- China

- /

- Electrical

- /

- SZSE:300068

ZHEJIANG NARADA POWER SOURCE Co. , Ltd.'s (SZSE:300068) Subdued P/S Might Signal An Opportunity

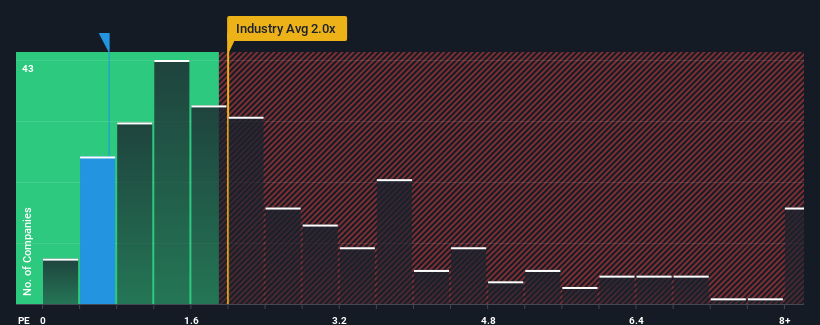

You may think that with a price-to-sales (or "P/S") ratio of 0.7x ZHEJIANG NARADA POWER SOURCE Co. , Ltd. (SZSE:300068) is a stock worth checking out, seeing as almost half of all the Electrical companies in China have P/S ratios greater than 2x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for ZHEJIANG NARADA POWER SOURCE

What Does ZHEJIANG NARADA POWER SOURCE's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, ZHEJIANG NARADA POWER SOURCE has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ZHEJIANG NARADA POWER SOURCE.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as ZHEJIANG NARADA POWER SOURCE's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. The latest three year period has also seen an excellent 43% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 39% over the next year. With the industry only predicted to deliver 27%, the company is positioned for a stronger revenue result.

With this information, we find it odd that ZHEJIANG NARADA POWER SOURCE is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On ZHEJIANG NARADA POWER SOURCE's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems ZHEJIANG NARADA POWER SOURCE currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for ZHEJIANG NARADA POWER SOURCE that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade ZHEJIANG NARADA POWER SOURCE, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ZHEJIANG NARADA POWER SOURCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300068

ZHEJIANG NARADA POWER SOURCE

Engages in the research, development, manufacture, sale, and service of lithium-ion batteries and systems, lead-acid batteries and systems, fuel cells and lithium products, and lead resource regeneration products.

High growth potential and fair value.

Market Insights

Community Narratives