- Hong Kong

- /

- Retail Distributors

- /

- SEHK:39

Undervalued Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are keenly observing potential opportunities. For those exploring beyond the usual blue-chip names, penny stocks—often representing smaller or newer companies—remain an intriguing area of interest despite their somewhat outdated label. These stocks can offer surprising value when backed by solid financials, and in this article, we explore three examples that combine balance sheet strength with promising potential for growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,854 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Ju Teng International Holdings (SEHK:3336)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ju Teng International Holdings Limited is an investment holding company that manufactures and sells casings for notebook computers and handheld devices in the People’s Republic of China and internationally, with a market cap of approximately HK$727.27 million.

Operations: The company generates revenue of HK$6.47 billion from its manufacturing and sale of casings for notebook computers and handheld devices.

Market Cap: HK$727.27M

Ju Teng International Holdings, with a market cap of approximately HK$727.27 million, generates revenue of HK$6.47 billion from manufacturing and selling casings for notebooks and handheld devices. Despite its unprofitability and declining earnings over the past five years, the company maintains stable weekly volatility at 4% and has short-term assets (HK$5.2 billion) exceeding both short- (HK$4.6 billion) and long-term liabilities (HK$419.4 million). Trading below estimated fair value by 17.3%, Ju Teng's debt management is satisfactory with a net debt to equity ratio of 26.1%, supported by an experienced management team averaging 5.9 years in tenure.

- Get an in-depth perspective on Ju Teng International Holdings' performance by reading our balance sheet health report here.

- Evaluate Ju Teng International Holdings' historical performance by accessing our past performance report.

China Beidahuang Industry Group Holdings (SEHK:39)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Beidahuang Industry Group Holdings Limited operates in the wine and liquor, food products trading, construction and development, rental, financial leasing, and mineral products sectors in China and Hong Kong with a market cap of HK$398.94 million.

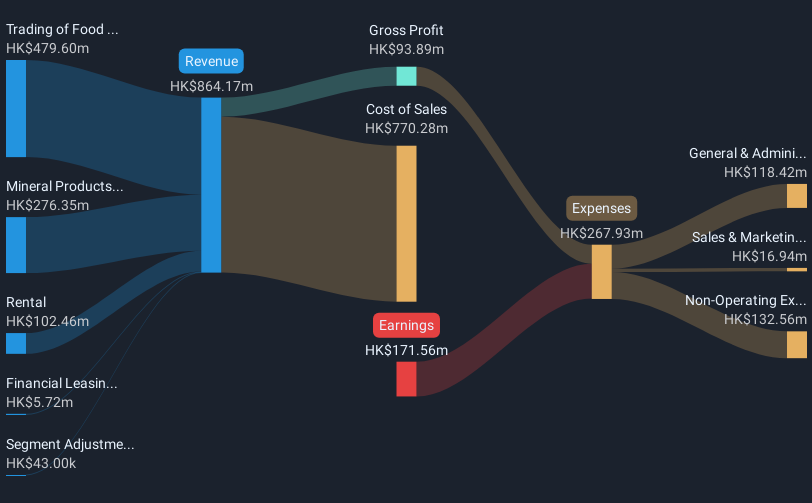

Operations: The company's revenue is derived from rental (HK$102.46 million), mineral products (HK$276.35 million), financial leasing (HK$5.72 million), and trading of food products (HK$479.60 million).

