- China

- /

- Commercial Services

- /

- SHSE:688156

Road Biology Environmental Protection Technology Co., Ltd.'s (SHSE:688156) Share Price Matching Investor Opinion

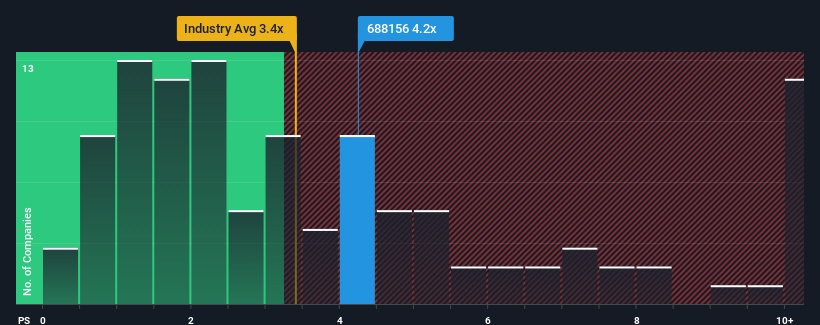

Road Biology Environmental Protection Technology Co., Ltd.'s (SHSE:688156) price-to-sales (or "P/S") ratio of 4.2x may not look like an appealing investment opportunity when you consider close to half the companies in the Commercial Services industry in China have P/S ratios below 3.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Road Biology Environmental Protection Technology

How Road Biology Environmental Protection Technology Has Been Performing

While the industry has experienced revenue growth lately, Road Biology Environmental Protection Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Road Biology Environmental Protection Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Road Biology Environmental Protection Technology's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Turning to the outlook, the next year should generate growth of 143% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 32%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Road Biology Environmental Protection Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Road Biology Environmental Protection Technology's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Road Biology Environmental Protection Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Commercial Services industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Road Biology Environmental Protection Technology with six simple checks.

If these risks are making you reconsider your opinion on Road Biology Environmental Protection Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688156

Road Biology Environmental Protection Technology

Road Biology Environmental Protection Technology Co., Ltd.

Mediocre balance sheet very low.

Market Insights

Community Narratives