- China

- /

- Communications

- /

- SZSE:300548

3 Growth Companies Driven By High Insider Ownership

Reviewed by Simply Wall St

In a week where global markets saw mixed performances, with the Nasdaq Composite reaching new heights while most major indexes declined, growth stocks continued to outshine their value counterparts. As economic indicators suggest potential shifts in monetary policies across regions, investors are increasingly focusing on companies with strong fundamentals and high insider ownership as these factors can indicate confidence in long-term growth prospects. In this context, understanding the role of insider ownership can provide valuable insights into a company's potential for sustained growth amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 65.9% |

We're going to check out a few of the best picks from our screener tool.

WemadeLtd (KOSDAQ:A112040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wemade Co., Ltd. develops and publishes games both in South Korea and internationally, with a market cap of ₩1.37 trillion.

Operations: The company generates revenue from its Gaming Business, amounting to ₩663.58 billion.

Insider Ownership: 39.7%

Revenue Growth Forecast: 12.2% p.a.

Wemade Ltd. demonstrates potential as a growth company with high insider ownership, despite recent challenges. The company reported Q3 2024 sales of KRW 214.36 billion, slightly down from the previous year, while net income remained stable at KRW 41.94 billion. Analysts anticipate Wemade's revenue to grow faster than the Korean market average and expect significant profit growth over the next three years, suggesting robust future prospects despite current trading below estimated fair value by 20.4%.

- Click to explore a detailed breakdown of our findings in WemadeLtd's earnings growth report.

- Our valuation report unveils the possibility WemadeLtd's shares may be trading at a discount.

Dongguan Mentech Optical & Magnetic (SZSE:002902)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Mentech Optical & Magnetic Co., Ltd. operates in the optical and magnetic components industry with a market cap of CN¥5.60 billion.

Operations: Dongguan Mentech Optical & Magnetic Co., Ltd. generates its revenue from various segments within the optical and magnetic components industry.

Insider Ownership: 34.8%

Revenue Growth Forecast: 44.8% p.a.

Dongguan Mentech Optical & Magnetic shows potential for growth with high insider ownership, despite recent financial challenges. The company reported a net loss of CNY 139.46 million for the first nine months of 2024, but its revenue is forecast to grow significantly faster than the market at 44.8% annually, and earnings are expected to increase by 159.94% per year. A recent acquisition by Shenzhen Jiayi Asset Management highlights continued interest in the company's prospects.

- Dive into the specifics of Dongguan Mentech Optical & Magnetic here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Dongguan Mentech Optical & Magnetic shares in the market.

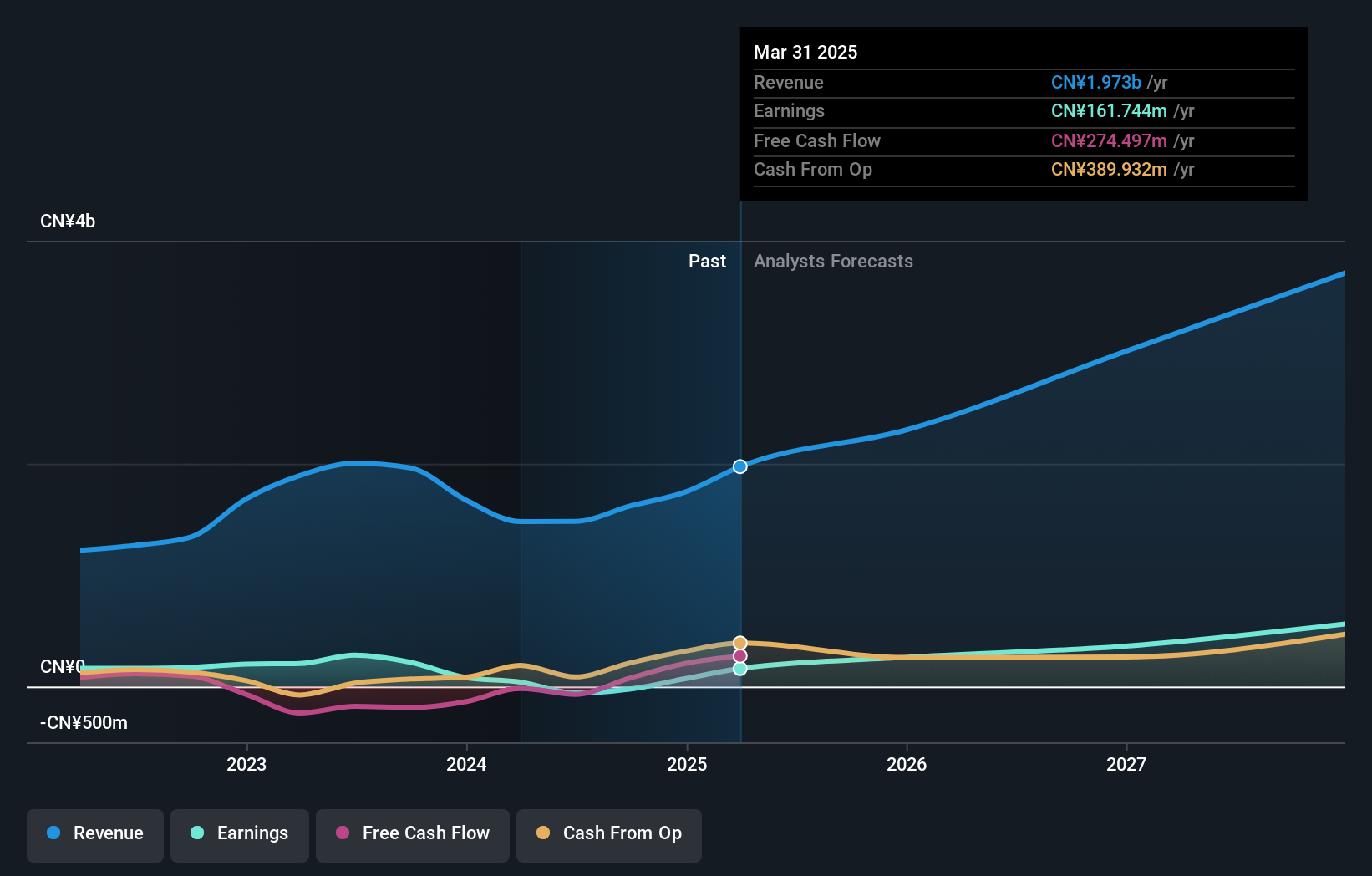

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Broadex Technologies Co., Ltd. is engaged in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥6.77 billion.

Operations: Broadex Technologies generates revenue through the research, development, production, and sale of integrated optoelectronic devices for optical communications across domestic and international markets.

Insider Ownership: 11.5%

Revenue Growth Forecast: 24.3% p.a.

Broadex Technologies is experiencing significant growth potential, with revenue expected to increase by 24.3% annually, outpacing the broader Chinese market. Earnings are projected to grow 63.88% per year and the company is anticipated to achieve profitability within three years. Despite a recent decline in net income for the first nine months of 2024, insider ownership remains high, as evidenced by Ningbo Ningju Asset Management's acquisition of a 5.04% stake for CNY 246.21 million.

- Get an in-depth perspective on Broadex Technologies' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Broadex Technologies is trading beyond its estimated value.

Key Takeaways

- Embark on your investment journey to our 1522 Fast Growing Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Broadex Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300548

Broadex Technologies

Researches and develops, produces, and sells integrated optoelectronic devices in the field of optical communications in China and internationally.

High growth potential with excellent balance sheet.