Market Cap: HK$398.94M

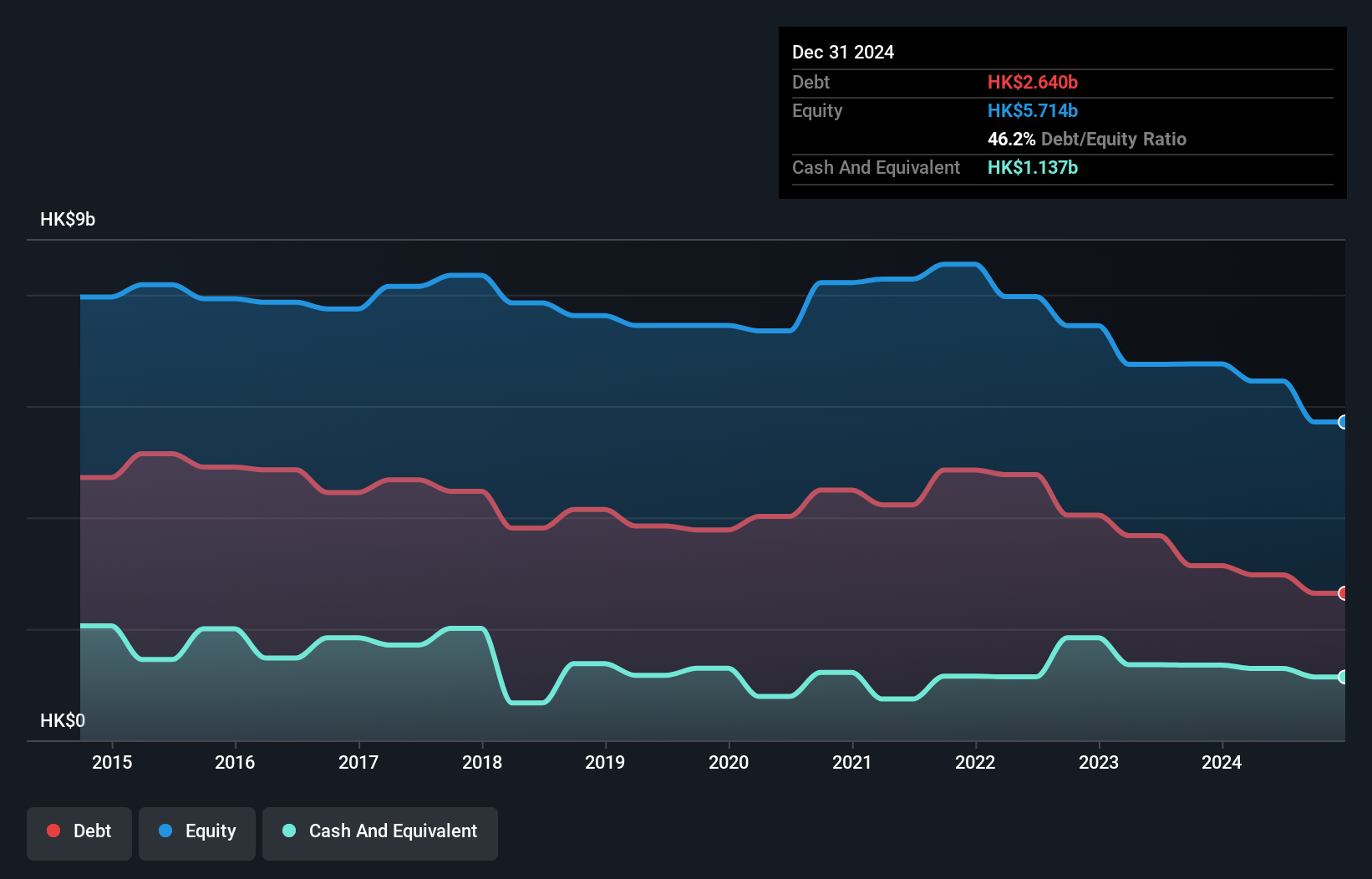

China Beidahuang Industry Group Holdings, with a market cap of HK$398.94 million, operates across diverse sectors including wine and liquor, food products trading, construction and development, rental services, financial leasing, and mineral products. Despite generating revenue from these segments—most notably HK$479.60 million from food products—the company remains unprofitable with losses increasing by 7.1% annually over the past five years. It maintains a high net debt to equity ratio of 69.4%, though its short-term assets of HK$1.2 billion cover both short- and long-term liabilities comfortably. The company benefits from an experienced board averaging 3.4 years in tenure and has not diluted shareholders recently while possessing a cash runway exceeding three years due to positive free cash flow growth.

- Jump into the full analysis health report here for a deeper understanding of China Beidahuang Industry Group Holdings.

- Learn about China Beidahuang Industry Group Holdings' historical performance here.

q.beyond (XTRA:QBY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: q.beyond AG operates in the cloud, SAP, Microsoft, data intelligence, security, and software development sectors both in Germany and internationally with a market cap of €90.20 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: €90.2M

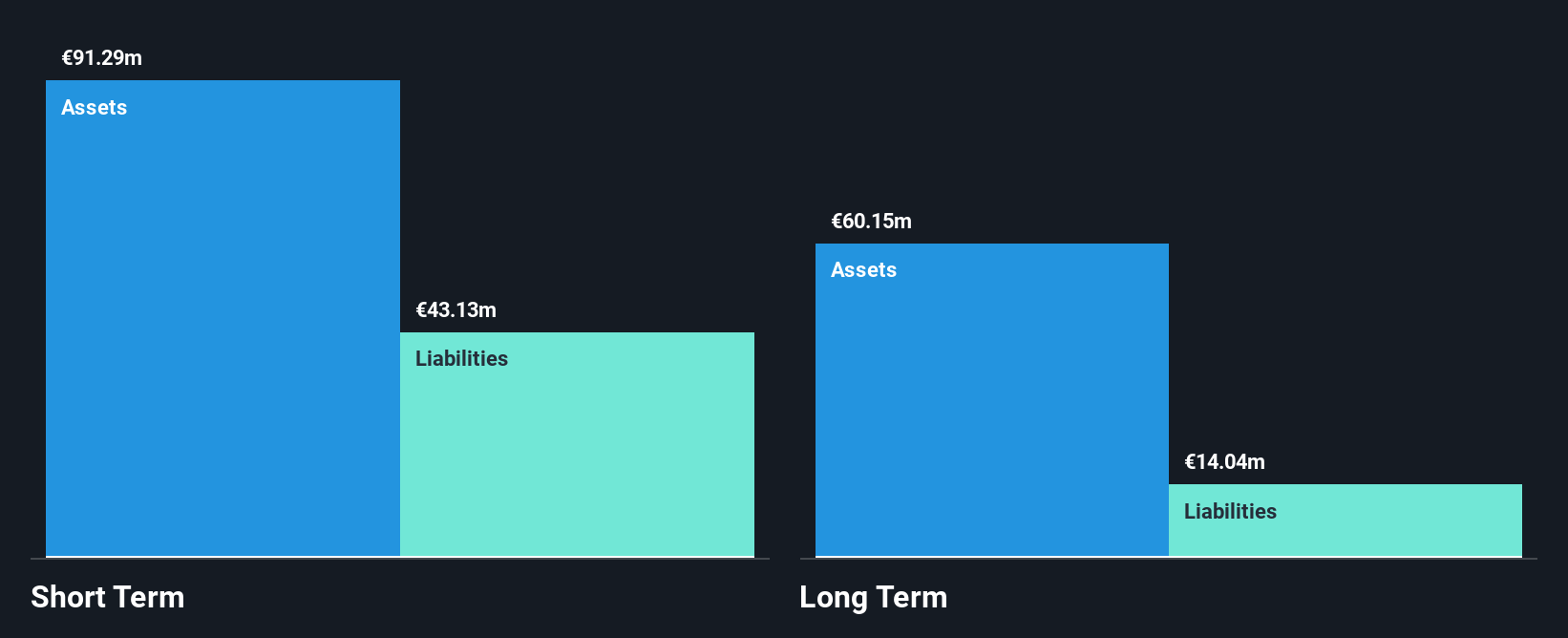

q.beyond AG, with a market cap of €90.20 million, operates in the cloud and software sectors and has shown resilience despite being unprofitable. The company reported Q3 2024 sales of €47 million, slightly up from the previous year, while reducing net losses significantly to €0.9 million from €4 million. It is debt-free and has not diluted shareholders recently, maintaining a strong cash runway for over three years due to positive free cash flow growth. Although its management team is relatively new with an average tenure of 1.9 years, q.beyond trades at good value compared to peers and industry estimates.

- Click to explore a detailed breakdown of our findings in q.beyond's financial health report.

- Review our growth performance report to gain insights into q.beyond's future.

Next Steps

- Jump into our full catalog of 5,854 Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:39

China Beidahuang Industry Group Holdings

An investment holding company, engages in trading of food products and rental business in the People’s Republic of China and Hong Kong.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives