Investors Still Waiting For A Pull Back In RoboTechnik Intelligent Technology Co., LTD (SZSE:300757)

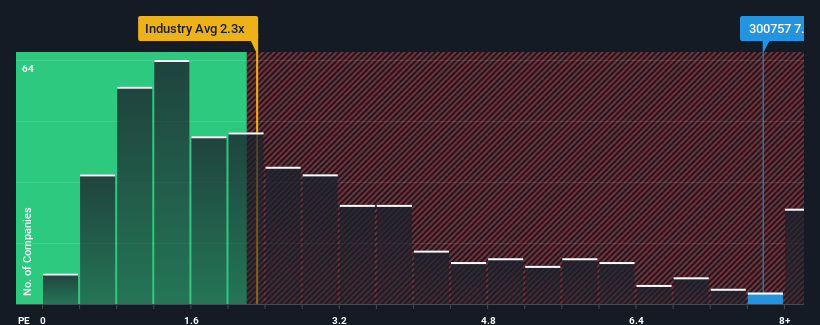

When close to half the companies in the Machinery industry in China have price-to-sales ratios (or "P/S") below 2.3x, you may consider RoboTechnik Intelligent Technology Co., LTD (SZSE:300757) as a stock to avoid entirely with its 7.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for RoboTechnik Intelligent Technology

What Does RoboTechnik Intelligent Technology's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, RoboTechnik Intelligent Technology has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on RoboTechnik Intelligent Technology will help you shine a light on its historical performance.How Is RoboTechnik Intelligent Technology's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like RoboTechnik Intelligent Technology's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 41% last year. The strong recent performance means it was also able to grow revenue by 121% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 24%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why RoboTechnik Intelligent Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that RoboTechnik Intelligent Technology maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - RoboTechnik Intelligent Technology has 3 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade RoboTechnik Intelligent Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300757

RoboTechnik Intelligent Technology

Engages in designing, developing, manufacturing, and selling smart manufactory automated equipment in China.

Slight with imperfect balance sheet.

Market Insights

Community Narratives