Xiamen East Asia Machinery Industrial Co., Ltd.'s (SZSE:301028) Shares Lagging The Market But So Is The Business

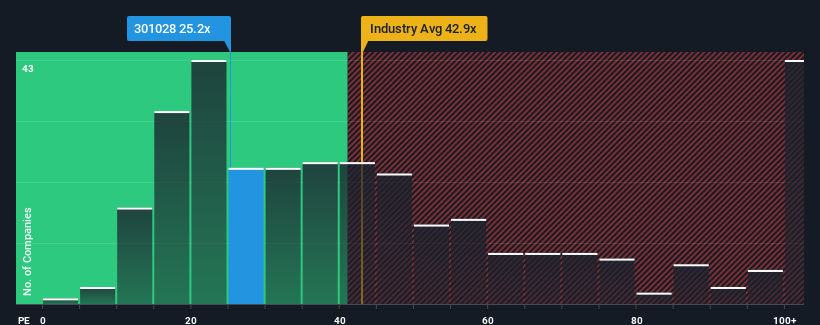

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 40x, you may consider Xiamen East Asia Machinery Industrial Co., Ltd. (SZSE:301028) as an attractive investment with its 25.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been quite advantageous for Xiamen East Asia Machinery Industrial as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Xiamen East Asia Machinery Industrial

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Xiamen East Asia Machinery Industrial's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 40% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 13% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 37% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Xiamen East Asia Machinery Industrial's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Xiamen East Asia Machinery Industrial's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Xiamen East Asia Machinery Industrial maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - Xiamen East Asia Machinery Industrial has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Xiamen East Asia Machinery Industrial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301028

Xiamen East Asia Machinery Industrial

Xiamen East Asia Machinery Industrial Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives