- China

- /

- Professional Services

- /

- SHSE:603017

Market Participants Recognise ARTS Group Co., Ltd's (SHSE:603017) Earnings Pushing Shares 68% Higher

ARTS Group Co., Ltd (SHSE:603017) shares have had a really impressive month, gaining 68% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

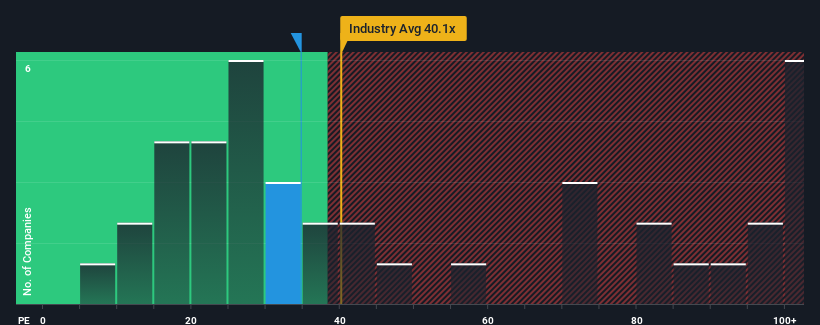

Since its price has surged higher, ARTS Group may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 34.7x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

ARTS Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for ARTS Group

Is There Enough Growth For ARTS Group?

In order to justify its P/E ratio, ARTS Group would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 15%. Still, incredibly EPS has fallen 50% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 43% during the coming year according to the only analyst following the company. With the market only predicted to deliver 34%, the company is positioned for a stronger earnings result.

With this information, we can see why ARTS Group is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From ARTS Group's P/E?

ARTS Group shares have received a push in the right direction, but its P/E is elevated too. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that ARTS Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for ARTS Group that you need to be mindful of.

Of course, you might also be able to find a better stock than ARTS Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade ARTS Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603017

ARTS Group

Operates in the engineering technology service industry in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives