As global markets navigate a landscape marked by interest rate cuts and mixed economic signals, the Nasdaq Composite has reached a record high, underscoring the resilience of growth stocks amid broader market declines. In such an environment, stocks with high insider ownership often attract attention due to their potential alignment of interests between company insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 65.9% |

Here we highlight a subset of our preferred stocks from the screener.

Bioneer (KOSDAQ:A064550)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bioneer Corporation is a biotechnology company operating in South Korea and internationally, with a market cap of approximately ₩517.50 billion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 15.8%

Return On Equity Forecast: 21% (2027 estimate)

Bioneer's revenue is expected to grow significantly at 26.1% annually, surpassing the KR market average. Although currently unprofitable, it is forecast to achieve profitability within three years with a high return on equity of 21.2%. Despite trading at a substantial discount to its estimated fair value, recent earnings reveal challenges as the company reported a net loss in Q3 2024 and negative sales for nine months ending September 30, 2024.

- Click here to discover the nuances of Bioneer with our detailed analytical future growth report.

- Our valuation report unveils the possibility Bioneer's shares may be trading at a discount.

People & Technology (KOSDAQ:A137400)

Simply Wall St Growth Rating: ★★★★★★

Overview: People & Technology Inc. provides machinery solutions such as coating, calendaring, slitting, and automation, with a market cap of ₩972.90 billion.

Operations: The company's revenue primarily comes from its Machinery & Industrial Equipment segment, which generated ₩874.54 billion.

Insider Ownership: 16.4%

Return On Equity Forecast: 26% (2027 estimate)

People & Technology is poised for significant growth, with earnings projected to increase by 37.26% annually over the next three years, outpacing the KR market's average. The company benefits from high-quality earnings and is trading at a substantial discount of 66.3% below its estimated fair value. Despite past shareholder dilution, its revenue is expected to grow rapidly at 35.4% per year, significantly faster than both the industry and market averages.

- Navigate through the intricacies of People & Technology with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report People & Technology implies its share price may be lower than expected.

Ningbo Deye Technology Group (SHSE:605117)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningbo Deye Technology Group Co., Ltd. specializes in manufacturing and selling heat exchangers, inverters, and dehumidifiers across China, the UK, the US, Germany, India, and other international markets with a market cap of CN¥54.98 billion.

Operations: The company generates revenue through its production and sales of heat exchangers, inverters, and dehumidifiers across various international markets including China, the UK, the US, Germany, and India.

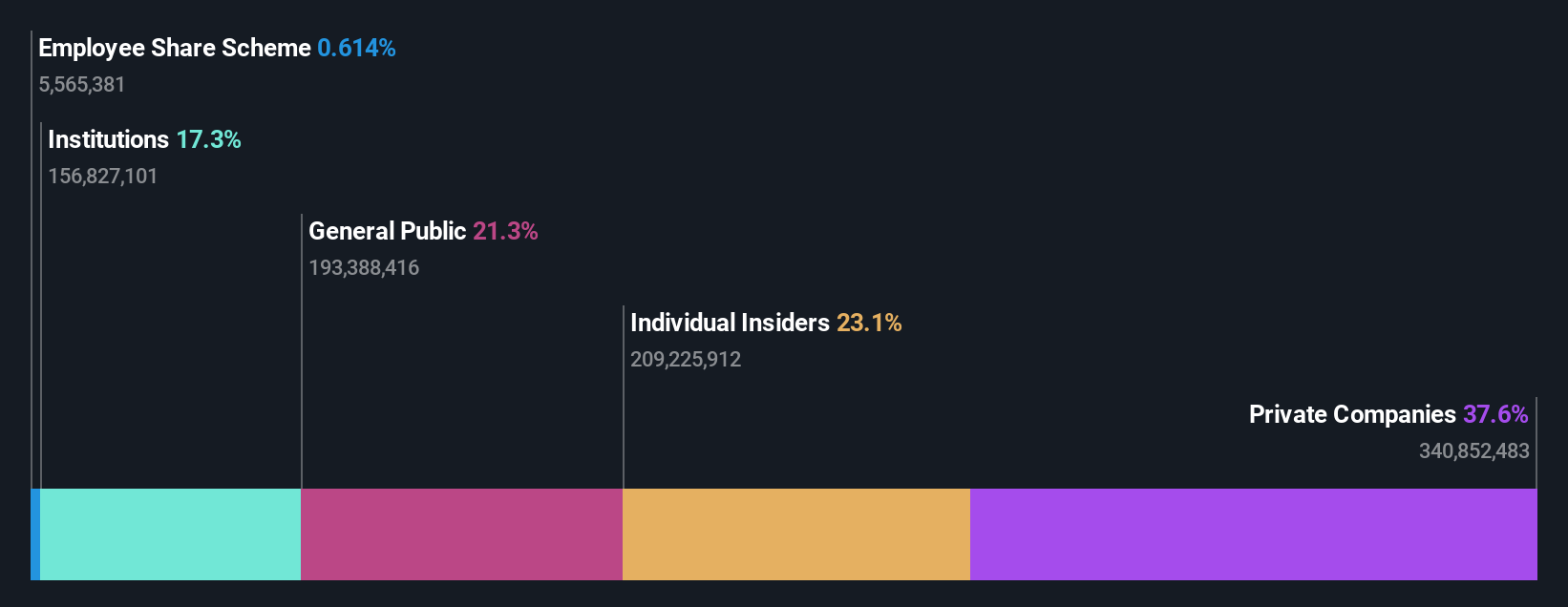

Insider Ownership: 23.1%

Return On Equity Forecast: 33% (2027 estimate)

Ningbo Deye Technology Group is positioned for robust growth, with earnings expected to rise 26.49% annually over the next three years, surpassing the CN market average. The company trades at a significant 33.7% discount to its estimated fair value and has shown strong revenue growth, reaching CNY 8 billion for the first nine months of 2024. Despite past shareholder dilution, it maintains a high forecasted return on equity of 33.2%.

- Take a closer look at Ningbo Deye Technology Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Ningbo Deye Technology Group is priced lower than what may be justified by its financials.

Key Takeaways

- Click this link to deep-dive into the 1522 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Deye Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605117

Ningbo Deye Technology Group

Engages in the production and sales of heat exchangers, inverters, and dehumidifiers in China, the United Kingdom, the United States, Germany, India, and internationally.

Very undervalued with exceptional growth potential.