Foshan Golden Milky Way Intelligent Equipment Co., Ltd. (SZSE:300619) Stock Rockets 39% But Many Are Still Ignoring The Company

Those holding Foshan Golden Milky Way Intelligent Equipment Co., Ltd. (SZSE:300619) shares would be relieved that the share price has rebounded 39% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

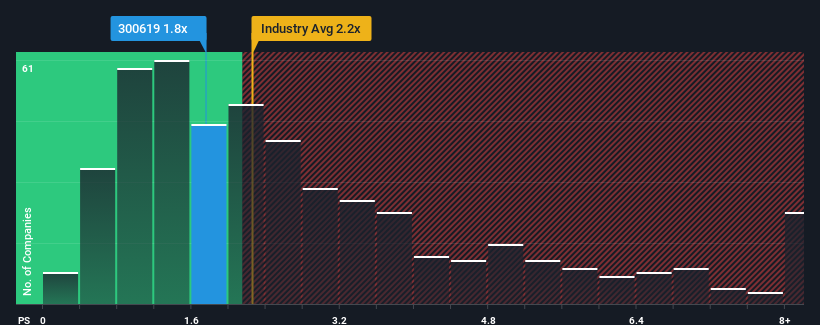

Although its price has surged higher, it's still not a stretch to say that Foshan Golden Milky Way Intelligent Equipment's price-to-sales (or "P/S") ratio of 1.8x right now seems quite "middle-of-the-road" compared to the Machinery industry in China, where the median P/S ratio is around 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Foshan Golden Milky Way Intelligent Equipment

How Foshan Golden Milky Way Intelligent Equipment Has Been Performing

For example, consider that Foshan Golden Milky Way Intelligent Equipment's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Foshan Golden Milky Way Intelligent Equipment's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Foshan Golden Milky Way Intelligent Equipment?

The only time you'd be comfortable seeing a P/S like Foshan Golden Milky Way Intelligent Equipment's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 132% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 24%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Foshan Golden Milky Way Intelligent Equipment's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Foshan Golden Milky Way Intelligent Equipment's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Foshan Golden Milky Way Intelligent Equipment currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Foshan Golden Milky Way Intelligent Equipment has 6 warning signs (and 4 which can't be ignored) we think you should know about.

If these risks are making you reconsider your opinion on Foshan Golden Milky Way Intelligent Equipment, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300619

Foshan Golden Milky Way Intelligent Equipment

Foshan Golden Milky Way Intelligent Equipment Co., Ltd.

Low and slightly overvalued.

Market Insights

Community Narratives