8%, impacted by a significant one-off loss of CN¥139.3 million over the past year ending June 2024.

- Click here to discover the nuances of LifeTech Scientific with our detailed analytical financial health report.

- Evaluate LifeTech Scientific's prospects by accessing our earnings growth report.

Newborn Town (SEHK:9911)

Simply Wall St Financial Health Rating: ★★★★★★

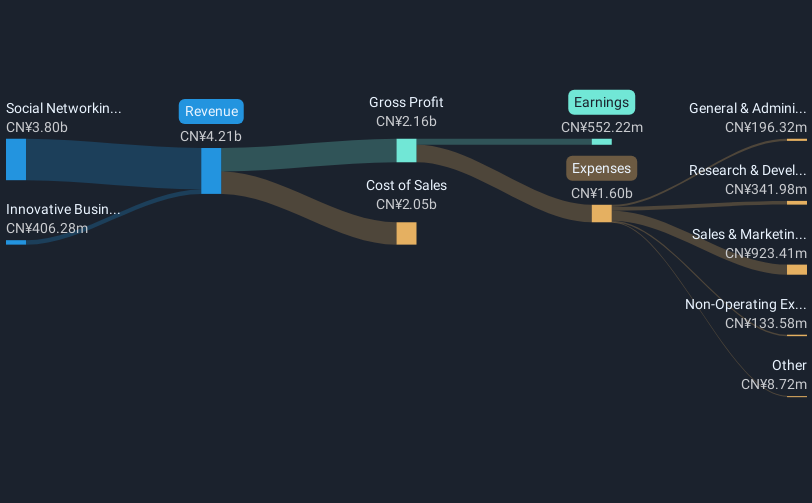

Overview: Newborn Town Inc., an investment holding company, operates in the global social networking sector with a market capitalization of HK$3.59 billion.

Operations: The company's revenue is primarily derived from its Social Networking Business, which generated CN¥3.80 billion, and its Innovative Business, which contributed CN¥406.28 million.

Market Cap: HK$3.59B

Newborn Town Inc. demonstrates financial stability with short-term assets of CN¥2.2 billion exceeding both short and long-term liabilities, indicating strong liquidity. The company's operating cash flow significantly covers its debt, and it has more cash than total debt, reducing financial risk. Recent earnings growth has been robust, with a substantial increase in net profit margins from 8.3% to 13.1%, despite a large one-off gain of CN¥152.7 million impacting results for the year ending June 2024. The appointment of a new COO could further enhance operational efficiency and strategic execution in expanding markets like the Middle East and North Africa.

- Take a closer look at Newborn Town's potential here in our financial health report.

- Understand Newborn Town's earnings outlook by examining our growth report.

Shandong Chiway Industry DevelopmentLtd (SZSE:002374)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Chiway Industry Development Co., Ltd. operates in various industrial sectors and has a market capitalization of approximately CN¥2.76 billion.

Operations: The company generates revenue from Bottle Cap Packaging and Commodity Trading amounting to CN¥711.67 million and Landscape services contributing CN¥31.57 million.

Market Cap: CN¥2.76B

Shandong Chiway Industry Development Co., Ltd. faces financial challenges, with a negative return on equity of -20.07% and increasing losses over the past five years at 10.7% annually. Despite its unprofitability, the company maintains liquidity with short-term assets of CN¥2.2 billion surpassing both short and long-term liabilities, indicating some financial stability. However, its debt to equity ratio has risen significantly from 88.1% to 150.1%, suggesting increased leverage risk. While the cash runway is sufficient for more than three years under stable conditions, strategic adjustments may be necessary given recent net losses and high debt levels.

- Click to explore a detailed breakdown of our findings in Shandong Chiway Industry DevelopmentLtd's financial health report.

- Assess Shandong Chiway Industry DevelopmentLtd's previous results with our detailed historical performance reports.

Make It Happen

- Take a closer look at our Penny Stocks list of 5,800 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newborn Town might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9911

Newborn Town

An investment holding company, engages in the social networking business worldwide.

Flawless balance sheet and undervalued.