As we enter January 2025, the global market landscape is marked by volatility, with U.S. equities experiencing declines amid inflation concerns and political uncertainty. Small-cap stocks have particularly struggled, underperforming their large-cap counterparts as reflected in the Russell 2000 Index's recent dip into correction territory. In such a turbulent environment, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and growth potential that can weather economic fluctuations and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| NJS | NA | 5.31% | 7.12% | ★★★★★★ |

| GakkyushaLtd | 19.76% | 4.94% | 18.11% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chuo WarehouseLtd | 12.36% | 0.35% | 9.16% | ★★★★★★ |

| MIRARTH HOLDINGSInc | 261.26% | 3.32% | 0.93% | ★★★★★☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Spic Yuanda Environmental-ProtectionLtd (SHSE:600292)

Simply Wall St Value Rating: ★★★★★☆

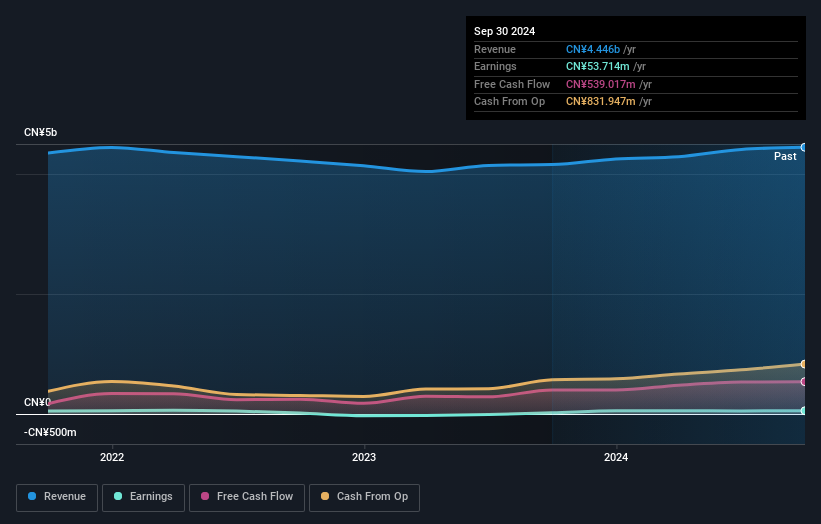

Overview: Spic Yuanda Environmental-Protection Co., Ltd. is a company focused on providing environmental protection solutions, with a market capitalization of CN¥9.20 billion.

Operations: Spic Yuanda generates revenue primarily from its environmental protection solutions. The company's gross profit margin is reported at 25%.

Spic Yuanda Environmental-Protection Ltd., a small player in the environmental services sector, has shown mixed financial performance recently. The company's earnings have grown by 176% over the past year, significantly outpacing the industry average of -2.7%. However, over five years, earnings have decreased annually by 27%. Despite this volatility, their net debt to equity ratio stands at a satisfactory 14%, and interest payments are well-covered with EBIT coverage of 29.6 times. Recent sales figures for nine months ending September 2024 were CNY 3.1 billion compared to CNY 2.9 billion last year, reflecting some growth in revenue streams despite challenges in profitability margins.

- Click here to discover the nuances of Spic Yuanda Environmental-ProtectionLtd with our detailed analytical health report.

Learn about Spic Yuanda Environmental-ProtectionLtd's historical performance.

Hangzhou DPtech TechnologiesLtd (SZSE:300768)

Simply Wall St Value Rating: ★★★★★★

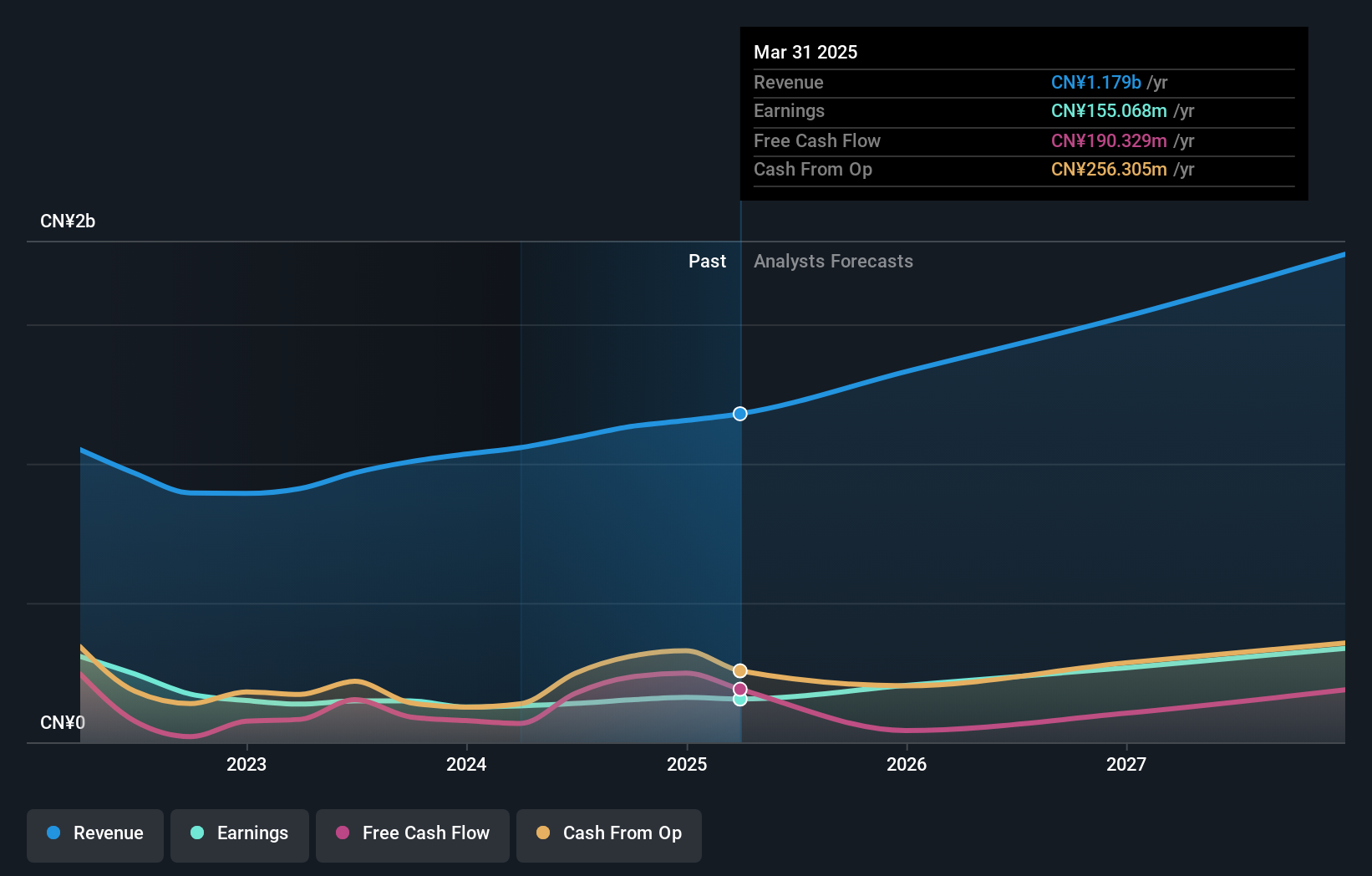

Overview: Hangzhou DPtech Technologies Co., Ltd. specializes in the research, development, production, and sale of network security and application delivery products both in China and internationally, with a market cap of CN¥10.29 billion.

Operations: DPtech generates revenue primarily through its network security and application delivery products. The company's cost structure includes expenses related to research, development, and production. Notably, the net profit margin has shown a trend worth observing over recent periods.

Hangzhou DPtech Technologies, a nimble player in the tech sector, has been making waves with its strong financial performance. With earnings of CNY 92.38 million for the first nine months of 2024, up from CNY 67.08 million last year, it showcases resilience and growth despite market volatility. The company is debt-free, eliminating concerns over interest coverage and enhancing financial stability. Trading at a discount of 23% to its fair value suggests potential upside for investors looking for undervalued opportunities. Additionally, it boasts high-quality earnings and forecasts indicate an impressive growth trajectory of 23.67% annually.

Zhongjing Food (SZSE:300908)

