- China

- /

- Electrical

- /

- SZSE:300833

A Piece Of The Puzzle Missing From Guangzhou Haoyang Electronic Co.,Ltd.'s (SZSE:300833) 26% Share Price Climb

Guangzhou Haoyang Electronic Co.,Ltd. (SZSE:300833) shareholders have had their patience rewarded with a 26% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

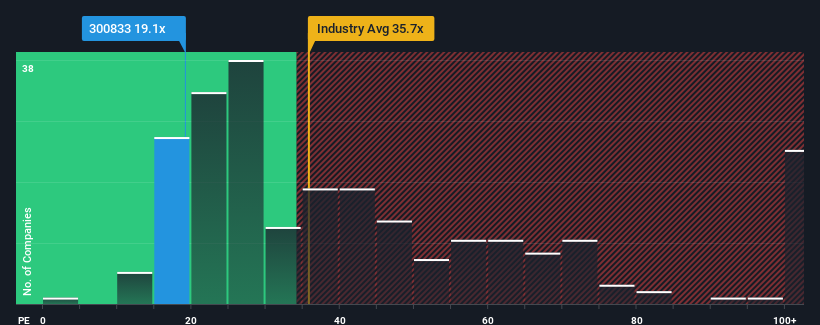

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 36x, you may still consider Guangzhou Haoyang ElectronicLtd as an attractive investment with its 19.1x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Guangzhou Haoyang ElectronicLtd has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Guangzhou Haoyang ElectronicLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Guangzhou Haoyang ElectronicLtd would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. Even so, admirably EPS has lifted 176% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 50% over the next year. That's shaping up to be materially higher than the 39% growth forecast for the broader market.

In light of this, it's peculiar that Guangzhou Haoyang ElectronicLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Guangzhou Haoyang ElectronicLtd's P/E

Guangzhou Haoyang ElectronicLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Guangzhou Haoyang ElectronicLtd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Guangzhou Haoyang ElectronicLtd (1 is significant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Guangzhou Haoyang ElectronicLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300833

Guangzhou Haoyang ElectronicLtd

Engages research and development, production , and sales of stage entertainment lighting equipment worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)