- China

- /

- Commercial Services

- /

- SZSE:000826

Why Investors Shouldn't Be Surprised By TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT Co., LTD.'s (SZSE:000826) 31% Share Price Plunge

TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT Co., LTD. (SZSE:000826) shares have had a horrible month, losing 31% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

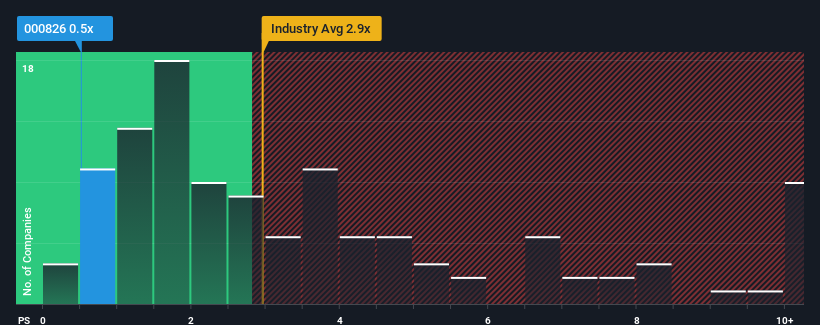

Following the heavy fall in price, TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Commercial Services industry in China have P/S ratios greater than 2.9x and even P/S higher than 6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT

How Has TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT Performed Recently?

For example, consider that TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT?

In order to justify its P/S ratio, TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.6%. This means it has also seen a slide in revenue over the longer-term as revenue is down 35% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 34% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's P/S Mean For Investors?

Shares in TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TUS Environmental Science and Technology Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000826

TUS Environmental Science and Technology Development

Provides environment improvement solutions in China.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)