3 Stocks That May Be Trading Up To 44.2% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate cuts from the ECB and SNB, alongside expectations for a Federal Reserve rate cut, investors are witnessing mixed performances across major indices. While the Nasdaq Composite reached new highs, other U.S. indexes showed declines, highlighting the nuanced dynamics at play in today's market environment. In such conditions, identifying undervalued stocks—those trading below intrinsic value estimates—can present potential opportunities for investors looking to capitalize on market inefficiencies and economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$266.00 | NT$530.08 | 49.8% |

| UMB Financial (NasdaqGS:UMBF) | US$122.18 | US$244.24 | 50% |

| GlobalData (AIM:DATA) | £1.88 | £3.73 | 49.6% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.40 | US$46.43 | 49.6% |

| Equity Bancshares (NYSE:EQBK) | US$46.49 | US$92.69 | 49.8% |

| BYD Electronic (International) (SEHK:285) | HK$40.30 | HK$79.95 | 49.6% |

| Wetteri Oyj (HLSE:WETTERI) | €0.298 | €0.59 | 49.7% |

| Gold Road Resources (ASX:GOR) | A$2.08 | A$4.15 | 49.9% |

| Equifax (NYSE:EFX) | US$265.81 | US$530.33 | 49.9% |

| Cellnex Telecom (BME:CLNX) | €32.32 | €64.59 | 50% |

We're going to check out a few of the best picks from our screener tool.

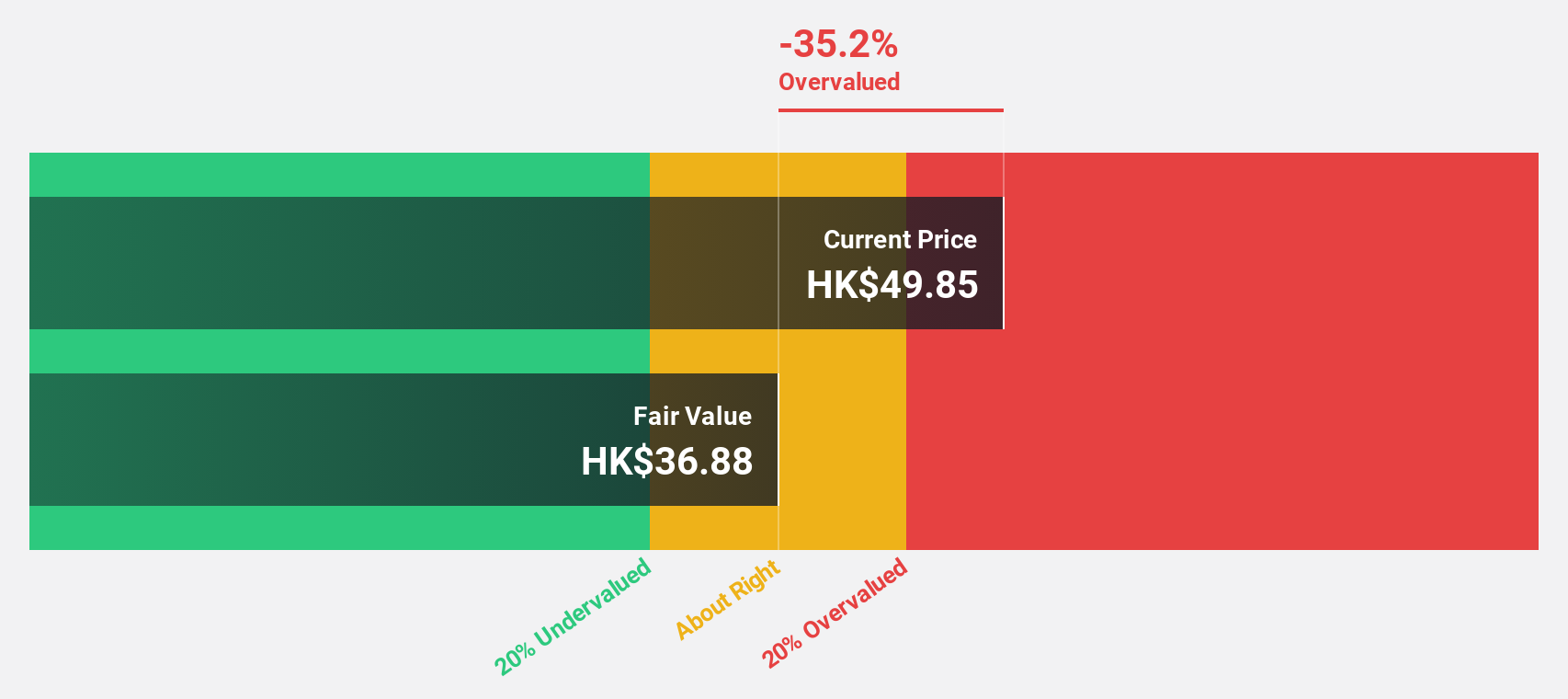

XD (SEHK:2400)

Overview: XD Inc. is an investment holding company that develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally, with a market cap of HK$11.53 billion.

