RoboTechnik Intelligent Technology Co., LTD's (SZSE:300757) 25% Share Price Plunge Could Signal Some Risk

The RoboTechnik Intelligent Technology Co., LTD (SZSE:300757) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 197% in the last twelve months.

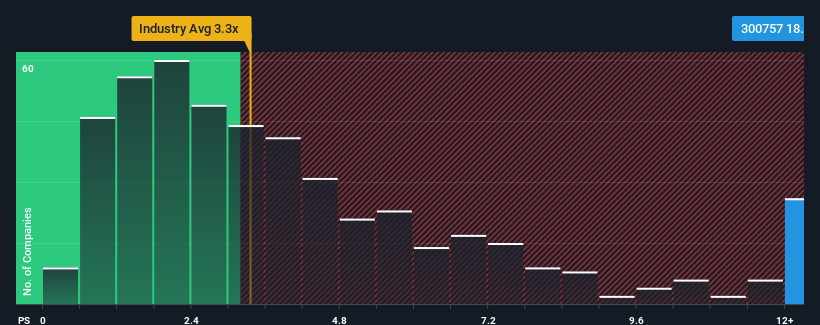

Even after such a large drop in price, you could still be forgiven for thinking RoboTechnik Intelligent Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 18x, considering almost half the companies in China's Machinery industry have P/S ratios below 3.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for RoboTechnik Intelligent Technology

How Has RoboTechnik Intelligent Technology Performed Recently?

RoboTechnik Intelligent Technology has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on RoboTechnik Intelligent Technology will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as RoboTechnik Intelligent Technology's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 6.0% gain to the company's revenues. The latest three year period has also seen an excellent 47% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that RoboTechnik Intelligent Technology's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does RoboTechnik Intelligent Technology's P/S Mean For Investors?

Even after such a strong price drop, RoboTechnik Intelligent Technology's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of RoboTechnik Intelligent Technology revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for RoboTechnik Intelligent Technology you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300757

RoboTechnik Intelligent Technology

Engages in designing, developing, manufacturing, and selling smart manufactory automated equipment in China.

Slight with imperfect balance sheet.

Market Insights

Community Narratives