- China

- /

- Aerospace & Defense

- /

- SZSE:300696

Revenues Not Telling The Story For Chengdu ALD Aviation Manufacturing Corporation (SZSE:300696) After Shares Rise 34%

Chengdu ALD Aviation Manufacturing Corporation (SZSE:300696) shares have had a really impressive month, gaining 34% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

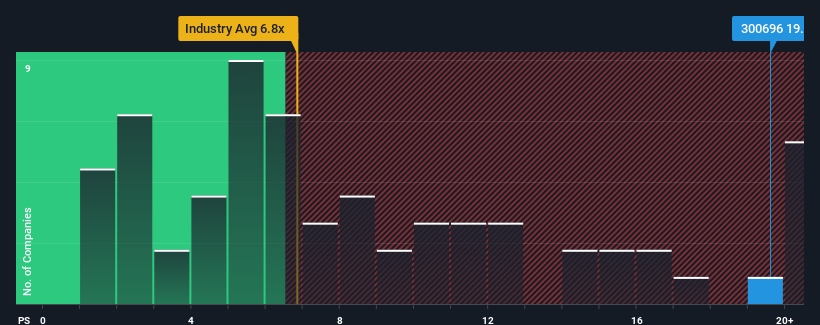

Since its price has surged higher, given around half the companies in China's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 6.8x, you may consider Chengdu ALD Aviation Manufacturing as a stock to avoid entirely with its 19.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Chengdu ALD Aviation Manufacturing

How Chengdu ALD Aviation Manufacturing Has Been Performing

Chengdu ALD Aviation Manufacturing could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chengdu ALD Aviation Manufacturing.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Chengdu ALD Aviation Manufacturing would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 45%. This means it has also seen a slide in revenue over the longer-term as revenue is down 42% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 41% over the next year. That's shaping up to be similar to the 40% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Chengdu ALD Aviation Manufacturing's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Chengdu ALD Aviation Manufacturing's P/S Mean For Investors?

Chengdu ALD Aviation Manufacturing's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Chengdu ALD Aviation Manufacturing currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Chengdu ALD Aviation Manufacturing is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300696

Chengdu ALD Aviation Manufacturing

Together with its subsidiary, Chengdu Tangan Aviation Manufacturing Co., Ltd., researches, designs, develops, manufactures and sells military and civil aircraft parts, aero-engine parts, and aerospace large structural parts in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives