As global markets react positively to the temporary de-escalation of U.S.-China trade tensions, Asian markets have shown resilience and potential for growth. In such an environment, companies with high insider ownership often signal confidence from those who know the business best, making them intriguing prospects for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.8% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.1% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

| giftee (TSE:4449) | 34.5% | 63.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Here we highlight a subset of our preferred stocks from the screener.

Henan Shijia Photons Technology (SHSE:688313)

Simply Wall St Growth Rating: ★★★★★★

Overview: Henan Shijia Photons Technology Co., Ltd. operates in the photonics industry and has a market cap of CN¥14.06 billion.

Operations: The company generates revenue primarily from its Optical Networking Equipments segment, which amounts to CN¥1.31 billion.

Insider Ownership: 10.1%

Earnings Growth Forecast: 40.2% p.a.

Henan Shijia Photons Technology exhibits strong growth potential, with earnings forecasted to grow significantly at 40.2% annually, outpacing the Chinese market's 23.7%. Recent earnings reveal a substantial rise in net income to CNY 93.19 million for Q1 2025 from CNY 8.44 million a year ago, reflecting robust revenue growth of over double the previous year's figure. Despite high volatility in share price and no recent insider trading activity, its expected revenue growth of 28% per year remains promising.

- Delve into the full analysis future growth report here for a deeper understanding of Henan Shijia Photons Technology.

- In light of our recent valuation report, it seems possible that Henan Shijia Photons Technology is trading beyond its estimated value.

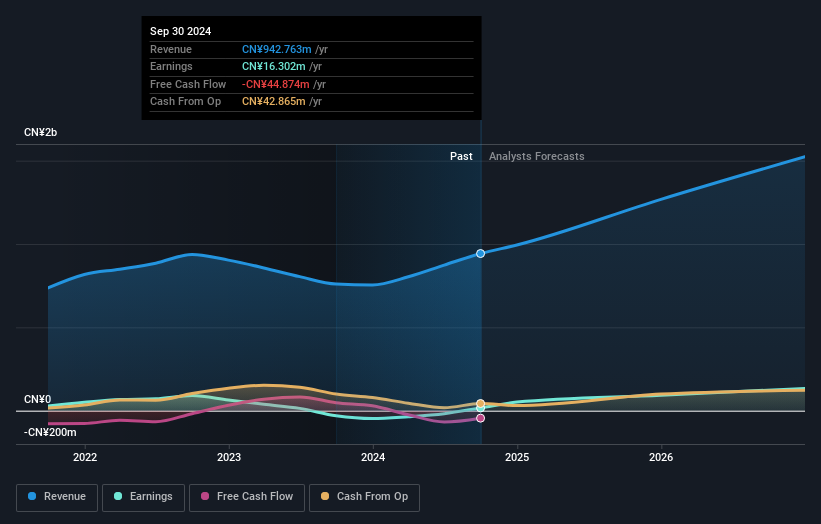

Luoyang Xinqianglian Slewing Bearing (SZSE:300850)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Luoyang Xinqianglian Slewing Bearing Co., Ltd. (SZSE:300850) specializes in the production of slewing bearings and has a market cap of CN¥11.78 billion.

Operations: The company's revenue primarily comes from the production and sale of slewing bearings.

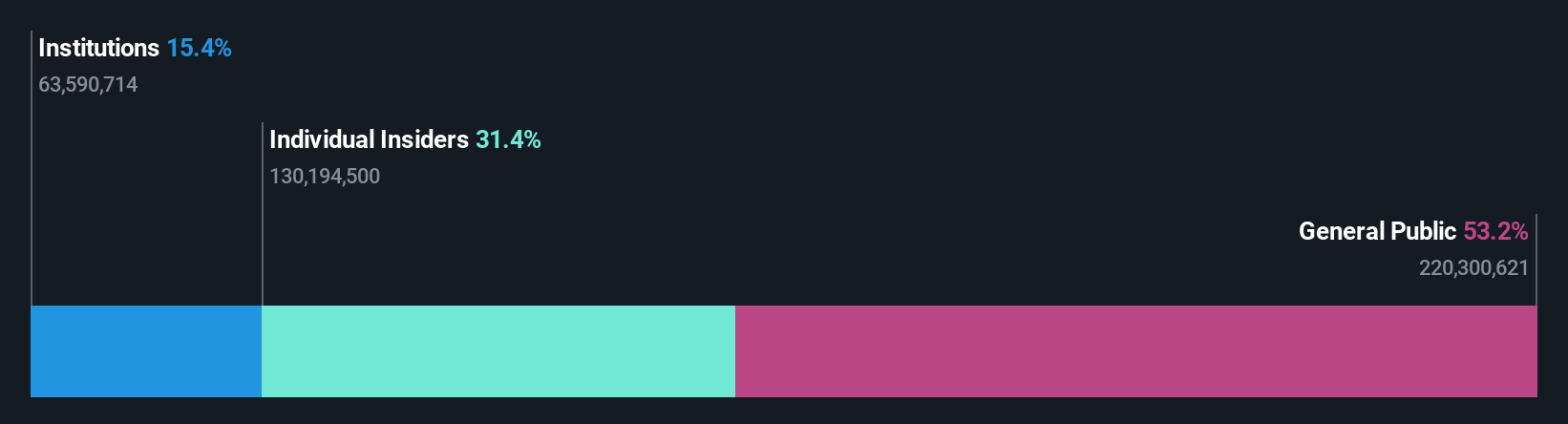

Insider Ownership: 34.2%

Earnings Growth Forecast: 30.9% p.a.

Luoyang Xinqianglian Slewing Bearing demonstrates promising growth prospects, with earnings forecasted to grow significantly at 30.9% annually, surpassing the Chinese market's 23.7%. Despite a recent decrease in dividends to CNY 0.92 per share for 2024, Q1 2025 results show a remarkable turnaround with net income reaching CNY 170.48 million from a previous loss of CNY 51.77 million. Revenue is expected to increase faster than the CN market at an annual rate of 14.4%.

- Click here and access our complete growth analysis report to understand the dynamics of Luoyang Xinqianglian Slewing Bearing.

- Our valuation report here indicates Luoyang Xinqianglian Slewing Bearing may be overvalued.

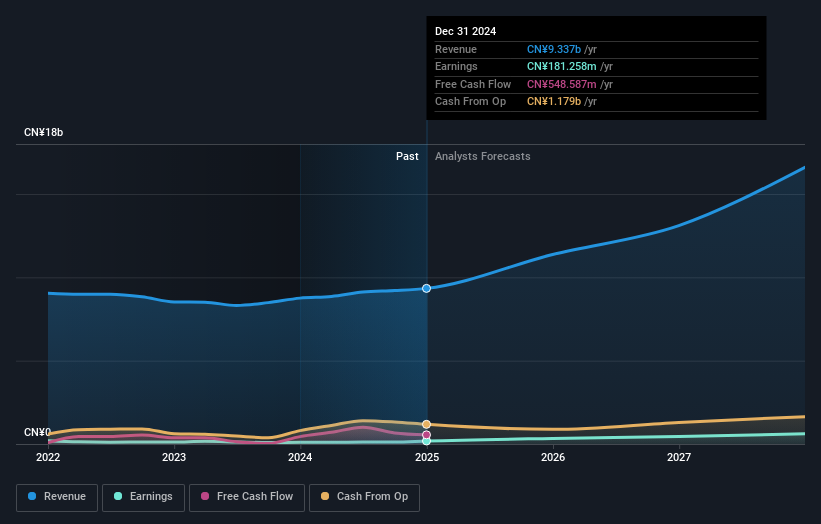

Kidswant Children ProductsLtd (SZSE:301078)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kidswant Children Products Co., Ltd. operates in China, focusing on the retail of maternal, infant, and child products with a market capitalization of CN¥16.48 billion.

Operations: The company generates revenue primarily from the retailing of mother and baby products, amounting to CN¥9.55 billion.

Insider Ownership: 28.5%

Earnings Growth Forecast: 36.2% p.a.

Kidswant Children Products Ltd. is experiencing robust growth, with earnings rising by 83.7% last year and forecasted to grow significantly at 36.2% annually, outpacing the Chinese market's 23.7%. The company's recent Q1 results showed a notable increase in net income to CNY 31.01 million from CNY 11.66 million a year prior, reflecting strong operational performance despite share price volatility and low future return on equity projections of 10.4%.

- Unlock comprehensive insights into our analysis of Kidswant Children ProductsLtd stock in this growth report.

- Our expertly prepared valuation report Kidswant Children ProductsLtd implies its share price may be too high.

Turning Ideas Into Actions

- Click here to access our complete index of 619 Fast Growing Asian Companies With High Insider Ownership.

- Contemplating Other Strategies? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300850

Luoyang Xinqianglian Slewing Bearing

Luoyang Xinqianglian Slewing Bearing Co., Ltd.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives