Even With A 50% Surge, Cautious Investors Are Not Rewarding Shenzhen Yinghe Technology Co., Ltd's (SZSE:300457) Performance Completely

Despite an already strong run, Shenzhen Yinghe Technology Co., Ltd (SZSE:300457) shares have been powering on, with a gain of 50% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

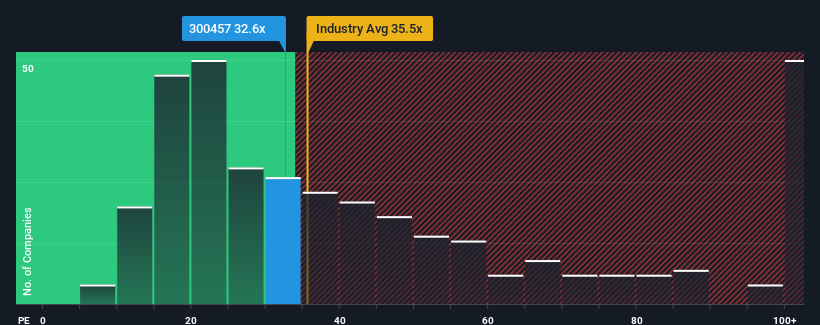

Even after such a large jump in price, Shenzhen Yinghe Technology's price-to-earnings (or "P/E") ratio of 32.6x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 73x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Shenzhen Yinghe Technology has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Shenzhen Yinghe Technology

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Shenzhen Yinghe Technology's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. Still, the latest three year period has seen an excellent 588% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 98% during the coming year according to the seven analysts following the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's peculiar that Shenzhen Yinghe Technology's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Shenzhen Yinghe Technology's P/E?

The latest share price surge wasn't enough to lift Shenzhen Yinghe Technology's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen Yinghe Technology's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shenzhen Yinghe Technology (1 makes us a bit uncomfortable!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Shenzhen Yinghe Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300457

Shenzhen Yinghe Technology

Engages in the research and development, production, and sale of lithium-ion battery automation equipment in China.

Very undervalued with high growth potential.