As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a period of cautious optimism, with indices like the CSI 300 and Hang Seng Index posting gains. In this environment, growth companies with high insider ownership can be particularly appealing as they often suggest strong confidence from those closest to the business, potentially offering resilience amid global economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| AcrelLtd (SZSE:300286) | 34.2% | 34.9% |

| WinWay Technology (TWSE:6515) | 22.1% | 21.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| UTour Group (SZSE:002707) | 23.5% | 32.7% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Below we spotlight a couple of our favorites from our exclusive screener.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. focuses on the research, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China with a market cap of CN¥24.87 billion.

Operations: Raytron Technology Co., Ltd. generates its revenue primarily through the development and sale of uncooled infrared imaging systems and MEMS sensor technology in China.

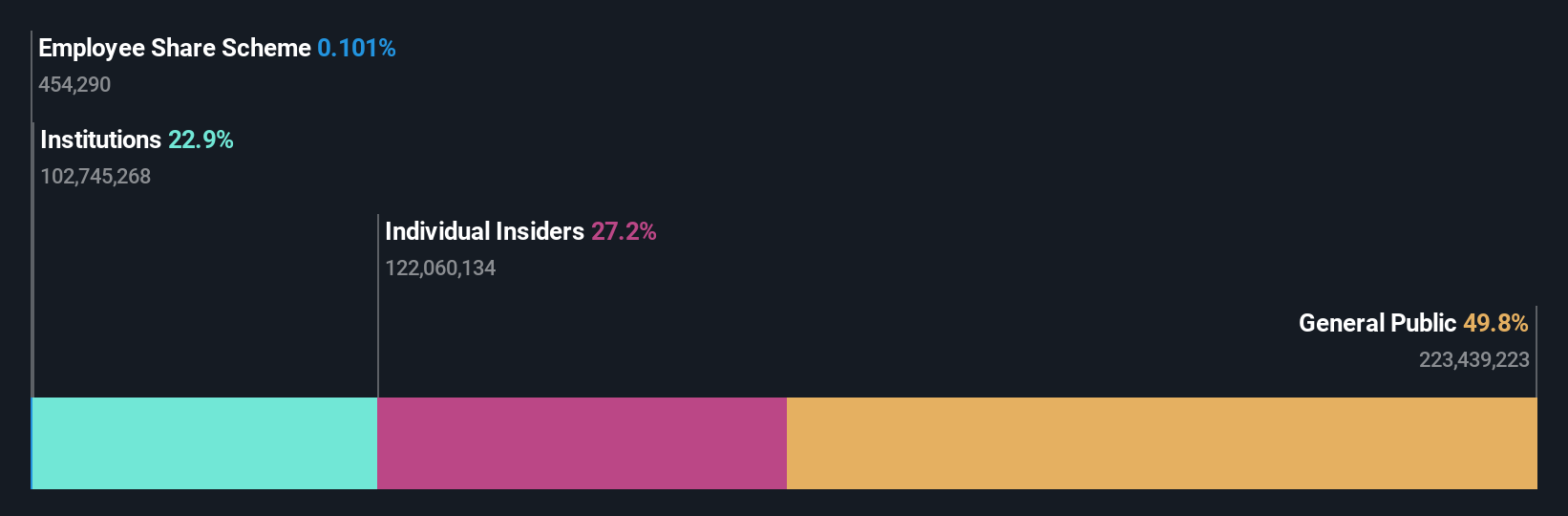

Insider Ownership: 27.3%

Earnings Growth Forecast: 26.7% p.a.

Raytron Technology Ltd. showcases robust growth potential with earnings forecasted to grow significantly at 26.72% annually, outpacing the Chinese market's 23.6%. Despite a lower-than-industry-average price-to-earnings ratio of 42.4x, its revenue growth is expected at 17.5% per year, surpassing the market average of 12.6%. Recent Q1 results indicate sales rose to ¥1.14 billion from ¥1 billion last year, while net income increased to ¥145.82 million from ¥128.57 million, reflecting strong financial performance amidst ongoing share buybacks totaling ¥100 million.

- Unlock comprehensive insights into our analysis of Raytron TechnologyLtd stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Raytron TechnologyLtd shares in the market.

Ningbo Zhenyu Technology (SZSE:300953)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Zhenyu Technology Co., Ltd. engages in the research, development, manufacturing, and sale of lamination dies and precision machining equipment both in China and internationally, with a market cap of CN¥18.02 billion.

Operations: The company's revenue is primarily derived from its Machinery & Industrial Equipment segment, totaling CN¥7.13 billion.

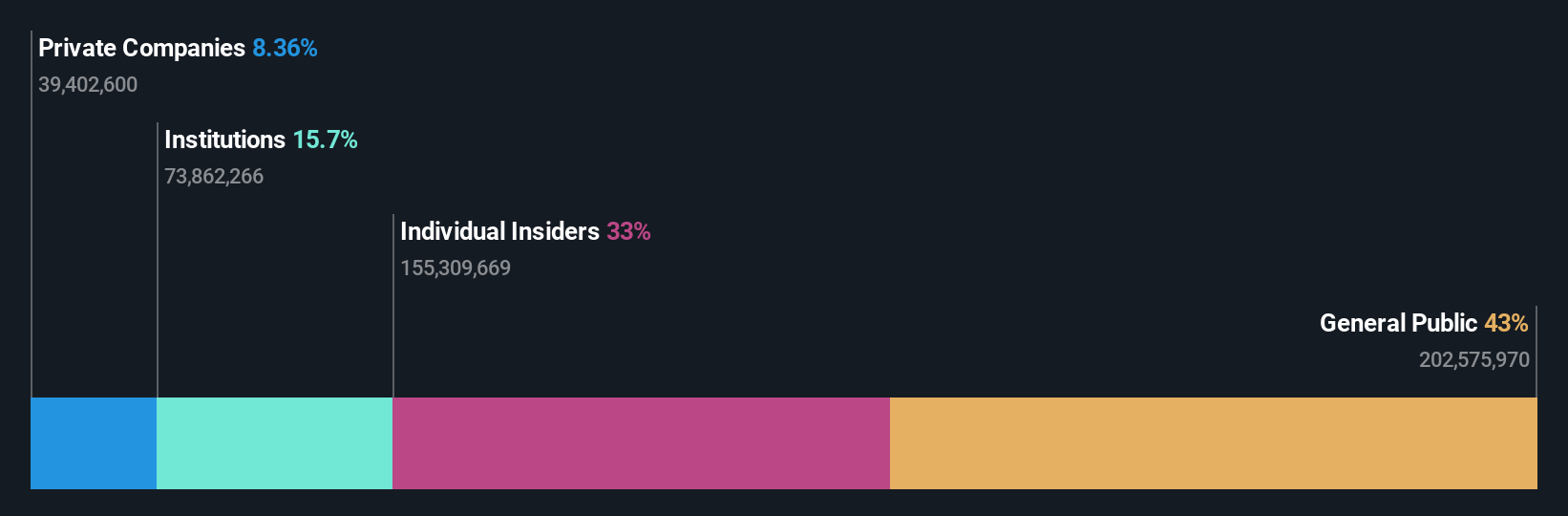

Insider Ownership: 38.1%

Earnings Growth Forecast: 28.3% p.a.

Ningbo Zhenyu Technology demonstrates strong growth potential, with earnings growing 496.6% last year and forecasted to rise by 28.3% annually, exceeding the Chinese market's average. Despite revenue growth expectations of 14.2%, lower than the desired threshold of 20%, recent financials show a significant sales increase to CNY 7.12 billion from CNY 18.51 million year-on-year and net income rising to CNY 254.9 million, indicating robust performance amidst high insider ownership levels and volatile share prices.

- Click to explore a detailed breakdown of our findings in Ningbo Zhenyu Technology's earnings growth report.

- Our expertly prepared valuation report Ningbo Zhenyu Technology implies its share price may be too high.

Easy Click Worldwide Network Technology (SZSE:301171)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Easy Click Worldwide Network Technology Co., Ltd. operates in the technology sector and has a market cap of CN¥12.67 billion.

Operations: Unfortunately, the provided text does not contain any specific revenue segments or figures for Easy Click Worldwide Network Technology Co., Ltd. If you have additional data regarding their revenue breakdown, I would be happy to help summarize it.

Insider Ownership: 32.9%

Earnings Growth Forecast: 27.8% p.a.

Easy Click Worldwide Network Technology is poised for growth, with earnings projected to rise 27.8% annually, surpassing the Chinese market's average. The company's revenue is expected to grow at 15.2% per year, slightly below the ideal threshold of 20%. Recent financials reveal a substantial sales increase to CNY 929.12 million from CNY 480.95 million year-on-year and net income improvement, reflecting solid performance despite share price volatility and limited recent insider trading data.

- Dive into the specifics of Easy Click Worldwide Network Technology here with our thorough growth forecast report.

- According our valuation report, there's an indication that Easy Click Worldwide Network Technology's share price might be on the expensive side.

Taking Advantage

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 619 companies by clicking here.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Easy Click Worldwide Network Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301171

Easy Click Worldwide Network Technology

Easy Click Worldwide Network Technology Co., Ltd.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)