- China

- /

- Electrical

- /

- SZSE:300014

EVE Energy Co., Ltd. (SZSE:300014) Analysts Are More Bearish Than They Used To Be

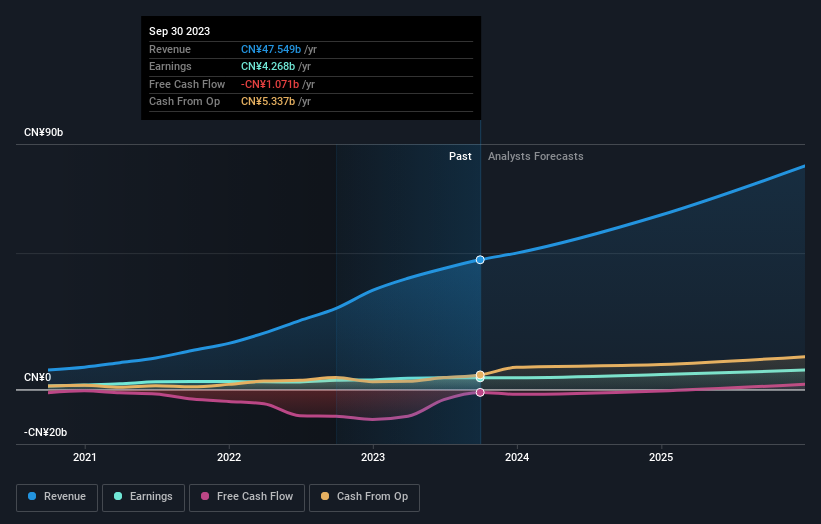

Today is shaping up negative for EVE Energy Co., Ltd. (SZSE:300014) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

Following the downgrade, the latest consensus from EVE Energy's 19 analysts is for revenues of CN¥57b in 2024, which would reflect a decent 19% improvement in sales compared to the last 12 months. Per-share earnings are expected to rise 2.2% to CN¥2.13. Prior to this update, the analysts had been forecasting revenues of CN¥64b and earnings per share (EPS) of CN¥2.66 in 2024. Indeed, we can see that the analysts are a lot more bearish about EVE Energy's prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for EVE Energy

Despite the cuts to forecast earnings, there was no real change to the CN¥48.54 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that EVE Energy's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 19% growth on an annualised basis. This is compared to a historical growth rate of 50% over the past five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 18% annually. Factoring in the forecast slowdown in growth, it looks like EVE Energy is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for EVE Energy. There was also a drop in their revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider market. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on EVE Energy after the downgrade.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple EVE Energy analysts - going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you're looking to trade EVE Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EVE Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300014

EVE Energy

Engages in the research, development, production, and sales of lithium batteries in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives