As global markets navigate a complex landscape of fluctuating interest rates and geopolitical tensions, investors are keenly observing the implications of AI competition and tariff risks on stock performance. Amidst this backdrop, dividend stocks remain an attractive option for those seeking stable income streams, as they often provide a buffer against market volatility while offering potential for long-term growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.09% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Ebro Foods (BME:EBRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ebro Foods, S.A. is a food company operating in Spain, Europe, the United States, Canada, and internationally with a market cap of approximately €2.53 billion.

Operations: Ebro Foods generates its revenue primarily from its Rice Business, which accounts for €2.45 billion, and its Pasta Business, contributing €682.24 million.

Dividend Yield: 4%

Ebro Foods' dividend payments are well-covered by both earnings and cash flows, with a payout ratio of 50.1% and a cash payout ratio of 28.1%. However, its dividend yield of 4.01% is below the top quartile in Spain, and the company has had an unreliable dividend history over the past decade due to volatility. Despite this, Ebro Foods trades at a significant discount to its estimated fair value and has shown recent earnings growth of 22.7%.

- Unlock comprehensive insights into our analysis of Ebro Foods stock in this dividend report.

- The analysis detailed in our Ebro Foods valuation report hints at an deflated share price compared to its estimated value.

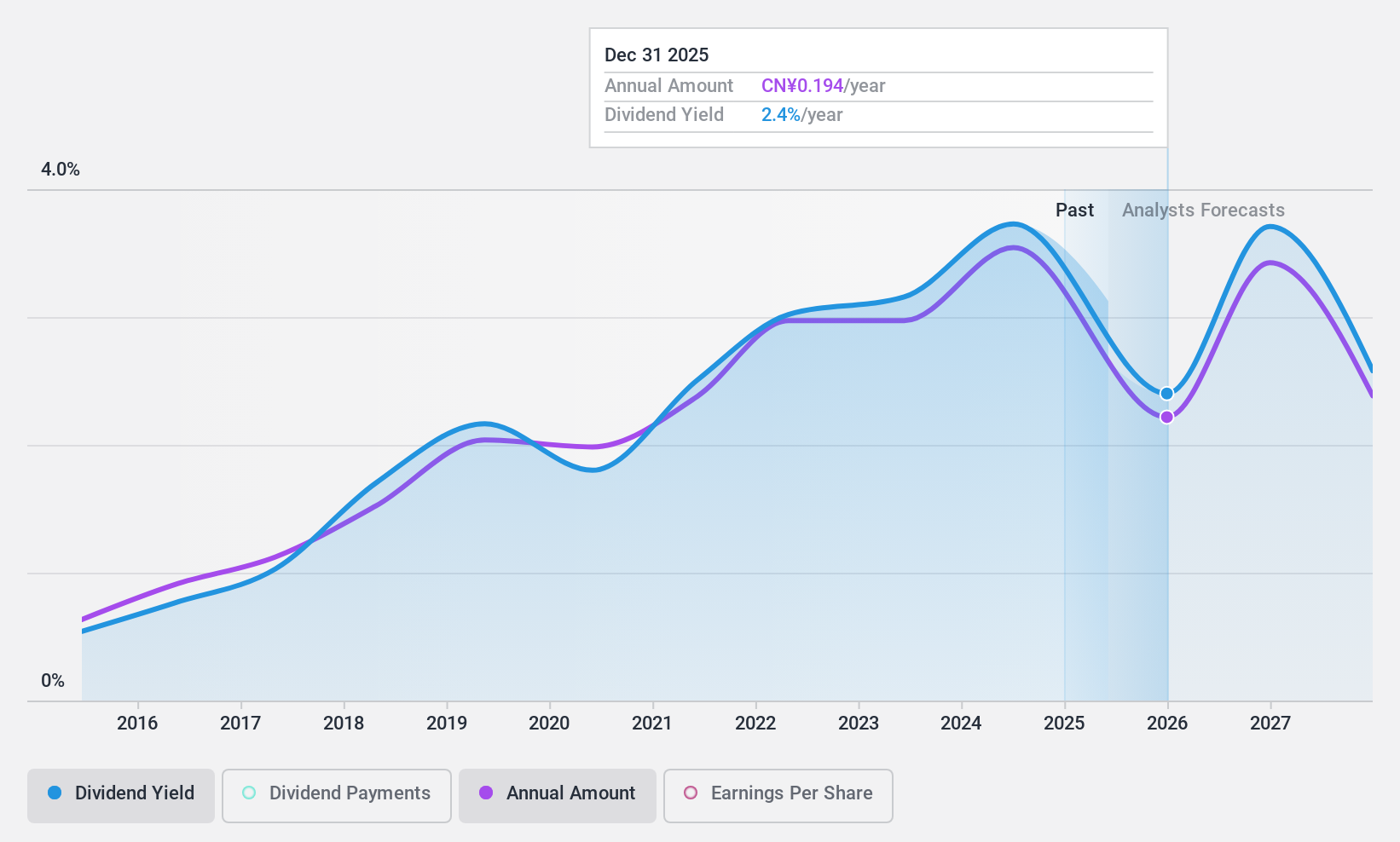

China Design Group (SHSE:603018)

Simply Wall St Dividend Rating: ★★★★★★

Overview: China Design Group Co., Ltd. offers engineering survey and design services in China with a market cap of CN¥6.16 billion.

Operations: China Design Group Co., Ltd. generates its revenue primarily from engineering survey and design services within China.

