Rongcheer Industrial Technology (Suzhou) Co., Ltd.'s (SZSE:301360) Share Price Is Still Matching Investor Opinion Despite 31% Slump

Rongcheer Industrial Technology (Suzhou) Co., Ltd. (SZSE:301360) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

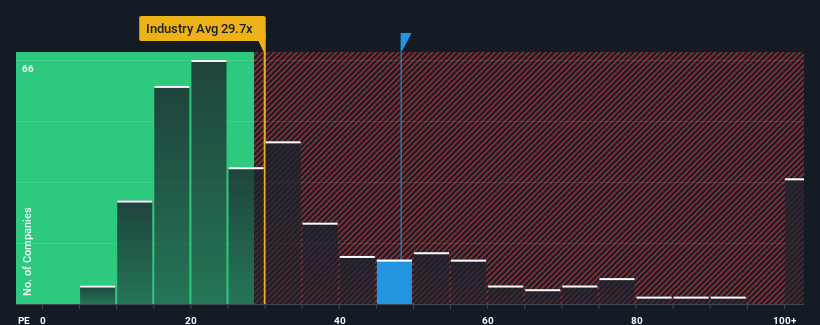

In spite of the heavy fall in price, Rongcheer Industrial Technology (Suzhou)'s price-to-earnings (or "P/E") ratio of 48.2x might still make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Rongcheer Industrial Technology (Suzhou) could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Rongcheer Industrial Technology (Suzhou)

How Is Rongcheer Industrial Technology (Suzhou)'s Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Rongcheer Industrial Technology (Suzhou)'s is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. The last three years don't look nice either as the company has shrunk EPS by 28% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 178% as estimated by the lone analyst watching the company. With the market only predicted to deliver 35%, the company is positioned for a stronger earnings result.

With this information, we can see why Rongcheer Industrial Technology (Suzhou) is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Rongcheer Industrial Technology (Suzhou)'s shares may have retreated, but its P/E is still flying high. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Rongcheer Industrial Technology (Suzhou)'s analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Rongcheer Industrial Technology (Suzhou) (of which 1 is a bit concerning!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301360

Rongcheer Industrial Technology (Suzhou)

Rongcheer Industrial Technology (Suzhou) Co., Ltd.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives