Zhejiang Chunhui Intelligent Control Co., Ltd.'s (SZSE:300943) Price Is Right But Growth Is Lacking After Shares Rocket 36%

Those holding Zhejiang Chunhui Intelligent Control Co., Ltd. (SZSE:300943) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

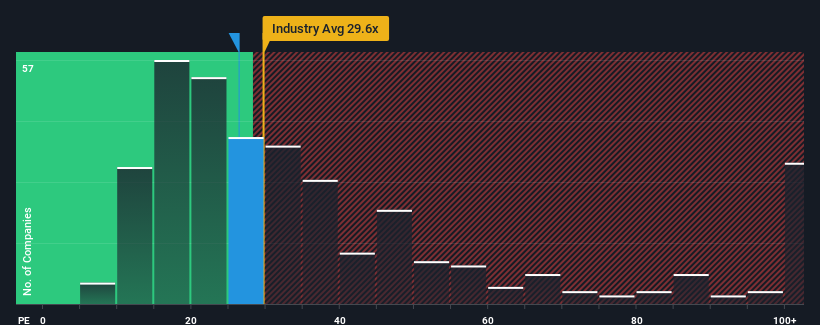

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Zhejiang Chunhui Intelligent Control as an attractive investment with its 26.4x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Zhejiang Chunhui Intelligent Control has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Zhejiang Chunhui Intelligent Control

Is There Any Growth For Zhejiang Chunhui Intelligent Control?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhejiang Chunhui Intelligent Control's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 31% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 21% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's an unpleasant look.

In light of this, it's understandable that Zhejiang Chunhui Intelligent Control's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Zhejiang Chunhui Intelligent Control's P/E

The latest share price surge wasn't enough to lift Zhejiang Chunhui Intelligent Control's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Zhejiang Chunhui Intelligent Control maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Zhejiang Chunhui Intelligent Control is showing 3 warning signs in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Zhejiang Chunhui Intelligent Control. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Chunhui Intelligent Control might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300943

Zhejiang Chunhui Intelligent Control

Zhejiang Chunhui Intelligent Control Co., Ltd.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives