Foshan Golden Milky Way Intelligent Equipment Co., Ltd. (SZSE:300619) Shares May Have Slumped 32% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, Foshan Golden Milky Way Intelligent Equipment Co., Ltd. (SZSE:300619) shares are down a considerable 32% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

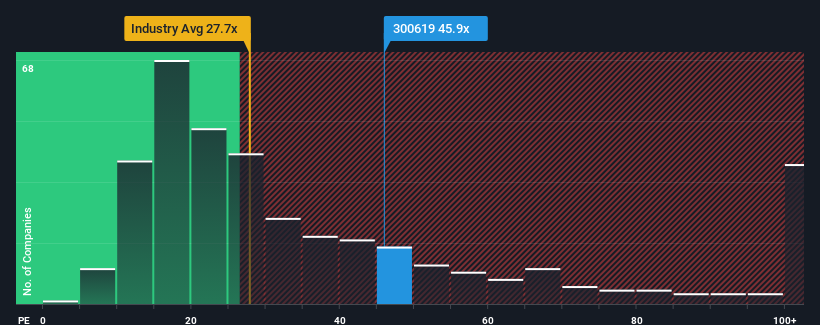

In spite of the heavy fall in price, Foshan Golden Milky Way Intelligent Equipment may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 45.9x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 17x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

As an illustration, earnings have deteriorated at Foshan Golden Milky Way Intelligent Equipment over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Foshan Golden Milky Way Intelligent Equipment

How Is Foshan Golden Milky Way Intelligent Equipment's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Foshan Golden Milky Way Intelligent Equipment's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 43%. Still, the latest three year period has seen an excellent 120% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it concerning that Foshan Golden Milky Way Intelligent Equipment is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

A significant share price dive has done very little to deflate Foshan Golden Milky Way Intelligent Equipment's very lofty P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Foshan Golden Milky Way Intelligent Equipment currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 6 warning signs we've spotted with Foshan Golden Milky Way Intelligent Equipment (including 3 which make us uncomfortable).

Of course, you might also be able to find a better stock than Foshan Golden Milky Way Intelligent Equipment. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300619

Foshan Golden Milky Way Intelligent Equipment

Foshan Golden Milky Way Intelligent Equipment Co., Ltd.

Low and slightly overvalued.

Market Insights

Community Narratives