Dividend Yield: 3.4%

China Design Group's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 37% and a cash payout ratio of 76.9%. The company has maintained stable and growing dividends over the past decade, offering an attractive yield of 3.4%, which is among the top quartile in China. Trading at a favorable valuation with a P/E ratio of 10.6x, it recently completed a share buyback worth CNY 52.53 million, enhancing shareholder value.

- Get an in-depth perspective on China Design Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of China Design Group shares in the market.

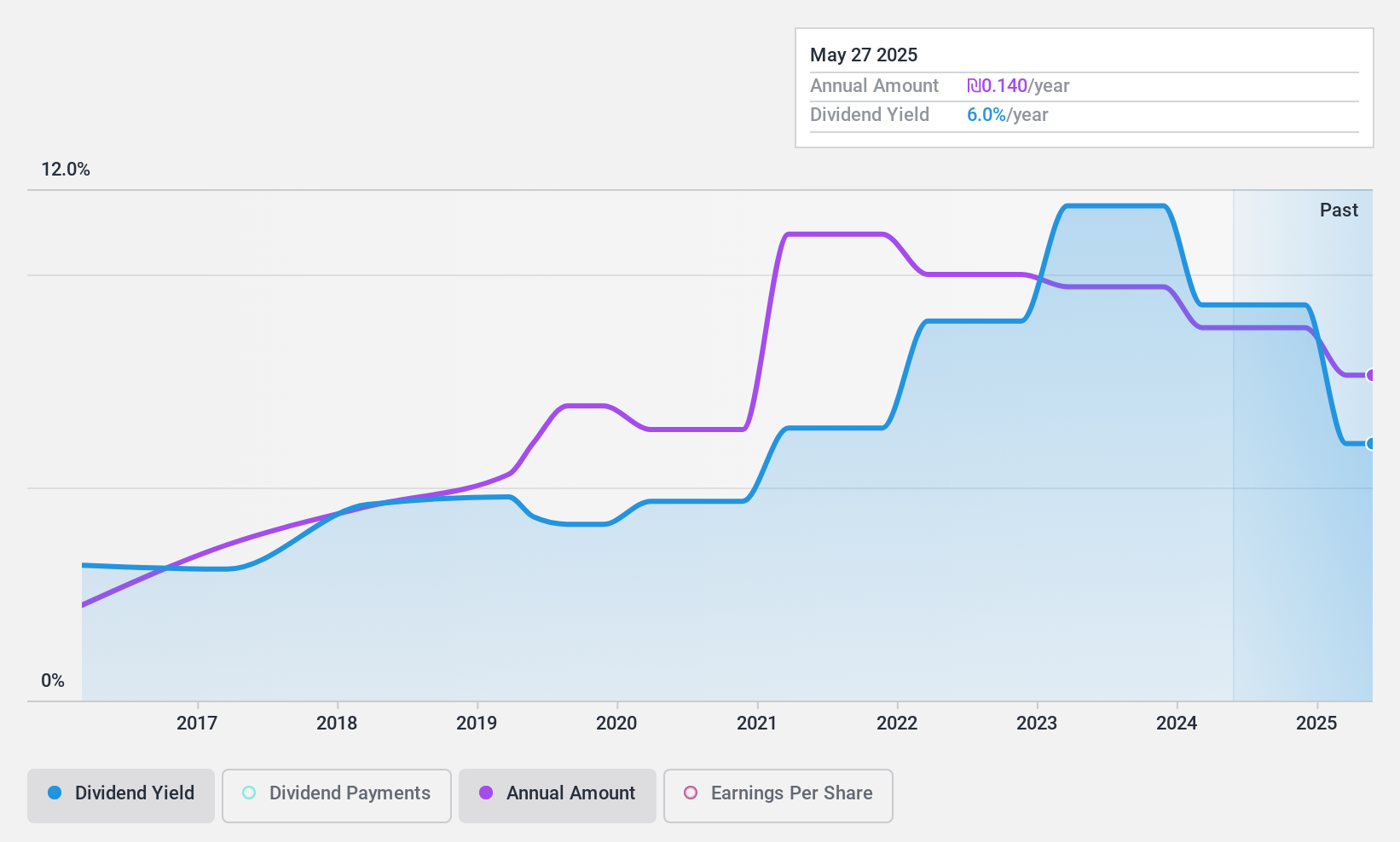

Peninsula Group (TASE:PEN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Peninsula Group Ltd offers credit solutions in Israel and has a market cap of ₪462.17 million.

Operations: Peninsula Group Ltd generates revenue from its Financial Services - Commercial segment, amounting to ₪99.59 million.

Dividend Yield: 7.7%

Peninsula Group offers a high dividend yield of 7.72%, ranking in the top 25% of Israeli payers, with stable and reliable payments over the past decade. The company's dividends are well-covered by earnings (payout ratio: 61.2%) and cash flows (cash payout ratio: 22.5%). Despite reporting a decrease in nine-month net income to ILS 36.31 million, Peninsula maintains a favorable P/E ratio of 9.6x, below the market average, though it carries a high level of debt.

- Navigate through the intricacies of Peninsula Group with our comprehensive dividend report here.

- Our expertly prepared valuation report Peninsula Group implies its share price may be too high.

Seize The Opportunity

- Click through to start exploring the rest of the 1952 Top Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ebro Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:EBRO

Ebro Foods

Operates as a food company in Spain, rest of Europe, the United States, Canada, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives