Guangdong Create Century Intelligent Equipment Group Corporation Limited's (SZSE:300083) P/S Is Still On The Mark Following 25% Share Price Bounce

Those holding Guangdong Create Century Intelligent Equipment Group Corporation Limited (SZSE:300083) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

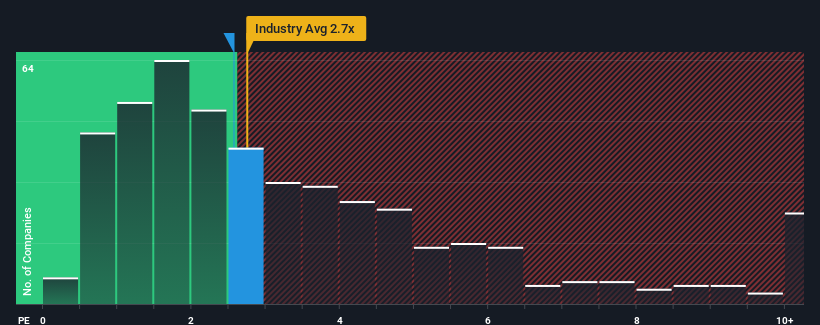

Although its price has surged higher, there still wouldn't be many who think Guangdong Create Century Intelligent Equipment Group's price-to-sales (or "P/S") ratio of 2.6x is worth a mention when the median P/S in China's Machinery industry is similar at about 2.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Guangdong Create Century Intelligent Equipment Group

How Has Guangdong Create Century Intelligent Equipment Group Performed Recently?

While the industry has experienced revenue growth lately, Guangdong Create Century Intelligent Equipment Group's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangdong Create Century Intelligent Equipment Group.How Is Guangdong Create Century Intelligent Equipment Group's Revenue Growth Trending?

In order to justify its P/S ratio, Guangdong Create Century Intelligent Equipment Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 2.9% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 30% over the next year. Meanwhile, the rest of the industry is forecast to expand by 28%, which is not materially different.

With this information, we can see why Guangdong Create Century Intelligent Equipment Group is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Guangdong Create Century Intelligent Equipment Group's P/S

Its shares have lifted substantially and now Guangdong Create Century Intelligent Equipment Group's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Guangdong Create Century Intelligent Equipment Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Machinery industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you settle on your opinion, we've discovered 1 warning sign for Guangdong Create Century Intelligent Equipment Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300083

Guangdong Create Century Intelligent Equipment Group

Engages in the research, development, production, and sale of high-end intelligent equipment business in China.

High growth potential with excellent balance sheet.