- China

- /

- Commercial Services

- /

- SZSE:001267

Identifying Undiscovered Gems on None in January 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by resilient labor markets, inflation concerns, and political uncertainties, small-cap stocks have faced notable challenges, underperforming their large-cap counterparts. With the Russell 2000 Index dipping into correction territory and broader market sentiment remaining cautious, investors are keenly observing economic indicators that could impact future performance. In such an environment, identifying potential "undiscovered gems" requires looking for companies with strong fundamentals and growth potential that may be overlooked amid prevailing market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Hainan Mining (SHSE:601969)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hainan Mining Co., Ltd. is engaged in the mining, processing, and sale of iron ore in China with a market cap of CN¥13.07 billion.

Operations: The company's primary revenue stream is derived from the sale of processed iron ore. It focuses on optimizing its cost structure to enhance profitability, with particular attention to operational efficiencies. The net profit margin is a key financial metric for assessing its performance over time.

Hainan Mining, a modestly-sized player in the mining sector, showcases a compelling financial profile. Its earnings have surged by 39% over the past year, outpacing the broader Metals and Mining industry's -2.3% growth rate. The company maintains high-quality earnings and boasts a price-to-earnings ratio of 19.4x, which is attractive compared to the CN market's 34.1x average. Despite an increase in its debt-to-equity ratio from 22.1% to 34.7% over five years, Hainan Mining holds more cash than total debt and has effectively covered interest payments with profits, indicating robust financial health amidst recent share repurchases totaling CNY 76.62 million.

- Click here and access our complete health analysis report to understand the dynamics of Hainan Mining.

Examine Hainan Mining's past performance report to understand how it has performed in the past.

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hui Lyu Ecological Technology Groups Co., Ltd. operates in the ecological technology sector and has a market capitalization of CN¥6.28 billion.

Operations: The company generates revenue primarily through its ecological technology operations. Its market capitalization stands at CN¥6.28 billion.