Operations: The company's revenue is primarily generated from its Game segment, which accounts for CN¥2.43 billion, and the TapTap Platform segment, contributing CN¥1.43 billion.

Estimated Discount To Fair Value: 38.4%

XD is trading at HK$26.8, significantly below its estimated fair value of HK$43.52, indicating it may be undervalued based on cash flows. Despite recent shareholder dilution, XD's earnings are expected to grow significantly at 51.9% annually over the next three years, outpacing the Hong Kong market's growth rate of 11.4%. While revenue growth is forecasted at 14.6% per year, slower than some benchmarks, it still exceeds the broader market's pace.

- According our earnings growth report, there's an indication that XD might be ready to expand.

- Click to explore a detailed breakdown of our findings in XD's balance sheet health report.

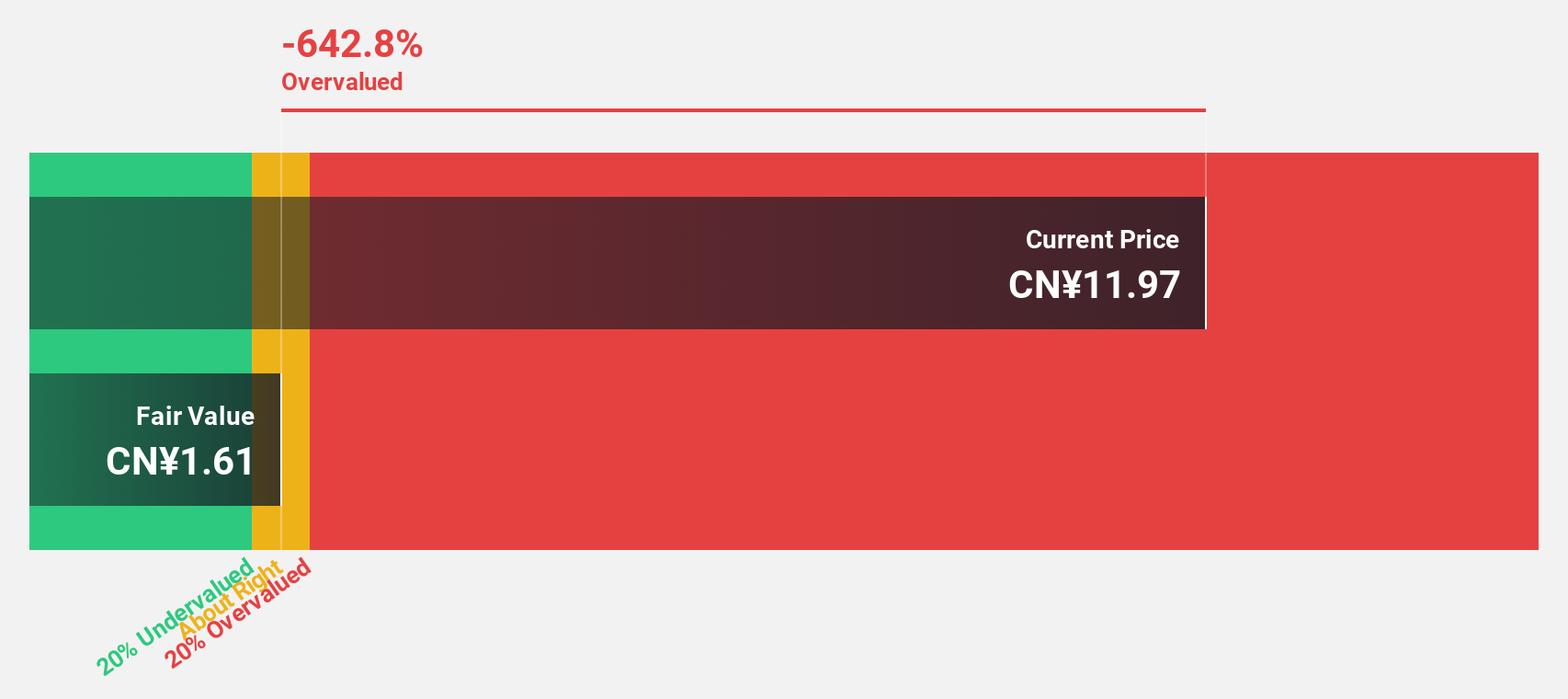

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Overview: Hui Lyu Ecological Technology Groups Ltd (SZSE:001267) operates in the ecological technology sector and has a market capitalization of CN¥7.80 billion.

Operations: Hui Lyu Ecological Technology Groups Ltd (SZSE:001267) operates in the ecological technology sector, but specific revenue segments are not provided in the available data.

Estimated Discount To Fair Value: 10.2%

Hui Lyu Ecological Technology Group's stock, trading at CNY 9.01, is below its estimated fair value of CNY 10.03, suggesting potential undervaluation based on cash flows. Despite a decline in sales to CNY 353.19 million for the nine months ending September 2024, net income rose slightly to CNY 26.26 million. The company's earnings are expected to grow significantly at over 41% annually, outpacing the broader Chinese market's growth rate of approximately 25%.

- In light of our recent growth report, it seems possible that Hui Lyu Ecological Technology GroupsLtd's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Hui Lyu Ecological Technology GroupsLtd stock in this financial health report.

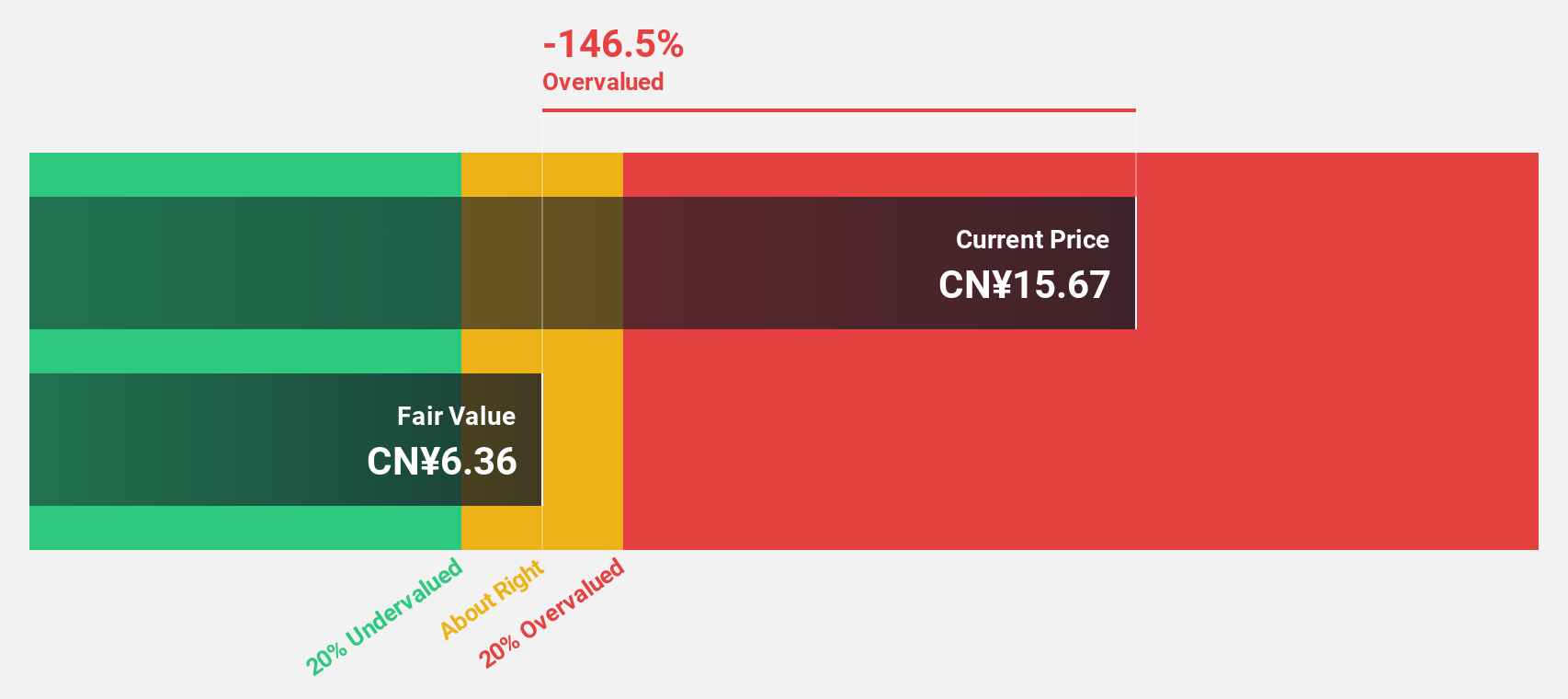

Zhejiang Meorient Commerce Exhibition (SZSE:300795)

Overview: Zhejiang Meorient Commerce Exhibition Inc. operates in the exhibition and trade show industry, with a market cap of CN¥5.07 billion.

Operations: Zhejiang Meorient Commerce Exhibition Inc. generates its revenue from various segments within the exhibition and trade show industry.

Estimated Discount To Fair Value: 44.2%

Zhejiang Meorient Commerce Exhibition is trading at CN¥26.83, significantly below its fair value estimate of CN¥48.05, highlighting potential undervaluation based on cash flows. Despite a decline in sales and net income for the nine months ending September 2024, the company's earnings are projected to grow significantly at 31.87% annually over the next three years, surpassing China's market growth rate of 25.8%. A recent share buyback may also enhance shareholder value.

- Our growth report here indicates Zhejiang Meorient Commerce Exhibition may be poised for an improving outlook.

- Navigate through the intricacies of Zhejiang Meorient Commerce Exhibition with our comprehensive financial health report here.

Taking Advantage

- Access the full spectrum of 910 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Meorient Commerce Exhibition might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300795

Zhejiang Meorient Commerce Exhibition

Zhejiang Meorient Commerce Exhibition Inc.

Exceptional growth potential with flawless balance sheet.