RoboTechnik Intelligent Technology Co., LTD's (SZSE:300757) 27% Price Boost Is Out Of Tune With Revenues

Those holding RoboTechnik Intelligent Technology Co., LTD (SZSE:300757) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 30%.

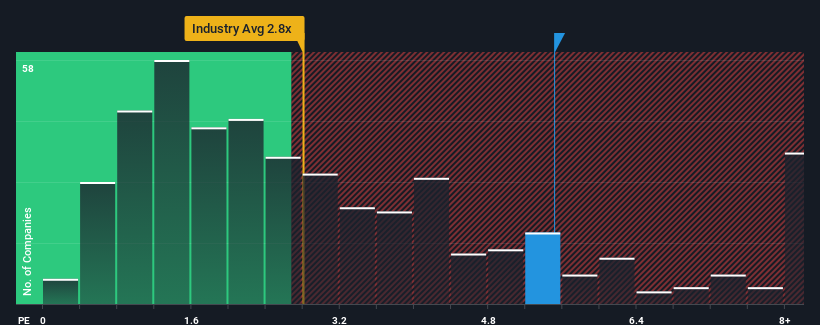

Since its price has surged higher, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider RoboTechnik Intelligent Technology as a stock to avoid entirely with its 5.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for RoboTechnik Intelligent Technology

What Does RoboTechnik Intelligent Technology's P/S Mean For Shareholders?

RoboTechnik Intelligent Technology certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on RoboTechnik Intelligent Technology's earnings, revenue and cash flow.How Is RoboTechnik Intelligent Technology's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like RoboTechnik Intelligent Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 85%. Pleasingly, revenue has also lifted 112% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 28% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it interesting that RoboTechnik Intelligent Technology is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Final Word

RoboTechnik Intelligent Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of RoboTechnik Intelligent Technology revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for RoboTechnik Intelligent Technology that you should be aware of.

If these risks are making you reconsider your opinion on RoboTechnik Intelligent Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300757

RoboTechnik Intelligent Technology

Engages in designing, developing, manufacturing, and selling smart manufactory automated equipment in China.

Slight with imperfect balance sheet.

Market Insights

Community Narratives