Simply Wall St Value Rating: ★★★★★★

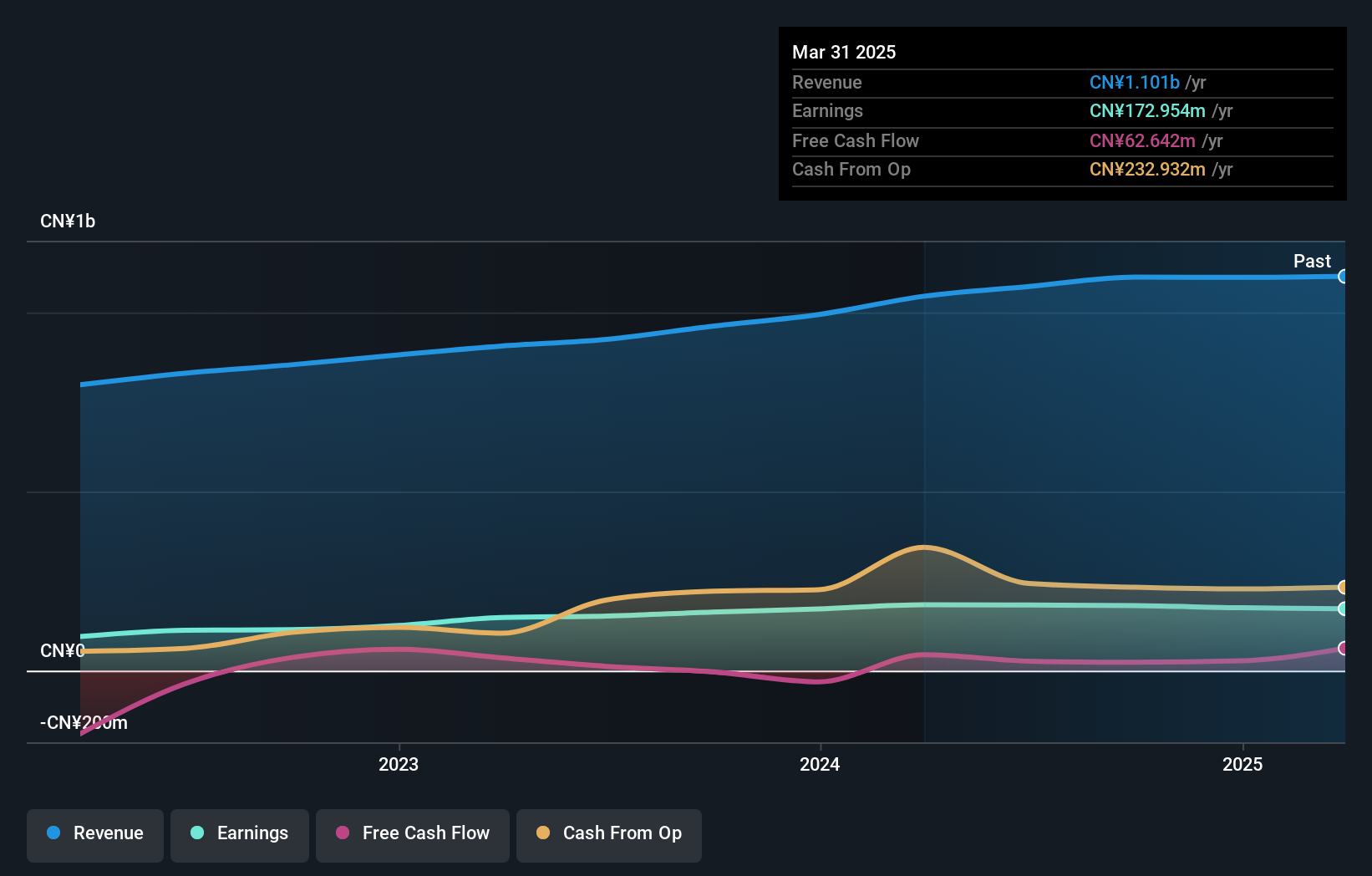

Overview: Zhongjing Food Co., Ltd. focuses on the research, development, production, and sale of seasoning food and ingredients in China, with a market cap of CN¥4.38 billion.

Operations: Zhongjing Food generates revenue primarily through the sale of seasoning food and ingredients in China.

Zhongjing Food, a smaller player in the food industry, has demonstrated robust financial health with more cash than total debt and a reduced debt-to-equity ratio from 10.5 to 0.6 over five years. The company’s earnings have grown by 10.9% over the past year, outpacing the industry average of -4.1%, indicating strong performance relative to peers. Additionally, its price-to-earnings ratio of 24.1x is attractive compared to the broader CN market at 31.8x, suggesting potential undervaluation. Recent dividend affirmations reflect confidence in profitability and shareholder returns, with CNY 2 per share approved for distribution in Q3 2024 profits.

- Get an in-depth perspective on Zhongjing Food's performance by reading our health report here.

Review our historical performance report to gain insights into Zhongjing Food's's past performance.

Taking Advantage

- Delve into our full catalog of 4536 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongjing Food might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300908

Zhongjing Food

Engages in the research and development, production, and sale of seasoning food and ingredients in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives