- China

- /

- Food and Staples Retail

- /

- SZSE:301078

3 Asian Stocks Estimated To Be Trading Below Intrinsic Value By Up To 46.5%

Reviewed by Simply Wall St

As global markets navigate the complexities of fluctuating interest rates and economic uncertainties, investors are increasingly turning their attention to Asia, where opportunities for undervalued stocks may be emerging amid broader market shifts. In this environment, identifying stocks that are trading below their intrinsic value can offer potential advantages, particularly when these equities demonstrate strong fundamentals and resilience in the face of market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.70 | CN¥25.23 | 49.7% |

| Taiwan Union Technology (TPEX:6274) | NT$434.00 | NT$867.46 | 50% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2332.00 | ¥4579.99 | 49.1% |

| NEXON Games (KOSDAQ:A225570) | ₩12310.00 | ₩24452.29 | 49.7% |

| Mobvista (SEHK:1860) | HK$15.65 | HK$30.74 | 49.1% |

| KoMiCo (KOSDAQ:A183300) | ₩84100.00 | ₩166235.75 | 49.4% |

| JINS HOLDINGS (TSE:3046) | ¥5500.00 | ¥10946.86 | 49.8% |

| Cowell e Holdings (SEHK:1415) | HK$27.82 | HK$55.55 | 49.9% |

| CaoCao (SEHK:2643) | HK$37.00 | HK$73.93 | 49.9% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥260.52 | CN¥515.42 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Mao Geping Cosmetics (SEHK:1318)

Overview: Mao Geping Cosmetics Co., Ltd. operates in China, offering color cosmetics and skincare products under the MAOGEPING and Love Keeps brands, with a market cap of HK$42.87 billion.

Operations: The company's revenue primarily comes from its Personal Products segment, totaling CN¥4.50 billion.

Estimated Discount To Fair Value: 23.7%

Mao Geping Cosmetics is trading 23.7% below its estimated fair value of HK$114.68, with a current price of HK$87.45, indicating potential undervaluation based on cash flows. The company’s earnings and revenue are both expected to grow over 24% annually, outpacing the Hong Kong market averages significantly. Analysts agree on a potential stock price increase of 39.4%. Recent profit growth was strong at 31.5%, supporting its attractive valuation status in Asia's market landscape.

- The analysis detailed in our Mao Geping Cosmetics growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Mao Geping Cosmetics.

Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985)

Overview: Beijing Beimo High-tech Frictional Material Co., Ltd specializes in the research, development, production, and sale of brake products for military aircraft and ground equipment with a market cap of CN¥9.86 billion.

Operations: Beijing Beimo High-tech Frictional Material Co., Ltd generates revenue primarily through its activities in the research, development, production, and sale of brake products for military aircraft and ground equipment.

Estimated Discount To Fair Value: 46.5%

Beijing Beimo High-tech Frictional Material Ltd. is trading at CNY 29.7, significantly below its estimated fair value of CNY 55.48, highlighting its potential undervaluation based on cash flows. The company reported strong revenue growth to CNY 650.4 million for the first nine months of 2025 and net income rose to CNY 127.54 million from the previous year, with earnings expected to grow over 56% annually, surpassing market averages despite a low forecasted return on equity and an unstable dividend history.

- Our earnings growth report unveils the potential for significant increases in Beijing Beimo High-tech Frictional MaterialLtd's future results.

- Click to explore a detailed breakdown of our findings in Beijing Beimo High-tech Frictional MaterialLtd's balance sheet health report.

Kidswant Children ProductsLtd (SZSE:301078)

Overview: Kidswant Children Products Co., Ltd. operates in China, focusing on the retail of maternal, infant, and child products, with a market cap of CN¥12.89 billion.

Operations: The company generates revenue primarily through its retail segment, which focuses on mother and baby products, amounting to CN¥9.89 billion.

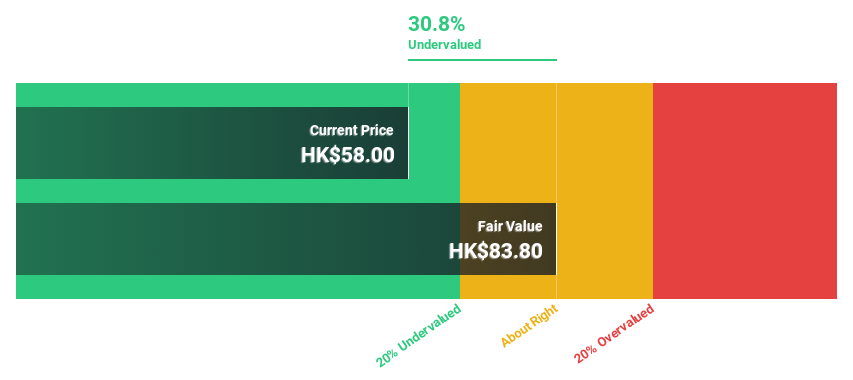

Estimated Discount To Fair Value: 27.3%

Kidswant Children Products Ltd. trades at CN¥10.3, below its estimated fair value of CN¥14.16, suggesting undervaluation based on cash flows. The company reported revenue of CN¥7.35 billion and net income of CN¥209.13 million for the first nine months of 2025, with earnings expected to grow significantly at 36.8% annually, outpacing market averages despite a low forecasted return on equity and an unstable dividend history amidst recent bylaw amendments and H-share offering plans.

- Our comprehensive growth report raises the possibility that Kidswant Children ProductsLtd is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Kidswant Children ProductsLtd stock in this financial health report.

Key Takeaways

- Click here to access our complete index of 276 Undervalued Asian Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kidswant Children ProductsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301078

Kidswant Children ProductsLtd

Engages in the retail of maternal, infant, and child products in China.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)