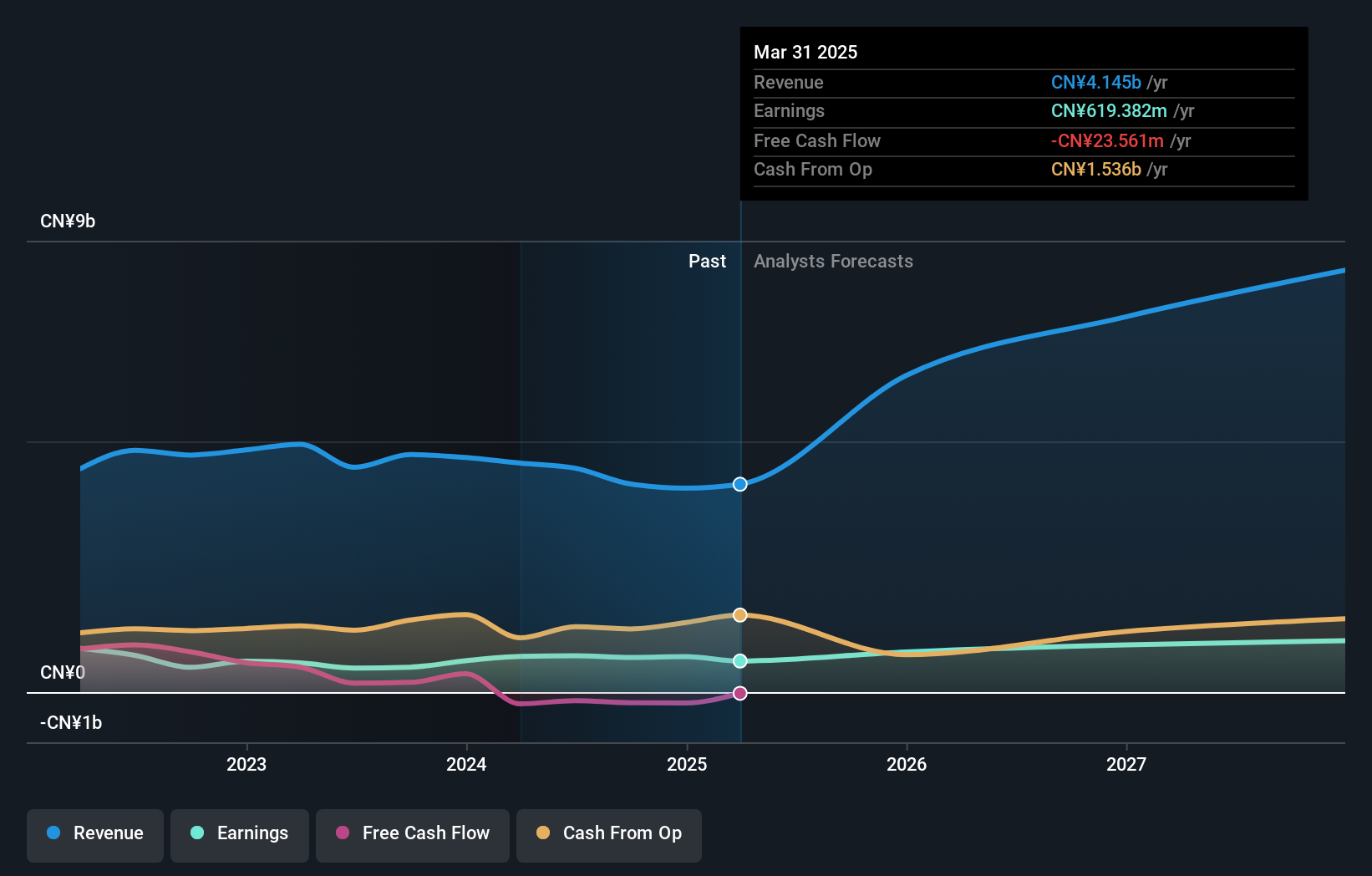

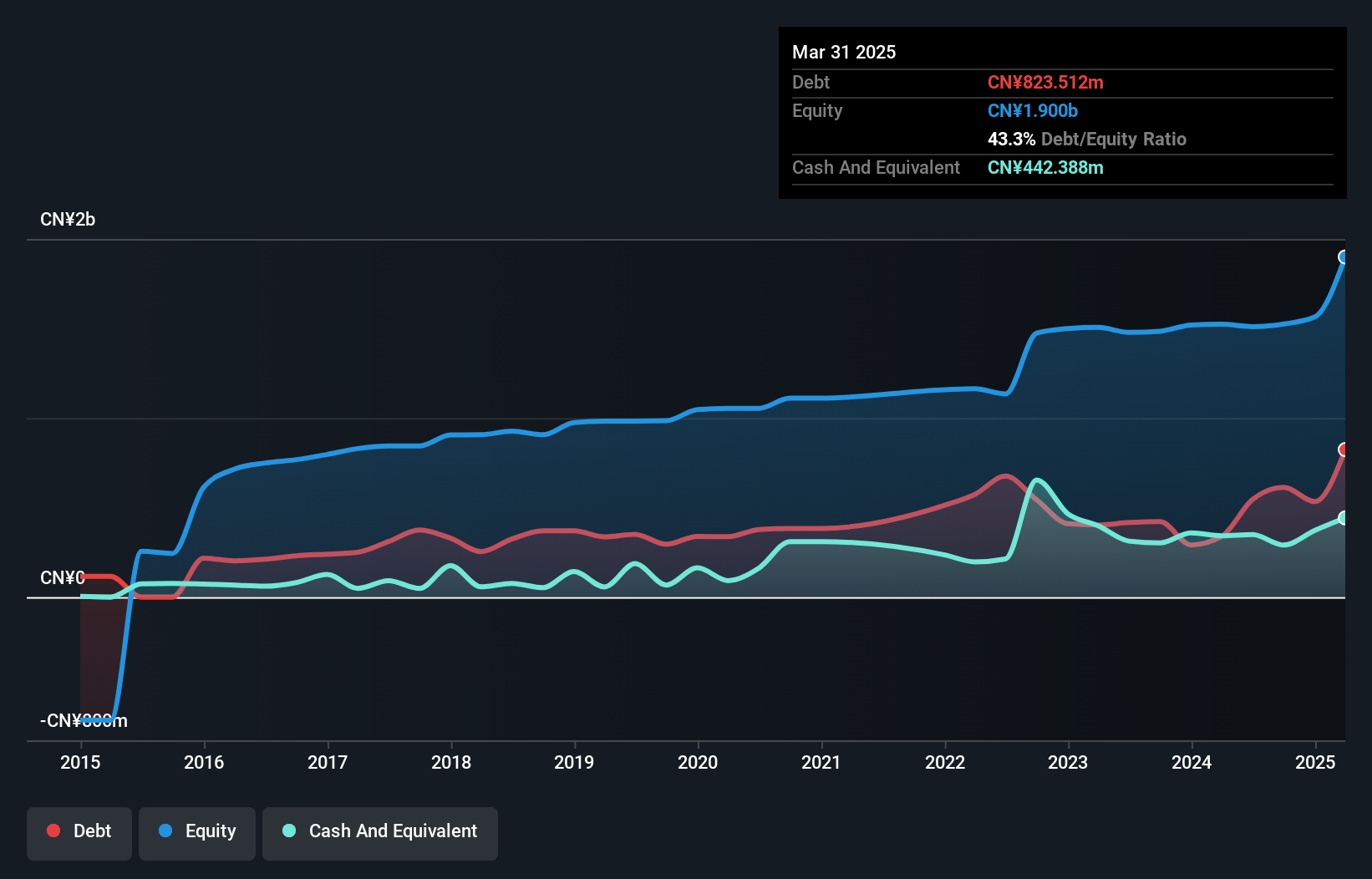

Hui Lyu Ecological Technology, a nimble player in its field, has shown resilience with earnings growing 17.3% over the past year, outpacing the industry average of 1.7%. Despite a volatile share price recently, the company's net income rose to CNY 26.26 million for nine months ending September 2024 from CNY 24.84 million previously. The debt to equity ratio increased from 30% to 40.2% over five years but remains satisfactory at a net level of 21.2%. With free cash flow positive and high-quality earnings reported, future growth seems promising as earnings are forecasted to grow significantly each year.

Asia Optical (TWSE:3019)

Simply Wall St Value Rating: ★★★★★★

Overview: Asia Optical Co., Inc. is a Taiwan-based company that manufactures and sells cameras and optical lenses for various devices both domestically and internationally, with a market cap of NT$44.68 billion.

Operations: Asia Optical generates revenue primarily from its Optical Components Division, contributing NT$10.66 billion, followed by the Image Sensing Components Business at NT$4.10 billion. The Digital Camera Division and Plastic Photoelectric Component Business Department add NT$2.77 billion and NT$3.46 billion respectively to the company's revenue streams.

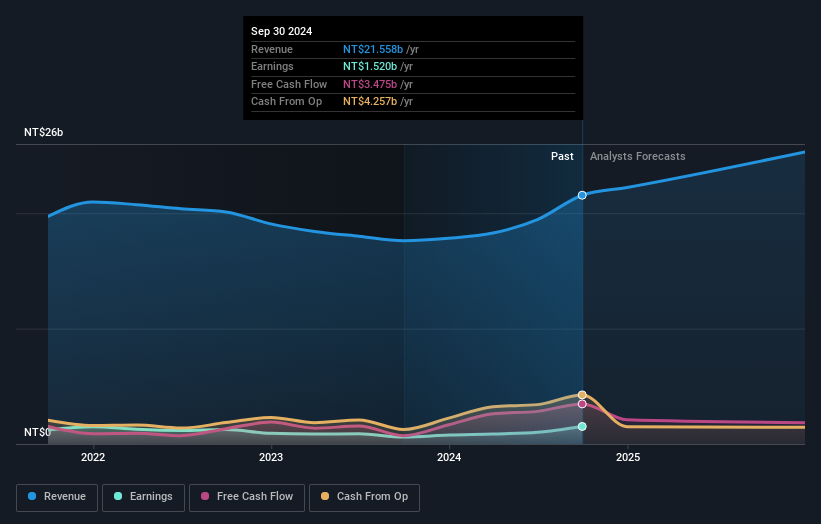

Asia Optical is making waves with its impressive earnings growth of 149.4% over the past year, outpacing the electronic industry's modest 6.6%. The company reported net income of TWD 684.71 million for Q3 2024, a significant jump from TWD 181.76 million in the same period last year, reflecting strong performance and high-quality earnings. Basic earnings per share rose to TWD 2.46 from TWD 0.65 a year ago, showcasing robust profitability without any debt concerns over the past five years. With revenue projected to grow at an annual rate of approximately 13%, Asia Optical's financial health seems promising for future endeavors.

Key Takeaways

- Embark on your investment journey to our 4617 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hui Lyu Ecological Technology GroupsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001267

Hui Lyu Ecological Technology GroupsLtd

Hui Lyu Ecological Technology Groups Co.,Ltd.

Reasonable growth potential with proven track record.